Operations Management

13th Edition

ISBN: 9781259667473

Author: William J Stevenson

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

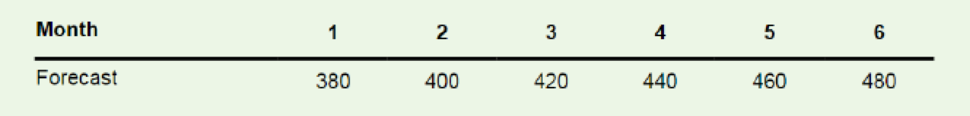

Chapter 11, Problem 3P

Determine the total cost for this plan given the following

Use steady regular output of 400 units per month, use overtime as needed for up to 40 units per month, and use subcontracting to make up any needed output to match the forecast. Unit costs are:

Regular output = $25

Overtime = $40

Subcontract = $60

Average Balance Inventory = $15

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the best way to manage emotions and thoughts?

How to work through Emotions and thoughts?

What are the emotions or stressful thoughts? What are the differences between them?

How can we work through the emotions or stressful thoughts?

How can we avoid or prevent emotions or stressful thoughts from happening or occurring?

What are the obstacles?

Main Challenges at TechInnovateStrategic DirectionTechInnovate's board of directors is pushing for a more aggressive expansion into emerging markets, particularly in Africaand Southeast Asia. However, there's internal disagreement about whether to focus on these new markets or consolidatetheir position in existing ones. Sarah Chen favors rapid expansion, while some senior executives advocate for a morecautious approach.Ethical ConcernsThe company's AI algorithms have come under scrutiny for potential biases, particularly in facial recognition technology.There are concerns that these biases disproportionately affect minority groups. Some employees have voiced ethicalconcerns about selling this technology to law enforcement agencies without addressing these issues.Team Leadership and DiversityTechInnovate's leadership team is predominantly male and Western, despite its global presence. There's growing pressurefrom employees and some board members to diversify the leadership team to…

Chapter 11 Solutions

Operations Management

Ch. 11 - What three levels of planning involve operations...Ch. 11 - What are the three phases of intermediate...Ch. 11 - Prob. 3DRQCh. 11 - Why is there a need for aggregate planning?Ch. 11 - What are the most common decision variables for...Ch. 11 - Prob. 6DRQCh. 11 - Briefly discuss the advantages and disadvantages...Ch. 11 - What are the primary advantages and limitations of...Ch. 11 - Briefly describe the planning techniques listed as...Ch. 11 - What are the inputs to master scheduling? What are...

Ch. 11 - Prob. 11DRQCh. 11 - What general trade-offs are involved in master...Ch. 11 - Who needs to interface with the master schedule...Ch. 11 - How has technology had an impact on master...Ch. 11 - Service operations often face more difficulty in...Ch. 11 - Name several behaviors related to aggregate...Ch. 11 - Compute the total cost for each aggregate plan...Ch. 11 - A manager would like to know the total cost of a...Ch. 11 - Determine the total cost for this plan given the...Ch. 11 - a. Given the following forecast and steady regular...Ch. 11 - Manager T. C. Downs of Plum Engines, a producer of...Ch. 11 - Manager Chris Channing of Fabric Mills, Inc., has...Ch. 11 - SummerFun. Inc., produces a variety of recreation...Ch. 11 - Nowjuice, Inc., produces Shakewell fruit juice. A...Ch. 11 - Wormwood, Ltd., produces a variety of furniture...Ch. 11 - Refer to Solved Problem 1. Prepare two additional...Ch. 11 - Refer to Solved Problem 1. Suppose another option...Ch. 11 - Prob. 12PCh. 11 - Prob. 13PCh. 11 - Prob. 14PCh. 11 - Prob. 15PCh. 11 - Refer to Example 3. Suppose that regular-time...Ch. 11 - Prob. 17PCh. 11 - Prob. 18PCh. 11 - Prepare a master production schedule for...Ch. 11 - Update the master schedule shown in Figure 11.11...Ch. 11 - Prepare a master schedule like that shown in...Ch. 11 - Determine the available-to-promise (ATP)...Ch. 11 - Prepare a schedule like that shown in Figure 11.12...Ch. 11 - The objective is to choose the plan that has the...Ch. 11 - Prob. 2CQ

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Similar questions

- Sarah Anderson, the Marketing Manager at Exeter Township's Cultural Center, is conducting research on the attendance history for cultural events in the area over the past ten years. The following data has been collected on the number of attendees who registered for events at the cultural center. Year Number of Attendees 1 700 2 248 3 633 4 458 5 1410 6 1588 7 1629 8 1301 9 1455 10 1989 You have been hired as a consultant to assist in implementing a forecasting system that utilizes various forecasting techniques to predict attendance for Year 11. a) Calculate the Three-Period Simple Moving Average b) Calculate the Three-Period Weighted Moving Average (weights: 50%, 30%, and 20%; use 50% for the most recent period, 30% for the next most recent, and 20% for the oldest) c) Apply Exponential Smoothing with the smoothing constant alpha = 0.2. d) Perform a Simple Linear Regression analysis and provide the adjusted…arrow_forwardRuby-Star Incorporated is considering two different vendors for one of its top-selling products which has an average weekly demand of 70 units and is valued at $90 per unit. Inbound shipments from vendor 1 will average 390 units with an average lead time (including ordering delays and transit time) of 4 weeks. Inbound shipments from vendor 2 will average 490 units with an average lead time of 2 weeksweeks. Ruby-Star operates 52 weeks per year; it carries a 4-week supply of inventory as safety stock and no anticipation inventory. Part 2 a. The average aggregate inventory value of the product if Ruby-Star used vendor 1 exclusively is $enter your response here.arrow_forwardSam's Pet Hotel operates 50 weeks per year, 6 days per week, and uses a continuous review inventory system. It purchases kitty litter for $13.00 per bag. The following information is available about these bags: > Demand 75 bags/week > Order cost = $52.00/order > Annual holding cost = 20 percent of cost > Desired cycle-service level = 80 percent >Lead time = 5 weeks (30 working days) > Standard deviation of weekly demand = 15 bags > Current on-hand inventory is 320 bags, with no open orders or backorders. a. Suppose that the weekly demand forecast of 75 bags is incorrect and actual demand averages only 50 bags per week. How much higher will total costs be, owing to the distorted EOQ caused by this forecast error? The costs will be $higher owing to the error in EOQ. (Enter your response rounded to two decimal places.)arrow_forward

- Yellow Press, Inc., buys paper in 1,500-pound rolls for printing. Annual demand is 2,250 rolls. The cost per roll is $625, and the annual holding cost is 20 percent of the cost. Each order costs $75. a. How many rolls should Yellow Press order at a time? Yellow Press should order rolls at a time. (Enter your response rounded to the nearest whole number.)arrow_forwardPlease help with only the one I circled! I solved the others :)arrow_forwardOsprey Sports stocks everything that a musky fisherman could want in the Great North Woods. A particular musky lure has been very popular with local fishermen as well as those who buy lures on the Internet from Osprey Sports. The cost to place orders with the supplier is $40/order; the demand averages 3 lures per day, with a standard deviation of 1 lure; and the inventory holding cost is $1.00/lure/year. The lead time form the supplier is 10 days, with a standard deviation of 2 days. It is important to maintain a 97 percent cycle-service level to properly balance service with inventory holding costs. Osprey Sports is open 350 days a year to allow the owners the opportunity to fish for muskies during the prime season. The owners want to use a continuous review inventory system for this item. Refer to the standard normal table for z-values. a. What order quantity should be used? lures. (Enter your response rounded to the nearest whole number.)arrow_forward

- In a P system, the lead time for a box of weed-killer is two weeks and the review period is one week. Demand during the protection interval averages 262 boxes, with a standard deviation of demand during the protection interval of 40 boxes. a. What is the cycle-service level when the target inventory is set at 350 boxes? Refer to the standard normal table as needed. The cycle-service level is ☐ %. (Enter your response rounded to two decimal places.)arrow_forwardOakwood Hospital is considering using ABC analysis to classify laboratory SKUs into three categories: those that will be delivered daily from their supplier (Class A items), those that will be controlled using a continuous review system (B items), and those that will be held in a two bin system (C items). The following table shows the annual dollar usage for a sample of eight SKUs. Fill in the blanks for annual dollar usage below. (Enter your responses rounded to the mearest whole number.) Annual SKU Unit Value Demand (units) Dollar Usage 1 $1.50 200 2 $0.02 120,000 $ 3 $1.00 40,000 $ 4 $0.02 1,200 5 $4.50 700 6 $0.20 60,000 7 $0.90 350 8 $0.45 80arrow_forwardA part is produced in lots of 1,000 units. It is assembled from 2 components worth $30 total. The value added in production (for labor and variable overhead) is $30 per unit, bringing total costs per completed unit to $60 The average lead time for the part is 7 weeks and annual demand is 3800 units, based on 50 business weeks per year. Part 2 a. How many units of the part are held, on average, in cycle inventory? enter your response here unitsarrow_forward

- assume the initial inventory has no holding cost in the first period and back orders are not permitted. Allocating production capacity to meet demand at a minimum cost using the transportation method. What is the total cost? ENTER your response is a whole number (answer is not $17,000. That was INCORRECT)arrow_forwardRegular Period Time Overtime Supply Available puewag Subcontract Forecast 40 15 15 40 2 35 40 28 15 15 20 15 22 65 60 Initial inventory Regular-time cost per unit Overtime cost per unit Subcontract cost per unit 20 units $100 $150 $200 Carrying cost per unit per month 84arrow_forwardassume that the initial inventory has no holding cost in the first period, and back orders are not permitted. Allocating production capacity to meet demand at a minimum cost using the transportation method. The total cost is? (enter as whole number)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage LearningMarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage LearningMarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Marketing

Marketing

ISBN:9780357033791

Author:Pride, William M

Publisher:South Western Educational Publishing

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Introduction to Forecasting; Author: Ekeeda;https://www.youtube.com/watch?v=5eIbVXrJL7k;License: Standard YouTube License, CC-BY