Soon after December 31, 2019, the auditor requested a

The

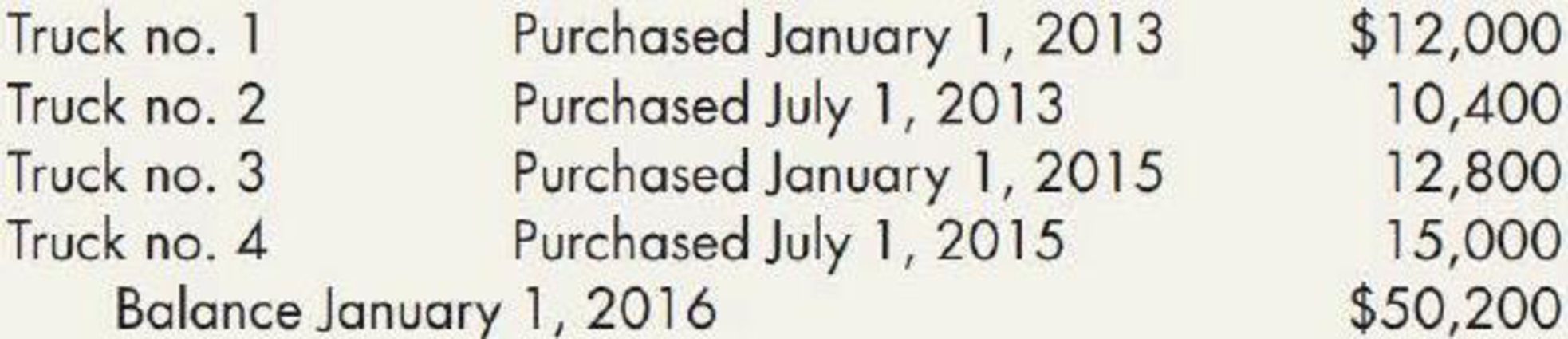

Transactions between January 1,2017, and December 31, 2019, and their record in the ledger were as follows:

- 1. July 1, 2016: Truck no. 1 was sold for $1,000 cash. The entry was a debit to Cash and a credit to Trucks, $1,000.

- 2. January 1, 2017: Truck no. 3 was traded for a larger one (no. 5) with a 5-year life. The agreed purchase price was $12,000. Jarrett paid the other company $1,780 cash on the transaction. The entry was a debit to Trucks, $1,780, and a credit to Cash, $1,780.

- 3. July 1, 2018: Truck no. 4 was damaged in a wreck to such an extent that it was sold as junk for $50 cash. Jarrett received $950 from the insurance company. The entry made by the bookkeeper was a debit to Cash, $1,000, and credits to Miscellaneous Revenue, $50, and Trucks, $950,

- 4. July 1, 2018: A new truck (no. 6) was acquired for $20,000 cash and debited at that amount to the Trucks account. The truck has a 5-year life.

Entries for depreciation had been made at the close of each year as follows: 2016, $8,840; 2017, $5,436; 2018, $4,896; 2019, $4,356.

Required:

- 1. Next Level For each of the 4 years, calculate separately the increase or decrease in earnings arising from the company’s errors in determining or entering depreciation or in recording transactions affecting trucks.

- 2. Prove your work by one compound

journal entry as of December 31, 2019; the adjustment of the Trucks account is to reflect the correct balances, assuming that the books have not been closed for 2019.

1.

Compute the effect of earnings (increase or decrease) of Company J that arise from the company’s error in determining the depreciation of the truck.

Explanation of Solution

Depreciation expense: Depreciation expense is a non-cash expense, which is recorded on the income statement reflecting the consumption of economic benefits of long-term asset on account of its wear and tear or obsolesces.

The effect of earnings that arise from the company’s error in determining the depreciation of the truck as follows:

| Year | Increase or decrease |

| 2016 | $(2,600) Decrease |

| 2017 | $496 Increase |

| 2018 | $(7,094) Decrease |

| 2019 | $(2,044) Decrease |

Table (1)

Compute the correct depreciation:

| Truck | 2016 | 2017 | 2018 | 2019 |

| 1. | $1,200 | - | - | - |

| 2. | $2,080 | $2,080 | $1,040 | - |

| 3. | $2,560 | - | - | - |

| 4. | $3,000 | $3,000 | $1,500 | - |

| 5. | - | $2,400 (5) | $2,400 (5) | $2,400 (5) |

| 6. | - | - | $2,000 | $4,000 (6) |

| Total | $8,840 | 7,480 | 6,940 | 6,400 |

| Depreciation recorded previously | 8,840 | 5,436 | 4,896 | 4,356 |

| Depreciation Corrected | 0 | $2,044 | $2,044 | $2,044 |

Table (2)

Compute the effort of earnings (increase or decrease) of Company J that arise from the company’s error in determining the depreciation of the truck as follows:

| Date | Account Title and Explanation | Post Ref |

Debit ($) | Credit ($) |

| Correct entry: | ||||

| July 1, 2016 | Cash | 1,000 | ||

| Accumulated Depreciation- Truck (2) | 8,400 | |||

| Loss on disposal of plant property, equipment | 2,600 | |||

| Truck (Number 1) | 12,000 | |||

| (To record the loss on disposal of plant, property and equipment) | ||||

| Entry made: | ||||

| Cash | 1,000 | |||

| Truck (Number 1) | 1,000 | |||

| (To record the sale of truck) | ||||

| Correcting entry: | ||||

| Accumulated Depreciation: Trucks (2) | 8,400 | |||

| Retained Earnings | 2,600 | |||

| Truck (Number 1) | 11,000 | |||

| (To record the accumulated depreciation) | ||||

| Correct entry: | ||||

| January 1, 2017 | Accumulated Depreciation: Trucks | 5,120 | ||

| Truck (Number 5) | 12,000 | |||

| Cash | 1,780 | |||

| Truck (Number 3) | 12,800 | |||

| Gain on Exchange (3) | 2,540 | |||

| (To record the gain on exchange) | ||||

| Entry made: | ||||

| Truck | 1,780 | |||

| Cash | 1,780 | |||

| (To record the cash paid for other company) | ||||

| Correcting entry: | ||||

| Accumulated Depreciation: Trucks | 5,120 | |||

| Truck | 2,580 | |||

| Retained Earnings (3) | 2,540 | |||

| (To record the accumulated depreciation) | ||||

| Correct entry: | ||||

| July 1, 2018 | Accumulated Depreciation –Truck (Number 4) (4) | 9,000 | ||

| Cash | 1,000 | |||

| Loss on disposal of plant property, equipment | 5,000 | |||

| Truck (Number 4) | 15,000 | |||

| (To record the loss on disposal of plant, property and equipment) | ||||

| Entry made: | ||||

| Cash | 1,000 | |||

| Miscellaneous Revenue | 50 | |||

| Truck (Number 4) | 950 | |||

| (To record the cash receipt from the damaged truck) | ||||

| Correcting entry: | ||||

| Accumulated Depreciation –Truck (Number 4) (4) | 9,000 | |||

| Retained Earnings | 5,050 | |||

| Truck (Number 4) | 14,050 | |||

| (To record the accumulated depreciation) |

Table (3)

Working note (1):

Compute the total accumulated depreciation of the trucks:

| Truck | Cost (a) | Life (b) | Annual Depreciation (c) | Years Owned (d) | Accumulated Depreciation |

| 1. | $12,000 | 5 | $2,400 | 3 | $7,200 |

| 2. | $10,400 | 5 | 2,080 | 2.5 | 5,200 |

| 3. | $12,800 | 5 | 2,560 | 1 | 2,560 |

| 4. | $15,000 | 5 | 3,000 | 0.5 | $1,500 |

| Total | $16,460 | ||||

Table (4)

Working note (2):

Compute the accumulated depreciation of the trucks for January 1, 2016:

Working note (3):

Compute the gain or loss on exchange:

Working note (4):

Compute the accumulated depreciation of Truck 4:

| Cost (a) | Life (b) | Annual Depreciation (c) | Years Owned (d) | Accumulated Depreciation |

| $15,000 | 5 | 3,000 | 0.5 (From July 1, 2015 to December 31, 2015) | $1,500 |

| $15,000 | 5 | 3,000 | 1 year (2016) | 3,000 |

| $15,000 | 5 | 3,000 | 1 year (2017) | 3,000 |

| $15,000 | 5 | 3,000 | 0.5 (From January 1, 2018 to July 1, 2018 | $1,500 |

| Total | 9,000 | |||

Table (5)

Working note (5):

Compute the depreciation expenses for truck 5:

Working note (6):

Compute the depreciation expenses of truck 6:

2.

Prepare a correcting compound journal entry as of December 31, 2019.

Explanation of Solution

Prepare a correcting compound journal entry as of December 31, 2019 as follows:

| Date | Account Title and Explanation | Post Ref |

Debit ($) | Credit ($) |

| December 31, 2019 | Retained Earnings (7) | 9,198 | ||

| Accumulated Depreciation of Trucks (8) | 16,388 | |||

| Depreciation expenses (Refer Table (2)) | 2,044 | |||

| Truck (9) | 27,630 | |||

| (To record the compound entry) |

Table (6)

- Retained earnings are the component of stockholder’s equity, and it decreases the value of equity. Hence, debit the retained earnings account with $9,198.

- Accumulated depreciation is a contra-asset, and it increases the value of assets. Hence, debit the accumulated depreciation account with $16,388.

- Depreciation expense is the component of stockholder’s equity, and it decreases the value of equity. Hence, debit the depreciation expense account with $2,044.

- Truck is an asset account, and it decreases the value of assets. Hence, credit the truck account with $27,630.

Working note (7):

Calculate the total retained earnings:

Working note (8):

Calculate the accumulated depreciation:

| Particulars | Amount ($) |

| Accumulated depreciation: | |

| 2016 | 8,400 |

| 2017 | 5,120 |

| 2018 | 9,000 |

| 22,520 | |

| Less: corrected depreciation | |

| 2017 | 2,044 |

| 2018 | 2,044 |

| 2019 | 2,044 |

| Total | 16,388 |

Table (6)

Working note (9):

Calculate the total cost of truck:

| Particulars | Amount ($) |

| Cost of truck: | |

| 2016 | 11,000 |

| 2017 | 2,580 |

| 2018 | 14,050 |

| Total | 27,630 |

Table (7)

Want to see more full solutions like this?

Chapter 11 Solutions

Intermediate Accounting: Reporting And Analysis

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub