Operations Management (McGraw-Hill Series in Operations and Decision Sciences)

12th Edition

ISBN: 9780078024108

Author: William J Stevenson

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 2P

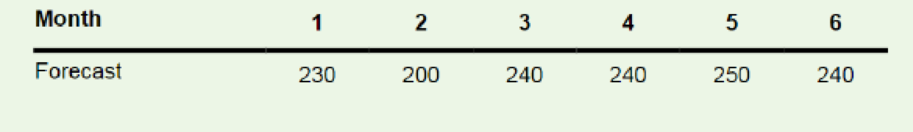

A manager would like to know the total cost of a chase strategy that matches the

Regular production= $35

Overtime = $70

Subcontracting = $80

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What are the ethical challenges regarding employees (i.e., diversity, discrimination, sexual harassment, privacy, employee theft, bad leadership, etc.) that Apple Inc. has faced over the past five to ten years and that they should prepare to face in the next five to ten years. Once a developed list of challenges is created, consider how having faced those challenges will impact and be impacted by the social cause you've selected.

Propose the findings on the ethical challenges faced by Apple Inc. in recent history and the near future.

Analyze ways in which each challenge was (and/or could be) appropriately handled and areas for improvement.

Evaluate the ethical/moral aspects of Apple Inc. that protected it from ethical challenges in the past and could protect it in the future.

Assess how ethical challenges and handling of ethical challenges could positively or negatively impact the charitable cause are selected and how the selection of your social cause could positively or negatively…

By selecting Cigna Accredo pharmacy that i identify in my resand compare the current feedback system against the “Characteristics of a Good Multiple Source Feedback Systems” described in section 8-3-3. What can be improved? As a consultant, what recommendations would you make?

Scenario

You have been given a task to create a demand forecast for the second year of sales of a premium outdoor grill.

Accurate forecasts are important for many reasons, including for the company to ensure they have the materials

they need to create the products required in a certain period of time. Your objective is to minimize the forecast

error, which will be measured using the Mean Absolute Percentage Error (MAPE) with a goal of being below 25%.

You have historical monthly sales data for the past year and access to software that provides forecasts based on

five different forecasting techniques (Naïve, 3-Month Moving Average, Exponential Smoothing for .2, Exponential

Smooth for .5, and Seasonal) to help determine the best forecast for that particular month. Based on the given

data, you will identify trends and patterns to create a more accurate forecast.

Approach

Consider the previous month's forecast to identify which technique is most effective. Use that to forecast the next…

Chapter 11 Solutions

Operations Management (McGraw-Hill Series in Operations and Decision Sciences)

Ch. 11 - What three levels of planning involve operations...Ch. 11 - What are the three phases of intermediate...Ch. 11 - Prob. 3DRQCh. 11 - Why is there a need for aggregate planning?Ch. 11 - What are the most common decision variables for...Ch. 11 - Prob. 6DRQCh. 11 - Briefly discuss the advantages and disadvantages...Ch. 11 - What are the primary advantages and limitations of...Ch. 11 - Briefly describe the planning techniques listed as...Ch. 11 - What are the inputs to master scheduling? What are...

Ch. 11 - Prob. 11DRQCh. 11 - What general trade-offs are involved in master...Ch. 11 - Who needs to interface with the master schedule...Ch. 11 - How has technology had an impact on master...Ch. 11 - Service operations often face more difficulty in...Ch. 11 - Name several behaviors related to aggregate...Ch. 11 - Compute the total cost for each aggregate plan...Ch. 11 - A manager would like to know the total cost of a...Ch. 11 - Determine the total cost for this plan given the...Ch. 11 - a. Given the following forecast and steady regular...Ch. 11 - Manager T. C. Downs of Plum Engines, a producer of...Ch. 11 - Manager Chris Channing of Fabric Mills, Inc., has...Ch. 11 - SummerFun. Inc., produces a variety of recreation...Ch. 11 - Nowjuice, Inc., produces Shakewell fruit juice. A...Ch. 11 - Wormwood, Ltd., produces a variety of furniture...Ch. 11 - Refer to Solved Problem 1. Prepare two additional...Ch. 11 - Refer to Solved Problem 1. Suppose another option...Ch. 11 - Prob. 12PCh. 11 - Prob. 13PCh. 11 - Prob. 14PCh. 11 - Prob. 15PCh. 11 - Refer to Example 3. Suppose that regular-time...Ch. 11 - Prob. 17PCh. 11 - Prob. 18PCh. 11 - Prepare a master production schedule for...Ch. 11 - Update the master schedule shown in Figure 11.11...Ch. 11 - Prepare a master schedule like that shown in...Ch. 11 - Determine the available-to-promise (ATP)...Ch. 11 - Prepare a schedule like that shown in Figure 11.12...Ch. 11 - The objective is to choose the plan that has the...Ch. 11 - Prob. 2CQ

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Similar questions

- Approach Consider the previous month's forecast to identify which technique is most effective. Use that to forecast the next month. Remember to select the forecasting technique that produces the forecast error nearest to zero. For example: a. Naïve Forecast is 230 and the Forecast Error is -15. b. 3-Month Moving Forecast is 290 and the Forecast Error is -75. c. Exponential Smoothing Forecast for .2 is 308 and the Forecast Error is -93. d. Exponential Smoothing Forecast for .5 is 279 and the Forecast Error is -64. e. Seasonal Forecast is 297 and the Forecast Error is -82. The forecast for the next month would be 230 as the Naïve Forecast had the Forecast Error closest to zero with a -15. This forecasting technique was the best performing technique for that month. You do not need to do any external analysis-the forecast error for each strategy is already calculated for you in the tables below. Naïve Month Period Actual Demand Naïve Forecast Error 3- Month Moving Forecast 3- Month Moving…arrow_forwardScenario You have been given a task to create a demand forecast for the second year of sales of a premium outdoor grill. Accurate forecasts are important for many reasons, including for the company to ensure they have the materials they need to create the products required in a certain period of time. Your objective is to minimize the forecast error, which will be measured using the Mean Absolute Percentage Error (MAPE) with a goal of being below 25%. You have historical monthly sales data for the past year and access to software that provides forecasts based on five different forecasting techniques (Naïve, 3-Month Moving Average, Exponential Smoothing for .2, Exponential Smooth for .5, and Seasonal) to help determine the best forecast for that particular month. Based on the given data, you will identify trends and patterns to create a more accurate forecast. Approach Consider the previous month's forecast to identify which technique is most effective. Use that to forecast the next…arrow_forwardUse the internet to obtain crash safety ratings for passenger vehicles. Then, answer thesequestions:a. Which vehicles received the highest ratings? The lowest ratings?b. How important are crash-safety ratings to new car buyers? Does the degree of importancedepend on the circumstances of the buyer?c. Which types of buyers would you expect to be the most concerned with crash-safety ratings?d. Are there other features of a new car that might sway a buyer from focusing solely on crashsafety? If so, what might they be?arrow_forward

- “Implementing a Performance Management Communication Plan at Accounting, Inc.” Evaluate Accounting Inc.’s communication plan. Specifically, does it answer all of the questions that a good communication plan should answer? Which questions are left unanswered? How would you provide answers to the unanswered questions? “Implementing an Appeals Process at Accounting, Inc.” If you were to design an appeals process to handle these complaints well, what would be the appeal process? Describe the recommended process and why.arrow_forwardThe annual demand for water bottles at Mega Stores is 500 units, with an ordering cost of Rs. 200 per order. If the annual inventory holding cost is estimated to be 20%. of unit cost, how frequently should he replenish his stocks? Further, suppose the supplier offers him a discount on bulk ordering as given below. Can the manager reduce his costs by taking advantage of either of these discounts? Recommend the best ordering policy for the store. Order size Unit cost (Rs.) 1 – 49 pcs. 20.00 50 – 149 pcs. 19.50 150 – 299 pcs. 19.00 300 pcs. or more 18.00arrow_forwardHelp answer showing level work and formulasarrow_forward

- I need to forecast using a 3-Period-Moving-Average-Monthly forecasting model which I did but then I need to use my forecast numbers to generate a Master Production Schedule (MPS) I have to Start with actual sales (my own test data numbers) for August-2022 Oct-2022 i need to create MPS to supply demand starting November-2022 April 2023 I just added numbers without applying formulas to the mps on the right side of the spreadsheet because I do not know how to do it. The second image is the example of what it should look like. Thank You.arrow_forwardSolve the following Question 1. How do volume and variety affect the process selection and layout types? Discuss 2. How is the human resource aspect important to operation function? Discuss 3. Discuss the supply network design and its impact on the overall performance of the organization.arrow_forwardHelp with question?arrow_forward

- What are some good examples of bullet points on a resume for a Christian Elementary School?arrow_forwardWhat is an example of a cover letter for a Christian School Long-Term Substitute Teaching position?arrow_forwardThe supply chain is a conventional notion, but organizations are only really interested in making products that they can sell to customers. Provided they have reliable supplies of materials and reasonable transport for finished products, logistics is irrelevant. Do you think this is true? If yes, explain, and if no, clearly explain as well.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Marketing

Marketing

ISBN:9780357033791

Author:Pride, William M

Publisher:South Western Educational Publishing

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Introduction to Forecasting; Author: Ekeeda;https://www.youtube.com/watch?v=5eIbVXrJL7k;License: Standard YouTube License, CC-BY