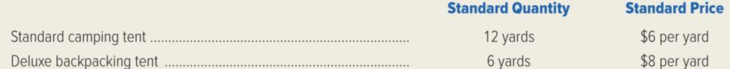

Rocky Mountain Camping Equipment, Inc. has established the following direct-material standards for its two products.

During March, the company purchased 2,100 yards of tent fabric for its standard model at a cost of $13,440. The actual March production of the standard tent was 100 tents, and 1,250 yards of fabric were used. Also during March, the company purchased 800 yards of the same tent fabric for its deluxe backpacking tent at a cost of $6,320. The firm used 720 yards of the fabric during March in the production of 120 deluxe tents.

Required:

- 1. Compute the direct-material purchase price variance and quantity variance for March.

- 2. Prepare

journal entries to record the purchase of material, use of material, and incurrence of variances in March.

1.

Calculate the direct material purchase price variance and direct material quantity variance of Company R for the month of March.

Explanation of Solution

Variance: Variance refers to the difference level in the actual cost incurred and standard cost. The total cost variance is subdivided into separate cost variances; this cost variance indicates that the amount of variance that is attributable to specific casual factors.

Standard cost: In the accounting records, the term standard cost refers to the practice of replacement of an expected cost for an actual cost. Then the difference between the expected costs and actual costs showing the variance are also recorded periodically. A standard costs is also known as target cost or predetermined cost.

Calculate the direct material purchase price variance and direct material quantity variance of Company R for the month of March as follows:

Direct material purchase price variance:

Working note (1):

Calculate the actual price for standard tent:

Working note (2):

Calculate the actual price for deluxe tent:

Working note (3):

Calculate the direct material purchased price variance of standard tent:

Working note (4):

Calculate the direct material purchased price variance of deluxe tent:

Direct material quantity variance:

Working note (5):

Calculate the standard quantity of standard tent:

Working note (6):

Calculate the standard quantity of deluxe tent:

Working note (7):

Calculate the direct material quantity variance of standard tent:

Working note (8):

Calculate the direct material quantity variance of deluxe tent:

2.

Prepare journal entries for the given transactions of Company R for the month of March.

Explanation of Solution

Prepare journal entry to record the purchase of direct material and variance:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Raw materials inventory (9) | 19,000 | ||

| Direct materials cost variance | 760 | ||

| Accounts payable | 19,760 | ||

| (To record the direct materials purchased on account) |

Table (1)

- Raw materials inventory is an asset account, and it increases the value of asset. Hence, debit the raw materials inventory account with $19,000.

- Direct materials cost variance is expense account and it decreases the value of stockholder’s equity. Hence, debit the direct material cost variance account with $760.

- Accounts payable is a liability account, and it increases the value of liabilities. Hence, credit the accounts payable account with $19,760.

Working note (9):

Calculate the raw materials inventory:

Prepare journal entry to record the use of direct material and variance:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Work-in-Process Inventory (10) | 12,960 | ||

| Direct Materials quantity Variance | 300 | ||

|

Raw Materials Inventory | 13,260 | ||

| (To record the direct materials used in the production process) |

Table (2)

- Work-in-process inventory is an asset account, and it increases the value of asset. Hence, debit the work-in-process inventory account with $12,960.

- Direct materials quantity variance is an expense account and it decreases the value of stockholder’s equity. Hence, debit t the direct material quantity variance account with $300.

- Raw materials inventory is an asset account, and it decreases the value of asset. Hence, credit the raw materials inventory account with $13,260.

Working note (10):

Calculate the work in process inventory:

Want to see more full solutions like this?

Chapter 10 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

- Harmon Household Products, Inc., manufactures a number of consumer items for general household use. One of these products, a chopping board, requires an expensive hardwood. During a recent month, the company manufactured 4,000 chopping boards using 11,000 board feet of hardwood. The hardwood cost the company $18,700. The company’s standards for one chopping board are 2.5 board feet of hardwood, at a cost of $1.80 per board foot. Required: 1. What cost for wood should have been incurred to make 4,000 chopping blocks? How much greater or less is this than the cost that was incurred? 2. Break down the difference computed in (1) above into a materials price variance and a materials quantity variance.arrow_forwardBandar Industries manufactures sporting equipment. One of the company's products is a football helmet that requires special plastic. During the quarter ending June 30, the company manufactured 3,100 helmets, using 2,170 kilograms of plastic. The plasti cost the company $14,322. According to the standard cost card, each helmet should require 0.65 kilograms of plastic, at a cost of $7.00 per kilogram. Required: 1. What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 3,100 helmets? 2. What is the standard materials cost allowed (SQ x SP) to make 3.100 helmets? 3. What is the materials spending variance? 4. What is the materials price variance and the materials quantity variance? (For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations.) 1. Standard quantity of kilograms allowed…arrow_forwardBandar Industries manufactures sporting equipment. One of the company’s products is a football helmet that requires special plastic. During the quarter ending June 30, the company manufactured 3,400 helmets, using 2,448 kilograms of plastic. The plastic cost the company $18,605. According to the standard cost card, each helmet should require 0.64 kilograms of plastic, at a cost of $8.00 per kilogram. Required: What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 3,400 helmets? What is the standard materials cost allowed (SQ × SP) to make 3,400 helmets? What is the materials spending variance? What is the materials price variance and the materials quantity variance? Note: For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations.arrow_forward

- Bandar Industries manufactures sporting equipment. One of the company's products is a football helmet that requires special plastic. During the quarter ending June 30, the company manufactured 3,200 helmets, using 2,048 kilograms of plastic. The plastic cost the company $13,517. According to the standard cost card, each helmet should require 0.58 kilograms of plastic, at a cost of $7.00 per kilogram. Required: 1. What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 3,200 helmets? 2. What is the standard materials cost allowed (SQ x SP) to make 3,200 helmets? 3. What is the materials spending variance? 4. What is the materials price variance and the materials quantity variance? Note: For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations. 1. Standard quantity of kilograms…arrow_forwardBandar Industries manufactures sporting equipment. One of the company's products is a football helmet that requires special plastic. During the quarter ending June 30, the company manufactured 3,400 helmets, using 2,584 kilograms of plastic. The plastic cost the company $17,054. According to the standard cost card, each helmet should require 0.69 kilogram of plastic, at a cost of $7.00 per kilogram. Required: 1. What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 3,400 helmets? 2. What is the standard materials cost allowed (SQx SP) to make 3,400 helmets? 3. What is the materials spending variance? 4. What are the materials price variance and the materials quantity variance? Note: For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations. 1. Standard quantity of kilograms…arrow_forwardBandar Industries manufactures sporting equipment. One of the company's products is a football helmet that requires special plastic. During the quarter ending June 30, the company manufactured 3,800 helmets, using 2,812 kilograms of plastic. The plastic cost the company $21,371. According to the standard cost card, each helmet should require 0.66 kilogram of plastic, at a cost of $8.00 per kilogram. Required: 1. What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 3,800 helmets? 2. What is the standard materials cost allowed (SQ x SP) to make 3,800 helmets? 3. What is the materials spending variance? 4. What are the materials price variance and the materials quantity variance? Note: For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations. 1. Standard quantity of kilograms…arrow_forward

- Bandar Industries manufactures sporting equipment. One of the company's products is a football helmet that requires special plastic. During the quarter ending June 30, the company manufactured 3,600 helmets, using 2,376 kilograms of plastic. The plastic cost the company $18,058. According to the standard cost card, each helmet should require 0.58 kilograms of plastic, at a cost of $8.00 per kilogram. Required: 1. What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 3,600 helmets? 2. What is the standard materials cost allowed (SQ * SP) to make 3,600 helmets? 3. What is the materials spending variance? 4. What is the materials price variance and the materials quantity variance? (For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations.) 1. Standard quantity of kilograms…arrow_forwardBandar Industries manufactures sporting equipment. One of the company’s products is a football helmet that requires special plastic. During the quarter ending June 30, the company manufactured 3,900 helmets, using 2,262 kilograms of plastic. The plastic cost the company $17,191. According to the standard cost card, each helmet should require 0.51 kilograms of plastic, at a cost of $8.00 per kilogram. Required: 1. What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 3,900 helmets? 2. What is the standard materials cost allowed (SQ × SP) to make 3,900 helmets? 3. What is the materials spending variance? 4. What is the materials price variance and the materials quantity variance? (For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations.)arrow_forwardBandar Industries manufactures sporting equipment. One of the company’s products is a football helmet that requires special plastic. During the quarter ending June 30, the company manufactured 4,000 helmets, using 3,040 kilograms of plastic. The plastic cost the company $20,064. According to the standard cost card, each helmet should require 0.67 kilograms of plastic, at a cost of $7.00 per kilogram. Required: What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 4,000 helmets? What is the standard materials cost allowed (SQ × SP) to make 4,000 helmets? What is the materials spending variance? What are the materials price variance and the materials quantity variance?arrow_forward

- Bandar Industries manufactures sporting equipment. One of the company's products is a football helmet that requires special plastic During the quarter ending June 30, the company manufactured 3,300 helmets, using 2,475 klograms of plastic. The plastic cost the company $18,810. According to the standard cost card, each helmet should require 0.68 kilograms of plastic, at a cost of $8.00 per kilogram. Required: 1. What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 3,300 helmets? 2. What is the standard materials cost allowed (SQ - SP) to make 3,300 helmets? 3. What is the materials spending variance? 4. What is the materials price varlance and the materials quantity variance? (For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediote calculations.) 1. Standard quantity of kilograms allowed…arrow_forwardSubject:arrow_forwardKinnear Plastics manufactures various components for the aircraft and marine industry. Kinnear buys plastic from two vendors: Tappan Corporation and Hill Enterprises. Kinnear chooses the vendor based on price. Once the plastic is received, it is inspected to ensure that it is suitable for production. Plastic that is deemed unsuitable is disposed of. The controller at Kinnear collected the following information on purchases for the past year: Tappan Hill Total purchases (tons) 6,000 10,000 Plastic discarded 120 600 The purchasing manager has just received bids on an order for 290 tons of plastic from both Tappan and Hill. Tappan bid $1,813 and Hill bid $1,786 per ton. Required: Assume that the average quality, measured by the amounts discarded…arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning