Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781337517386

Author: WARREN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 11.4C

Variable costs and activity bases in decision making

The owner of Dawg Prints, a printing company, is planning direct labor needs for the upcoming year. The owner has provided you with the following information for next year's plans:

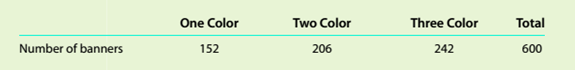

Each color on the banner must be printed one at a time. Thus, for example, a four-color banner will need to be run through the printing operation four separate times. The total production volume last year was 600 banners, as shown below.

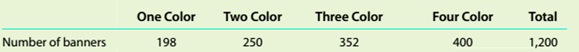

The four-color banner is a new product offering for the upcoming year. The owner believes that the expected 600-unit increase in volume from last year means that direct labor expenses should increase by 100% (600 + 600). What do you think?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

choose best answer for this questions carefully

subject- general accountant

I want answer

Chapter 11 Solutions

Survey of Accounting (Accounting I)

Ch. 11 - Which of the following statements describes...Ch. 11 - If sales are $500,000, variable costs are...Ch. 11 - If the unit selling price is $16. the unit...Ch. 11 - Based on the data presented in Question 3, how...Ch. 11 - Prob. 5SEQCh. 11 - Describe how total variable costs and unit...Ch. 11 - How would each of the following costs be...Ch. 11 - Describe the behavior of (a) total fixed costs and...Ch. 11 - How would each of the following costs be...Ch. 11 - In cost analyses, how arc mixed costs treated?

Ch. 11 - Which of the following graphs illustrates how...Ch. 11 - Which of the following graphs illustrates how unit...Ch. 11 - Which of the following graphs best illustrates...Ch. 11 - In applying the high-low method of Cost...Ch. 11 - Prob. 10CDQCh. 11 - Prob. 11CDQCh. 11 - Prob. 12CDQCh. 11 - If insurance rates are increased, what effect will...Ch. 11 - Prob. 14CDQCh. 11 - The reliability of cost-volume-profit (CVP)...Ch. 11 - How does the sales mix affect the calculation of...Ch. 11 - Prob. 17CDQCh. 11 - Classify costs Following is a list of various...Ch. 11 - Identify cost graphs The following cost graphs...Ch. 11 - Prob. 11.3ECh. 11 - Identify activity bases From the following list of...Ch. 11 - Identify fixed and variable costs Intuit Inc....Ch. 11 - Relevant range and fixed and variable costs Third...Ch. 11 - High-low method Liberty Inc. has decided to use...Ch. 11 - High-low method for service company Miss River...Ch. 11 - Contribution margin ratio a. Matzinger Company...Ch. 11 - Contribution margin and contribution margin ratio...Ch. 11 - Break-even sales and sales to realize operating...Ch. 11 - Prob. 11.12ECh. 11 - Prob. 11.13ECh. 11 - Break-even analysis The Garden Club of Palm...Ch. 11 - Break-even analysis Media outlets such as ESPN and...Ch. 11 - Prob. 11.16ECh. 11 - Prob. 11.17ECh. 11 - Prob. 11.18ECh. 11 - Prob. 11.19ECh. 11 - Prob. 11.20ECh. 11 - Break-even sales and sales mix for a service...Ch. 11 - Operating leverage SunRise Inc. and SunSet Inc....Ch. 11 - Classify costs Peak Apparel Co. manufactures a...Ch. 11 - Break-even sales under present and proposed...Ch. 11 - Prob. 11.2.2PCh. 11 - Prob. 11.2.3PCh. 11 - Prob. 11.2.4PCh. 11 - Prob. 11.2.5PCh. 11 - Break-even sales under present and proposed...Ch. 11 - Prob. 11.2.7PCh. 11 - Prob. 11.2.8PCh. 11 - Break-even sales and cost-volume-profit graph For...Ch. 11 - Prob. 11.3.2PCh. 11 - Break-even sales and cost-volume-profit graph For...Ch. 11 - Prob. 11.3.4PCh. 11 - Prob. 11.4.1PCh. 11 - Prob. 11.4.2PCh. 11 - Prob. 11.4.3PCh. 11 - Prob. 11.4.4PCh. 11 - Prob. 11.5.1PCh. 11 - Prob. 11.5.2PCh. 11 - Sales mix and break-even sales Data related to the...Ch. 11 - Prob. 11.5.4PCh. 11 - Prob. 11.5.5PCh. 11 - Contribution margin, break-even sales,...Ch. 11 - Contribution margin, break-even sales,...Ch. 11 - Contribution margin, break-even sales,...Ch. 11 - Contribution margin, break-even sales,...Ch. 11 - Contribution margin, break-even sales,...Ch. 11 - Margin of safety a. If Go-Go Buggies Company, with...Ch. 11 - Prob. 11.2MBACh. 11 - Margin of safety Use the data from E11-12 and...Ch. 11 - Margin of safety Use the data from E11-12 and...Ch. 11 - Sales mix and margin of safety Use the data from...Ch. 11 - Prob. 11.4.2MBACh. 11 - Prob. 11.4.3MBACh. 11 - Margin of safety Using the data from P11-2,...Ch. 11 - Prob. 11.5.2MBACh. 11 - Margin of safety Using the data from P11-6....Ch. 11 - Prob. 11.6.2MBACh. 11 - Prob. 11.6.3MBACh. 11 - Prob. 11.1CCh. 11 - Break-even sales, contribution margin "Every...Ch. 11 - Break-even analysis Aquarius Games Inc. has...Ch. 11 - Variable costs and activity bases in decision...Ch. 11 - Variable costs and activity bases in decision...Ch. 11 - Prob. 11.6C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Fixed Asset Replacement Decision 1235; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=LJRzn9K8Nwk;License: Standard Youtube License