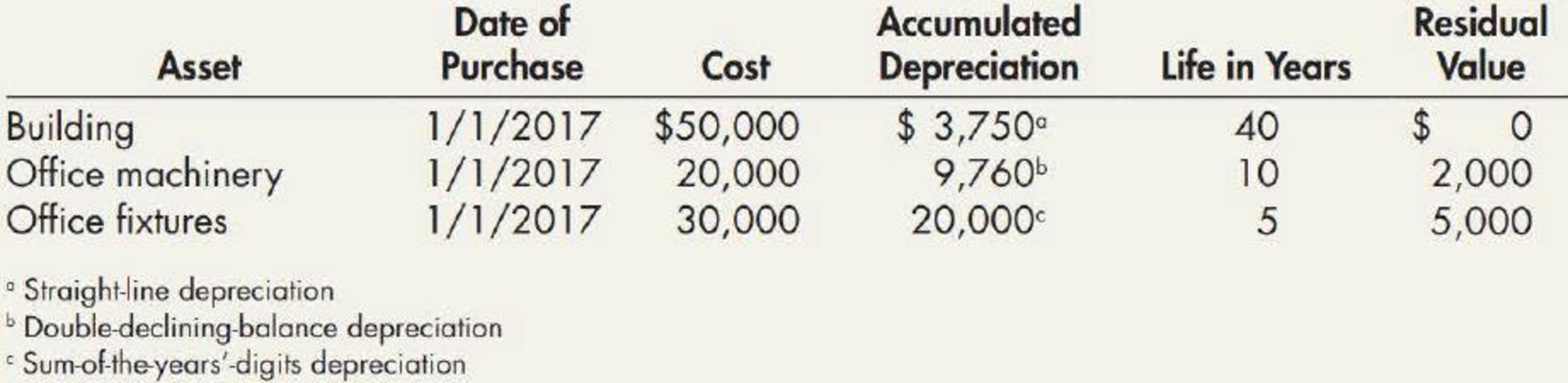

On December 31, 2019, Vail Company owned the following assets:

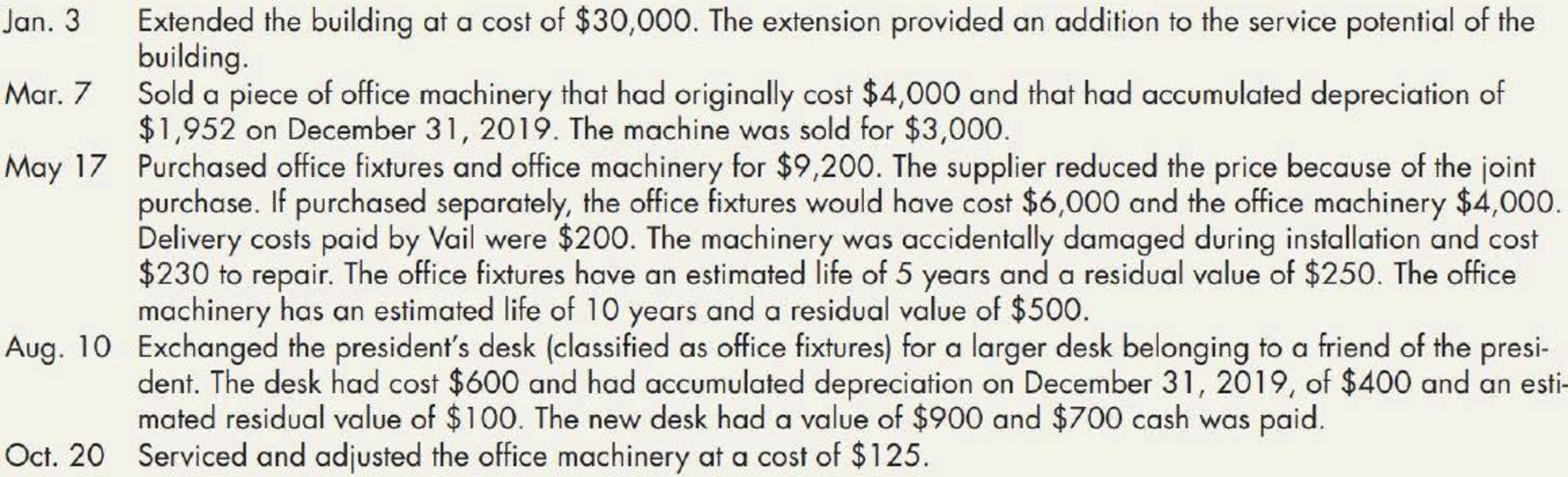

Vail computes depreciation and amortization expense to the nearest whole year. During 2020, Vail engaged in the following transactions:

Required:

- 1. Check the accuracy of the

accumulated depreciation balances at December 31, 2019. Round to the nearest whole dollar in all requirements. - 2. Prepare

journal entries to record the preceding events in 2020, as well as the year-end recording of depreciation expense. - 3. Prepare an Accumulated Depreciation account for each category of assets, enter the beginning balance,

post the journal entries from Requirement 2, and compute the ending balance.

1.

Calculate the accumulated depreciation balance at December 31, 2019 for the given assets, and check it’s ‘accuracy.

Explanation of Solution

Depreciation expense: Depreciation expense is a non-cash expense, which is recorded on the income statement reflecting the consumption of economic benefits of long-term asset on account of its wear and tear or obsolesces.

Straight-line depreciation method: The depreciation method which assumes that the consumption of economic benefits of long-term asset could be distributed equally throughout the useful life of the asset is referred to as straight-line method.

Sum-of- the-years’ digits method: Sum-of-the years’ digits method determines the depreciation by multiplying the depreciable base and declining fraction.

Double-declining-balance method: The depreciation method which assumes that the consumption of economic benefits of long-term asset is high in the early years but gradually declines towards the end of its useful life is referred to as double-declining-balance method.

Calculate the accumulated depreciation balance at December 31, 2019 for the given assets, and cross check its’ accuracy as follows:

Building:

Office machinery:

| Year | Beginning book value (A) |

Depreciation rate (2) (B) | Depreciation expense |

Ending book value |

| 2017 | 20,000 | 20% | 4,000 | 16,000 |

| 2018 | 16,000 | 20% | 3,200 | 12,800 |

| 2019 | 12,800 | 20% | 2,560 | 10,240 |

| Total | 9,760 |

Table (1)

Note: Ending book value of the prior year is considered as the beginning book value of current year.

Office fixtures:

| Year | Depreciation base (3) (A) |

Faction (4) (B) | Depreciation expense |

Ending book value |

| 2017 | 25,000 | 8,333 | 21,667 | |

| 2018 | 25,000 | 6,667 | 15,000 | |

| 2019 | 25,000 | 5,000 | 10,000 | |

| Total | 20,000 |

Table (2)

Working note (1):

Calculate the annual depreciation expense of building.

Working note (2):

Compute the straight line rate:

Useful life = 10 years

Working note (3):

Calculate the depreciable base of office fixtures.

Working note (4):

Calculate the denominator of the fraction for sum-of-the-year’s digit.

2.

Prepare necessary journal entries for the given transaction for 2020.

Explanation of Solution

Prepare necessary journal entries for the given transaction for 2020 as follows:

| Date | Account Title & Explanation | Debit ($) |

Credit ($) |

| January 3, 2020 | Building | 30,000 | |

| Cash | 30,000 | ||

| (To record the purchase of building for cash) | |||

| March 8, 2020 | Cash | 3,000 | |

| Accumulate depreciation-Office machinery | 1,952 | ||

| Office machinery | 4,000 | ||

| Gain on disposal of office machinery (5) | 952 | ||

| (To record a piece of office machinery sold during the year) | |||

| May 17, 2020 | Office fixtures (6) | 5,640 | |

| Office machinery (6) | 3,760 | ||

| Repair expense | 230 | ||

| Cash | 9,630 | ||

| (To record office fixtures and machinery purchased during the year) | |||

| August 10, 2020 | Depreciation expense (7) | 67 | |

| Accumulated depreciation-Office fixtures | 67 | ||

| (To record the depreciation expense incurred for office fixtures) | |||

| August 10, 2020 | Office fixtures | 900 | |

| Accumulated depreciation-Office fixtures (7) | 467 | ||

| Cash | 700 | ||

| Office fixtures | 600 | ||

| Gain on disposal of office fixtures (8) | 67 | ||

| (To record the office fixtures exchanged during the year ) | |||

| October 20, 2020 | Repair expense | 125 | |

| Cash | 125 | ||

| (To record the repair expense incurred during the year) | |||

| December 31, 2020 | Depreciation expense – Building (9) | 2,061 | |

| Depreciation expense - Office machinery (14) | 2,390 | ||

| Depreciation expense - Office fixtures (17) | 5,064 | ||

| Accumulated depreciation-Building | 2,061 | ||

| Accumulated depreciation-Office machinery | 2,390 | ||

| Accumulated depreciation-Office fixtures | 5,064 | ||

| (To record the depreciation expense of assets incurred at the end of the accounting year) |

Table (3)

Working note (5):

Calculate the gain on disposal of office machinery.

Working note (6):

Calculate the cost of office fixtures and office machinery.

| Particulars | Appraisal value (A) | Total appraisal value (B) |

Proportion | Total purchase cost (D) |

Cost ($) |

| Office fixtures | $6,000 | $10,000 | 60% |

$9,400 | $5,640 |

| Office machinery | $4,000 | 10,000 | 40% | $9,400 | $3,760 |

| Total | $10,000 | 100% | $9,400 |

Table (4)

Working note (7):

Calculate the depreciation expense of desk.

| Year | Depreciation base |

Faction (4) (B) | Depreciation expense |

| 2017 | 500 | 167 | |

| 2018 | 500 | 133 | |

| 2019 | 500 | 100 | |

| 2020 | 500 | 67 | |

| Total | 467 |

Table (5)

Working note (8):

Calculate the gain on disposal of desk.

Working note (9):

Calculate the depreciation expense of building at the end of the year 2020.

Working note (10):

Calculate the remaining office machinery at 2020.

Working note (11):

Calculate the depreciation expense of office machinery at the end of the year 2020.

Working note (12):

Calculate the depreciation expense for remaining office machinery under double declining balance method.

Working note (13):

Calculate depreciation expense of office machinery purchased during 2020 under double declining balance method.

Working note (14):

Calculate total depreciation expense of office machinery at 2020.

Working note (15):

Calculate the depreciation expense of remaining office fixtures under the sum of the year’s digit method.

Working note (16):

Calculate the depreciation expense of new office fixtures under the sum of the year’s digit method.

Working note (17):

Calculate the total depreciation expense for office fixtures.

3.

Prepare T-account for the accumulated depreciation, and calculate the ending balance of accumulated depreciation for the given assets.

Explanation of Solution

Prepare T-account for the accumulated depreciation, and calculate the ending balance of accumulated depreciation as follows:

| Accumulated depreciation - Building | |||

| December 31, 2019 | 3,750 | ||

| December 31, 2019 | $2,061 | ||

| Clos. Bal. | $5,811 | ||

| Accumulated depreciation – Office machinery | |||

| July 3, 2020 | $1,952 | December 31, 2019 | 9,760 |

| December 31, 2019 | $2,390 | ||

| Clos. Bal. | $10,198 | ||

| Accumulated depreciation – Office mixtures | |||

| October 8, 2020 | 467 | December 31, 2019 | $20,000 |

| October 8, 2020 | $67 | ||

| December 31, 2019 | $5,064 | ||

| Clos. Bal. | $24,664 | ||

Want to see more full solutions like this?

Chapter 11 Solutions

Intermediate Accounting: Reporting And Analysis

- A supplier offers credit terms of 2/10, net 30, meaning a 2% discount is available if payment is made within 10 days. If a company purchases $12,000 worth of goods and pays within 7 days, calculate the amount paid after applying the discount.arrow_forwardQuestionarrow_forwardKindly help me with accounting questionsarrow_forward

- General accounting questionarrow_forwardA factory's budgeted production is 12,000 units, and the total fixed overhead cost is $72,000. However, actual production is 10,000 units. A. Compute the fixed overhead applied per unit. B. Calculate the fixed overhead volume variance.arrow_forwardWhat is the book equivalent of taxable incomearrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning