Concept explainers

SummerFun. Inc., produces a variety of recreation and leisure products. The

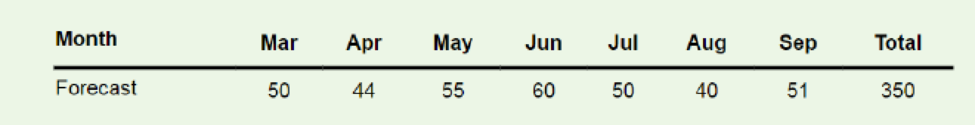

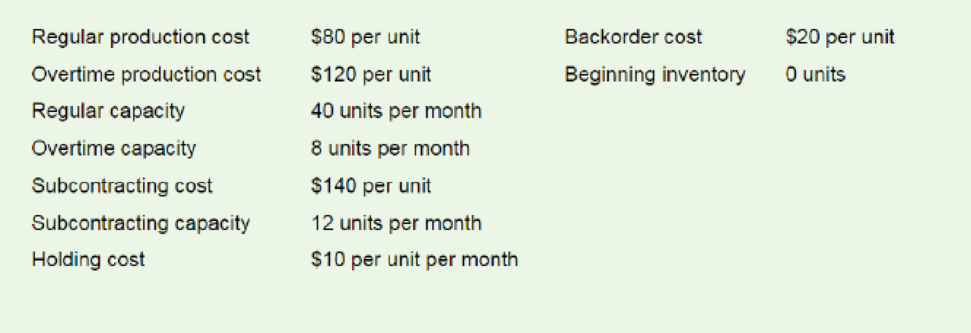

Use the following information to develop aggregate plans.

Develop an aggregate plan using each of the following guidelines and compute the total cost for each plan. Hint: You will need extra output in April and August to accommodate demand in the following months.

a. Use regular production. Supplement using inventory, overtime, and subcontracting as needed. No backlogs allowed.

b. Use a level strategy. Use a combination of backlogs, subcontracting, and inventory to handle variations in demand. There should not be a backlog in the final period.

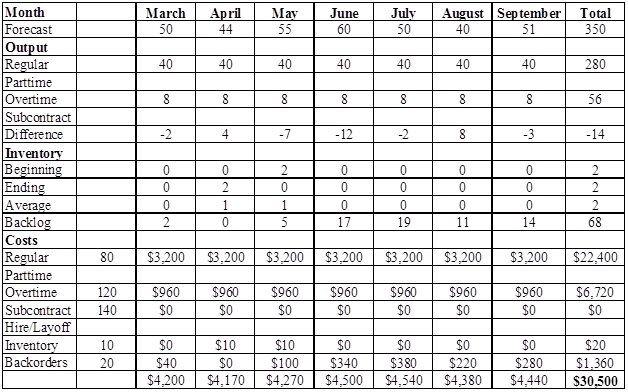

a)

To determine: The total cost using an aggregate plan.

Introduction:The aggregate plan is the output of sales and operations planning. The major concern of aggregate planning is the production time and quantity for the intermediate future. Aggregate planning would encompass a time prospect of approximately 3 to 18 months.

Answer to Problem 7P

Explanation of Solution

Given information:

Regular production cost is $80, overtime production cost is $120, subcontracting cost is $140, backorder cost is $20, holding cost is $10, regular capacity is 40 units, overtime cost is 8 units, and subcontracting capacity is 12 units. Beginning inventory is given as 0 units. In addition to this forecast for 7 months is given as follows:

| Month | March | April | May | June | July | August | September | Total |

| Forecast | 50 | 44 | 55 | 60 | 50 | 40 | 51 | 350 |

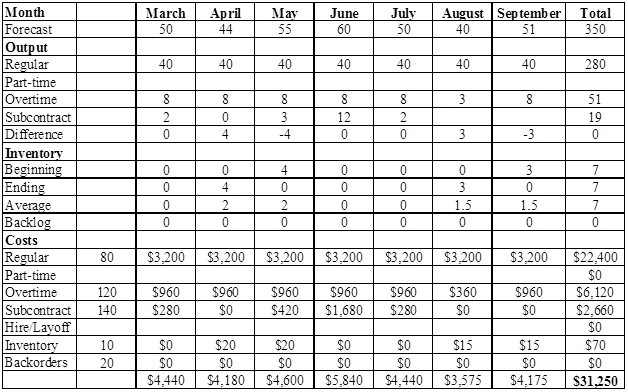

Determine the total cost of the plan:

It is given that regular productions should be used. No backlogs are allowed. Supplements can be satisfied using overtime, subcontracting, and inventory.

Supporting explanation:

Forecast and regular time capacity are given. Regular time capacity is given as 40 units, remaining units should be produced using the overtime capacity. Maximum overtime capacity is given as 8 units. Thus, if the forecast is not satisfied, it can be produced using the subcontract:

Calculate the difference for the month of March:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 0 units.

Calculate the difference for the month of April:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 4 units.

Calculate the difference for the month of May:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is -4 units.

Note: The calculation repeats for all the months.

Beginning inventory:

The initial inventory is given as 0. For the remaining months, ending inventory of previous month would be the beginning inventory of present month.

Ending inventory for the month of March:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 0 units.

Ending inventory for the month of April:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 4 units.

Ending inventory for the month of May:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 0 units.

Note: The calculation repeats for all the months.

Average inventory for the month of March:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 0 units.

Average inventory for the month of April:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 2 units.

Average inventory for the month of May:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 2 units.

Note: The calculation repeats for all the months.

Calculate the regular time cost for the month of March:

Regular time cost per unit is given as $80 and regular time unit is given as 40. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $3,200.

Calculate the regular time cost for the month of April:

Regular time cost per unit is given as $80 and regular time unit is given as 40. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $3,200.

Calculate the regular time cost for the month of May:

Regular time cost per unit is given as $80 and regular time unit is given as 40. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $3,200.

Note: The calculation repeats for all the months.

Calculate the total regular time cost:

It is calculated by adding the regular time cost of all the months.

Hence, the total regular time cost is $22,400.

Calculate the overtime cost for the month of March:

Overtime cost per unit is given as $120 and overtime unit is given as 8. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $960.

Calculate the overtime cost for the month of April:

Overtime cost per unit is given as $120 and overtime unit is given as 8. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $960.

Calculate the overtime cost for the month of May:

Overtime cost per unit is given as $120 and overtime unit is given as 8. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $960.

Note: The calculation repeats for all the months.

Calculate the total overtime cost:

It is calculated by adding the overtime cost of all the months.

Hence, the total overtime cost is 6,120.

Calculate the subcontract cost for the month of March:

Subcontract cost per unit is given as $140 and subcontract unit is given as 2. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $280.

Calculate the subcontract cost for the month of April:

Subcontract cost per unit is given as $140 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $0.

Calculate the subcontract cost for the month of May:

Subcontract cost per unit is given as $140 and subcontract unit is given as 3. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $420.

Note: The calculation repeats for all the months.

Calculate the total subcontract cost:

It is calculated by adding the subcontract cost of all the months.

Hence, the total subcontract cost is $2,660.

Calculate the inventory cost for the month of March:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $0.

Calculate the inventory cost for the month of April:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $20.

Calculate the inventory cost for the month of May:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $20.

Note: The calculation repeats for all the months.

Calculate the total inventory cost:

It is calculated by adding the inventory cost of all the months.

Hence, the total inventory cost is $70.

Calculate the backorder cost for the month of March:

It is calculated by multiplying the backorder cost and the backlog. Hence, the backorder cost is $0.

Calculate the backorder cost for the month of April:

It is calculated by multiplying the backorder cost and the backlog. Hence, the backorder cost is $0.

Calculate the backorder cost for the month of May:

It is calculated by multiplying the backorder cost and the backlog. Hence, the backorder cost is $0.

Note: The calculation repeats for all the months.

Calculate the total cost of the plan:

It is calculated by adding the total regular time cost, overtime cost, subcontract cost, and inventory cost.

Hence, the total cost of the plan is $31,250.

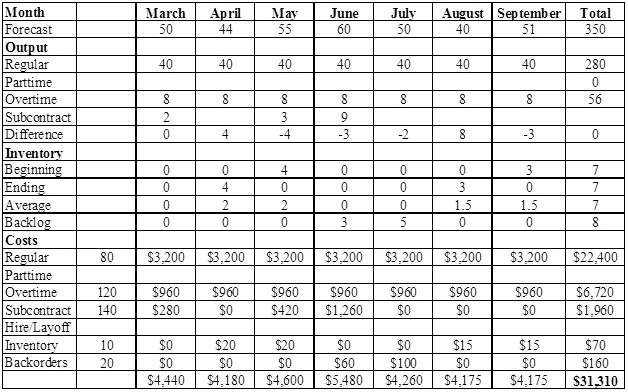

b)

To determine: The total cost using a level strategy of aggregate planning.

Introduction:Level production strategy is a production strategy used to produce at a constant rate. This strategy keeps constant level of workforce and backlog of demand.

Answer to Problem 7P

Explanation of Solution

Given information:

Regular production cost is $80, overtime production cost is $120, subcontracting cost is $140, backorder cost is $20, holding cost is $10, regular capacity is 40 units, overtime cost is 8 units, and subcontracting capacity is 12 units. Beginning inventory is given as 0 units. In addition to this forecast for 7 months is given as follows:

| Month | March | April | May | June | July | August | September | Total |

| Forecast | 50 | 44 | 55 | 60 | 50 | 40 | 51 | 350 |

Determine the total cost of the plan:

Subcontracting, inventory, and backlogs can be used to handle the fluctuations in the demand. Initial solution using regular time and overtime without using subcontracting is as follows:

Supporting explanation:

Determine the regular time productivity:

It is calculated by taking an average of the given forecast.

Calculate the difference for the month of March:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is -2 units.

Calculate the difference for the month of April:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 4 units.

Calculate the difference for the month of May:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is --7 units.

Note: The calculation repeats for all the months.

Beginning inventory:

The initial inventory is given as 0. For the remaining months, ending inventory of previous month would be the beginning inventory of present month.

Ending inventory for the month of March:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 0 units.

Ending inventory for the month of April:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Difference between output and forecast is 2 (4-2). Hence, the ending inventory is 2 units.

Ending inventory for the month of May:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 0 units.

Note: The calculation repeats for all the months.

Average inventory for the month of March:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 0 units.

Average inventory for the month of April:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 1unit.

Average inventory for the month of May:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 1unit.

Note: The calculation repeats for all the months.

Backlogs for the month of 1:

It is number of units required in the month. As there is no previous month for 1st month, the difference would be the backlog. Hence, the backlog for 1st is 2 units.

Backlogs for the month of 2:

As the difference is positive, there would not be backlog.

Backlogs for the month of 3:

It is number of units required in the month. It is calculated by adding the backlog of previous month and the difference between output and forecast of current month (without considering the negative sign). Hence, the backlog is 5 units.

Note: The calculation repeats for all the months.

Calculate the regular time cost for the month of March:

Regular time cost per unit is given as $80 and regular time unit is given as 40. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $3,200.

Calculate the regular time cost for the month of April:

Regular time cost per unit is given as $80 and regular time unit is given as 40. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $3,200.

Calculate the regular time cost for the month of May:

Regular time cost per unit is given as $80 and regular time unit is given as 40. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $3,200.

Note: The calculation repeats for all the months.

Calculate the total regular time cost:

It is calculated by adding the regular time cost of all the months.

Hence, the total regular time cost is $22,400.

Calculate the overtime cost for the month of March:

Overtime cost per unit is given as $120 and overtime unit is given as 8. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $960.

Calculate the overtime cost for the month of April:

Overtime cost per unit is given as $120 and overtime unit is given as 8. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $960.

Calculate the overtime cost for the month of May:

Overtime cost per unit is given as $120 and overtime unit is given as 8. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $960.

Note: The calculation repeats for all the months.

Calculate the total overtime cost:

It is calculated by adding the overtime cost of all the months.

Hence, the total overtime cost is 6,120.

Calculate the subcontract cost for the month of March:

Subcontract cost per unit is given as $140 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $140.

Calculate the subcontract cost for the month of April:

Subcontract cost per unit is given as $140 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $0.

Calculate the subcontract cost for the month of May:

Subcontract cost per unit is given as $140 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $0.

Note: The calculation repeats for all the months.

Calculate the total subcontract cost:

It is calculated by adding the subcontract cost of all the months.

Hence, the total subcontract cost is $0.

Calculate the inventory cost for the month of March:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $0.

Calculate the inventory cost for the month of April:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $10.

Calculate the inventory cost for the month of May:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $10.

Note: The calculation repeats for all the months.

Calculate the total inventory cost:

It is calculated by adding the inventory cost of all the months.

Hence, the total inventory cost is $70.

Calculate the backorder cost for the month of March:

It is calculated by multiplying the backorder cost and the backlog. Hence, the backorder cost is $40.

Calculate the backorder cost for the month of April:

It is calculated by multiplying the backorder cost and the backlog. Hence, the backorder cost is $0.

Calculate the backorder cost for the month of May:

It is calculated by multiplying the backorder cost and the backlog. Hence, the backorder cost is $100.

Note: The calculation repeats for all the months.

Calculate the total backorder cost:

It is calculated by adding the backorder cost of all the months.

Hence, the total backorder cost is $1,360.

Calculate the total cost of the plan:

It is calculated by adding the total regular time cost, overtime cost, subcontract cost, and inventory cost.

Hence, the total cost of the plan is $30,500.

Determine the total cost of the plan:

Subcontracting, inventory, and backlogs can be used to handle the fluctuations in the demand. Final solution using regular time, overtime, and subcontracting is as follows:

Supporting explanation:

Determine the regular time productivity:

It is calculated by taking an average of the given forecast.

Calculate the difference for the month of March:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 0 units.

Calculate the difference for the month of April:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 4 units.

Calculate the difference for the month of May:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is -4 units.

Note: The calculation repeats for all the months.

Beginning inventory:

The initial inventory is given as 0. For the remaining months, ending inventory of previous month would be the beginning inventory of present month.

Ending inventory for the month of March:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 0 units.

Ending inventory for the month of April:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 4 units.

Ending inventory for the month of May:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 0 units.

Note: The calculation repeats for all the months.

Average inventory for the month of March:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 0 units.

Average inventory for the month of April:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 2 units.

Average inventory for the month of May:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 2 units.

Note: The calculation repeats for all the months.

Backlogs for the month of June:

It is number of units required in the month. It is calculated by adding the backlog of previous month and the difference between output and forecast of current month (without considering the negative sign). Hence, the backlog is 3 units.

Backlogs for the month of July:

It is number of units required in the month. It is calculated by adding the backlog of previous month and the difference between output and forecast of current month (without considering the negative sign). Hence, the backlog is 5 units.

Note: The calculation repeats for all the months.

Calculate the regular time cost for the month of March:

Regular time cost per unit is given as $80 and regular time unit is given as 40. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $3,200.

Calculate the regular time cost for the month of April:

Regular time cost per unit is given as $80 and regular time unit is given as 40. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $3,200.

Calculate the regular time cost for the month of May:

Regular time cost per unit is given as $80 and regular time unit is given as 40. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $3,200.

Note: The calculation repeats for all the months.

Calculate the total regular time cost:

It is calculated by adding the regular time cost of all the months.

Hence, the total regular time cost is $22,400.

Calculate the overtime cost for the month of March:

Overtime cost per unit is given as $120 and overtime unit is given as 8. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $960.

Calculate the overtime cost for the month of April:

Overtime cost per unit is given as $120 and overtime unit is given as 8. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $960.

Calculate the overtime cost for the month of May:

Overtime cost per unit is given as $120 and overtime unit is given as 8. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $960.

Note: The calculation repeats for all the months.

Calculate the total overtime cost:

It is calculated by adding the overtime cost of all the months.

Hence, the total overtime cost is 6,120.

Calculate the subcontract cost for the month of March:

Subcontract cost per unit is given as $140 and subcontract unit is given as 2. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $280.

Calculate the subcontract cost for the month of April:

Subcontract cost per unit is given as $140 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $0.

Calculate the subcontract cost for the month of May:

Subcontract cost per unit is given as $140 and subcontract unit is given as 3. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $420.

Note: The calculation repeats for all the months.

Calculate the total subcontract cost:

It is calculated by adding the subcontract cost of all the months.

Hence, the total subcontract cost is $1,960.

Calculate the inventory cost for the month of March:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $0.

Calculate the inventory cost for the month of April:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $20.

Calculate the inventory cost for the month of May:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $20.

Note: The calculation repeats for all the months.

Calculate the total inventory cost:

It is calculated by adding the inventory cost of all the months.

Hence, the total inventory cost is $70.

Calculate the backorder cost for the month of March:

It is calculated by multiplying the backorder cost and the backlog. Hence, the backorder cost is $0.

Calculate the backorder cost for the month of April:

It is calculated by multiplying the backorder cost and the backlog. Hence, the backorder cost is $0.

Calculate the backorder cost for the month of May:

It is calculated by multiplying the backorder cost and the backlog. Hence, the backorder cost is $0.

Note: The calculation repeats for all the months.

Calculate the total backorder cost:

It is calculated by adding the backorder cost of all the months.

Hence, the total backorder cost is $160.

Calculate the total cost of the plan:

It is calculated by adding the total regular time cost, overtime cost, subcontract cost, and inventory cost.

Hence, the total cost of the plan is $31,310.

Want to see more full solutions like this?

Chapter 11 Solutions

Operations Management (McGraw-Hill Series in Operations and Decision Sciences)

- EXPLAIN Human Resource Information System (HRIS)arrow_forwardRead the mini-case study below and answer the following questions.With an enormous amount of data stored in databases and data warehouses, it is increasinglyimportant to develop powerful tools for analysis of such data and mining interestingknowledge from it. Data mining is a process of inferring knowledge from such huge data. Themain problem related to the retrieval of information from the World Wide Web is theenormous number of unstructured documents and resources, i.e., the difficulty of locating andtracking appropriate sources.Briefly explain any five (5) types of information you can get from data mining.arrow_forwardProblem 1: Practice Problems Chapter 6 Managing Quality The accounts receivable department has documented the following defects over a 30-day period: Category Frequency Invoice amount does not agree with the check amount 108 Invoice not on record (not found) 24 No formal invoice issued Check (payment) not received on time 18 30 Check not signed 8 Invoice number and invoice referenced do not agree 12 What techniques would you use and what conclusions can you draw about defects in the accounts receivable department? Problem 2: Prepare a flow chart for purchasing a Big Mac at the drive-through window at McDonalds. Problem 3: Draw a fishbone chart detailing reasons why a part might not be correctly machined.arrow_forward

- Problem 5: Development of a new deluxe version of a particular software product is being considered. The activities necessary for the completion of this project are listed in the table below along with their costs and completion times in weeks. Activity Normal Crash Normal Crash Immediate Time Time Cost Cost Predecessor A 4 3 2,000 2,600 B 2 1 2,200 2,800 A C 3 3 500 500 A D 8 4 2,300 2,600 A E 6 3 900 1,200 B, D F 3 2 3,000 4,200 C, E G 4 2 1,400 2,000 F a. What is the project expected completion date? b. What is the total cost required for completing this project on normal time? c. If you wish to reduce the time required to complete this project by 1 week, which activity should be crashed, and how much will this increase the total cost?arrow_forwardI need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.with diagramarrow_forwardnot use ai pleasearrow_forward

- provide scholarly reseach and references for the following 1. explain operational risks and examples of such risk faced by management at financial institutions 2. discuss the importance of establishing an effective risk management policy at financial institutions to manage operational risk, giving example of a risk management strategy used by financial institutions to mitigate such risk. 3. what is the rold of the core principles of effective bank supervision as it relates to operational risk, in the effective management of financial institutions.arrow_forwardPlease show all units, work, and steps needed to solve this problem I need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.arrow_forwardIM.82 A distributor of industrial equipment purchases specialized compressors for use in air conditioners. The regular price is $50, however, the manufacturer of this compressor offers quantity discounts per the following discount schedule: Option Plan Quantity Discount A 1 - 299 0% B 300 - 1,199 0.50% C 1,200+ 1.50% The distributor pays $56 each time it places an order with the manufacturer. Holding costs are negligible (none) but they do earn 10% annual interest on all cash balances (meaning there will be a financial opportunity cost when they put cash into inventory). Annual demand is expected to be 10,750 units. When there is no quantity discount (Option Plan A, the first row of the schedule listed above), what is the adjusted order quantity? (Display your answer to the nearest whole number.) 491 Based on your answer to the previous question, and based on the annual demand as stated above, what will be the annual ordering costs? (Display your answer to the…arrow_forward

- Excel Please. The workload of many areas of banking operations varies considerably based on time of day. A variable capacity can be achieved effectively by employing part-time personnel. Because part-timers are not entitled to all the fringe benefits, they are often more economical than full-time employees. Other considerations, however, may limit the extent to which part-time people can be hired in a given department. The problem is to find an optimal workforce schedule that would meet personnel requirements at any given time and also be economical. Some of the factors affecting personnel assignments are listed here: The bank is open from 9:00am to 7:00pm. Full-time employees work for 8 hours (1 hour for lunch included) per day. They do not necessarily have to start their shift when the bank opens. Part-time employees work for at least 4 hours per day, but less than 8 hours per day and do not get a lunch break. By corporate policy, total part-time personnel hours is limited…arrow_forwardIM.84 An outdoor equipment manufacturer sells a rugged water bottle to complement its product line. They sell this item to a variety of sporting goods stores and other retailers. The manufacturer offers quantity discounts per the following discount schedule: Option Plan Quantity Price A 1 - 2,399 $5.50 B 2,400 - 3,999 $5.20 C 4,000+ $4.50 A large big-box retailer expects to sell 9,700 units this year. This retailer estimates that it incurs an internal administrative cost of $225 each time it places an order with the manufacturer. Holding cost for the retailer is $55 per case per year. (There are 40 units or water bottles per case.) Based on this information, and not taking into account any quantity discount offers, what is the calculated EOQ (in units)? (Display your answer to the nearest whole number.) Number Based on this information, sort each quantity discount plan from left to right by dragging the MOST preferred option plan to the left, and the LEAST preferred…arrow_forwardIn less than 150 words, what is an example of what your reflection of core values means to you and your work: Commitment, Perseverance, Community, Service, Pride?arrow_forward

- MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,  Foundations of Business (MindTap Course List)MarketingISBN:9781337386920Author:William M. Pride, Robert J. Hughes, Jack R. KapoorPublisher:Cengage Learning

Foundations of Business (MindTap Course List)MarketingISBN:9781337386920Author:William M. Pride, Robert J. Hughes, Jack R. KapoorPublisher:Cengage Learning