Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

11th Edition

ISBN: 9781259727788

Author: Hilton & Platt

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 49C

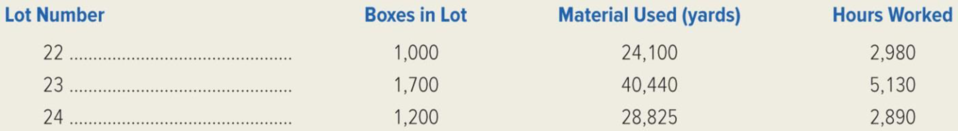

European Styles, Inc. manufactures women’s blouses of one quality, which are produced in lots to fill each special order. Its customers are department stores in various cities. European Styles sews the particular stores’ labels on the blouses. During November, the company worked on three orders, for which the month’s job-cost records disclose the following data.

The following additional information is available:

- 1. The firm purchased 95,000 yards of material during November at a cost of $106,400.

- 2. Direct labor during November amounted to $165,000. According to payroll records, production employees were paid $15.00 per hour.

- 3. There was no work in process on November 1. During November, lots 22 and 23 were completed. All material was issued for lot 24, which was 80 percent completed as to direct labor.

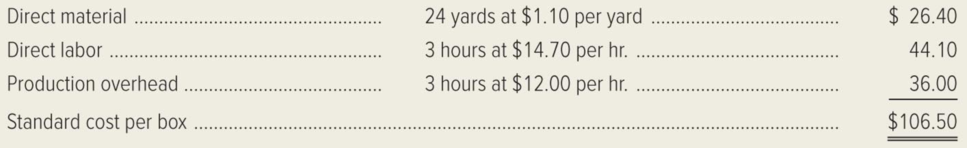

- 4. The standard costs for a box of six blouses are as follows:

Required:

- 1. Prepare a schedule computing the

standard cost of lots 22, 23, and 24 for November. - 2. Prepare a schedule showing, for each lot produced during November:

- a. Direct-material purchase price variance.

- b. Direct-material quantity variance.

- c. Direct-labor efficiency variance.

- d. Direct-labor rate variance.

Indicate whether each variance is favorable or unfavorable.

- 3. Prepare

journal entries to record each of the following events.- Purchase of material.

- Incurrence of direct-labor cost.

- Addition of direct-material and direct-labor cost to Work-in-Process Inventory.

- Recording of direct-material and direct-labor variances.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Dillon Products manufactures various machined parts to customer specifications. The company uses a joborder costing system and applies overhead cost to jobs on the basis of machine-hours. At the beginning ofthe year, it was estimated that the company would work 240,000 machine-hours and incur $4,800,000 inmanufacturing overhead costs.The company spent the entire month of January working on a large order for 16,000 custom mademachined parts. The company had no work in process at the beginning of January. Cost data relating toJanuary follow:a. Raw materials purchased on account, $325,000.b. Raw materials requisitioned for production, $290,000 (80% direct materials and 20% indirect materials).c. Labor cost incurred in the factory, $180,000 (one-third direct labor and two-thirds indirect labor).d. Depreciation recorded on factory equipment, $75,000.e. Other manufacturing overhead costs incurred, $62,000 (credit Accounts Payable).f. Manufacturing overhead cost was applied to production on…

Dillon Products manufactures various machined parts to customer specifications. The company uses a job-order costing system and applies overhead cost to jobs on the basis of machine-hours. At the beginning of the year, the company used a cost formula to estimate that it would incur$4,800,000 in manufacturing overhead cost at an activity level of 240,000 machine-hours.The company spent the entire month of January working on a large order for 16,000 custommade machined parts. The company had no work in process at the beginning of January. Cost data relating to January follow:a. Raw materials purchased on account, $325,000.b. Raw materials used in production, $290,000 (80% direct materials and 20% indirect materials).c. Labor cost accrued in the factory, $180,000 (one-third direct labor and two-thirds indirect labor).d. Depreciation recorded on factory equipment, $75,000.e. Other manufacturing overhead costs incurred on account, $62,000.f. Manufacturing overhead cost was applied to…

Dillon Products manufactures various machined parts to customer specifications.The company uses a job-order costing system and applies overhead cost to jobson the basis of machine-hours. At the beginning of the year, the company used acost formula to estimate that it would incur $4,290,000 in manufacturing overheadcost at an activity level of 572,000 machine-hours.The company spent the entire month of January working on a large order for12,200 custom-made machined parts. The company had no work in process at thebeginning of January. Cost data relating to January follow:

a. Raw materials purchased on account, $315,000.b. Raw materials used in production, $254,000 (80% direct materials and 20%indirect materials).c. Labor cost accrued in the factory, $177,000 (one-third direct labor and two-thirdsindirect labor).d. Depreciation recorded on factory equipment, $62,300.e. Other manufacturing overhead costs incurred on account, $84,200.f. Manufacturing overhead cost was applied to production…

Chapter 10 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

Ch. 10 - Prob. 1RQCh. 10 - What is meant by the phrase management by...Ch. 10 - Prob. 3RQCh. 10 - Prob. 4RQCh. 10 - Prob. 5RQCh. 10 - Prob. 6RQCh. 10 - What is the interpretation of the direct-material...Ch. 10 - What manager is usually in the best position to...Ch. 10 - What is the interpretation of the direct-material...Ch. 10 - Prob. 10RQ

Ch. 10 - Prob. 11RQCh. 10 - What is the interpretation of the direct-labor...Ch. 10 - What manager is generally in the best position to...Ch. 10 - What is the interpretation of the direct-labor...Ch. 10 - What manager is generally in the best position to...Ch. 10 - Prob. 16RQCh. 10 - Describe five factors that managers often consider...Ch. 10 - Discuss several ways in which standard-costing...Ch. 10 - Describe how standard costs are used for product...Ch. 10 - Prob. 20RQCh. 10 - Prob. 21RQCh. 10 - Saskatewan Can Company manufactures recyclable...Ch. 10 - Refer to the data in the preceding exercise. Use...Ch. 10 - Cayuga Hardwoods produces handcrafted jewelry...Ch. 10 - During June, Danby Companys material purchases...Ch. 10 - Refer to the data in the preceding exercise. Draw...Ch. 10 - The director of cost management for Odessa Company...Ch. 10 - Due to evaporation during production, Plano...Ch. 10 - Prob. 30ECh. 10 - Refer to the data in Exercise 1022, regarding...Ch. 10 - Saskatewan Can Company manufactures recyclable...Ch. 10 - New Jersey Valve Company manufactured 7,800 units...Ch. 10 - Prob. 34PCh. 10 - During May, Joliet Fabrics Corporation...Ch. 10 - Sal Amato operates a residential landscaping...Ch. 10 - Santa Rosa Industries uses a standard-costing...Ch. 10 - The following data pertain to Colgate-Palmolives...Ch. 10 - Orion Corporation has established the following...Ch. 10 - Associated Media Graphics (AMG) is a rapidly...Ch. 10 - The director of cost management for Portland...Ch. 10 - Ogwood Companys Johnstown Division is a small...Ch. 10 - Quincy Farms produces items made from local farm...Ch. 10 - Schiffer Corporation manufactures agricultural...Ch. 10 - Aqua float Corporation manufactures rafts for use...Ch. 10 - Rocky Mountain Camping Equipment, Inc. has...Ch. 10 - Springsteen Company manufactures guitars. The...Ch. 10 - Springsteen Company manufactures guitars. The...Ch. 10 - European Styles, Inc. manufactures womens blouses...Ch. 10 - MacGyver Corporation manufactures a product called...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Antolini Enterprises produces mens sports coats that are sold by popular department stores. Each retail order is treated as a job that accumulates materials, labor, and overhead costs for a batch of sports coats. Management has obtained data on the labor costs for four selected jobs over a six-month period. Each selected job represents a similar style and size of sports coat. The data are as follows: a. Determine the direct labor cost per unit for each job. b. Interpret the trend in per-unit labor cost. c. Determine the direct labor hours per sports coat. d. Interpret what may be happening with Job 192.arrow_forwardThe cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forwardRockford Company has four departmental accounts: Building Maintenance, General Factory Overhead, Machining, and Assembly. The direct labor hour method is used to apply factory overhead to the jobs being worked on in Machining and Assembly. The company expects each production department to use 30,000 direct labor hours during the year. The estimated overhead rates for the year include the following: During the year, both Machining and Assembly used 28,000 direct labor hours. Factory overhead costs incurred during the year follow: In determining application rates at the beginning of the year, cost allocations were made as follows, using the sequential distribution method: Building Maintenance to: General Factory Overhead, 10%; Machining, 50%; Assembly, 40%. General factory overhead was distributed according to direct labor hours. Required: Determine the under- or overapplied overhead for each production department. (Hint: First you must distribute the service department costs.)arrow_forward

- Lucy Sportswear manufactures a specialty line of T-shirts using a job order cost system. During March, the following costs were incurred in completing Job ICU2: direct materials, 13,700; direct labor, 4,800; administrative, 1,400; and selling, 5,600. Factory overhead was applied at the rate of 25 per machine hour, and Job ICU2 required 800 machine hours. If Job ICU2 resulted in 7,000 good shirts, the cost of goods sold per unit would be: a. 5.70. b. 6.50. c. 5.50. d. 6.30.arrow_forwardDillon Products manufactures various machined parts to customer specifications. The company uses a job-order costing system and applies overhead cost to jobs on the basis of machine-hours. At the beginning of the year, the company used a cost formula to estimate that it would incur $4,800,000 in manufacturing overhead cost at an activity level of 240,000 machine-hours. The company spent the entire month of January working on a large order for 16,000 custom-made machined parts. The company had no work in process at the beginning of January. Cost data relating to January follow: a. Raw materials purchased on account, $325,000. b. Raw materials used in production, $290,000 (80% direct materials and 20% indirect materials). c. Labor cost accrued in the factory, $180,000 (one-third direct labor and two-thirds indirect labor). d. Depreciation recorded on factory equipment, $75,000. e. Other manufacturing overhead costs incurred on account, $62,000. f. Manufacturing overhead cost was applied…arrow_forwardDillon Products manufactures various machined parts to customer specifications. The company uses a job-order costing system and applies overhead cost to jobs on the basis of machine-hours. At the beginning of the year, the company used a cost formula to estimate that it would incur $4,255,000 in manufacturing overhead cost at an activity level of 575,000 machine-hours. The company spent the entire month of January working on a large order for 12,700 custom-made machined parts. The company had no work in process at the beginning of January. Cost data relating to January follow: a. Raw materials purchased on account, $317,000. b. Raw materials used in production, $263,000 (80% direct materials and 20% indirect materials). c. Labor cost accrued in the factory, $171,000 (one-third direct labor and two-thirds indirect labor). d. Depreciation recorded on factory equipment, $63,700. e. Other manufacturing overhead costs incurred on account, $85,000. f. Manufacturing overhead cost was applied…arrow_forward

- Dillon Products manufactures various machined parts to customer specifications. The company uses a job-order costing system and applies overhead cost to jobs on the basis of machine-hours. At the beginning of the year, the company used a cost formula to estimate that it would incur $4,225,600 in manufacturing overhead cost at an activity level of 556,000 machine-hours. The company spent the entire month of January working on a large order for 12,100 custom-made machined parts. The company had no work in process at the beginning of January. Cost data relating to January follow: Raw materials purchased on account, $325,000. Raw materials used in production, $264,000 (80% direct materials and 20% indirect materials). Labor cost accrued in the factory, $153,000 (one-third direct labor and two-thirds indirect labor). Depreciation recorded on factory equipment, $62,100. Other manufacturing overhead costs incurred on account, $85,300. Manufacturing overhead cost was applied to production…arrow_forwardDillon Products manufactures various machined parts to customer specifications. The company uses a job-order costing system and applies overhead cost to jobs on the basis of machine-hours. At the beginning of the year, the company used a cost formula to estimate that it would incur $4,166,200 in manufacturing overhead cost at an activity level of 563,000 machine-hours. The company spent the entire month of January working on a large order for 12,900 custom-made machined parts. The company had no work in process at the beginning of January. Cost data relating to January follow: a. Raw materials purchased on account, $316,000. b. Raw materials used in production, $256,000 (80% direct materials and 20% Indirect materials). c. Labor cost accrued in the factory, $153,000 (one-third direct labor and two-thirds Indirect labor). d. Depreciation recorded on factory equipment, $62,600. e. Other manufacturing overhead costs incurred on account, $85,300. f. Manufacturing overhead cost was applied…arrow_forwardDillon Products manufactures various machined parts to customer specifications. The company uses a job-order costing system and applies overhead cost to jobs on the basis of machine-hours. At the beginning of the year, the company used a cost formula to estimate that it would incur $4,339,600 in manufacturing overhead cost at an activity level of 571,000 machine-hours. The company spent the entire month of January working on a large order for 12,400 custom-made machined parts. The company had no work in process at the beginning of January. Cost data relating to January follow: a. Raw materials purchased on account, $321,00o. b. Raw materials used in production, $250,000 (80% direct materials and 20% indirect materials). c. Labor cost accrued in the factory, $174,000 (one-third direct labor and two-thirds indirect labor). d. Depreciation recorded on factory equipment, $63,800. e. Other manufacturing overhead costs incurred on account, $85,800. f. Manufacturing overhead cost was applied…arrow_forward

- Post the relevant items from your journal entries to thes accounts. 3. Prepare a journal entry for item (g) above. 4. If 11,000 of the custom-made machined parts are shipped to the customer in February, how much of this job's cost will be inclu cost of goods sold for February? Answer is not complete. Complete the question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 If 11,000 of the custom-made machined parts are shipped to the customer in February, how much of this job's cost will be included in cost of goods sold for February? (Round your intermediate calculations to 2 decimal places and final answer to the nearest whole dollar amount.) Portion of job cost included in cost of goods sold 45 X < Required 3arrow_forwardDillon Products manufactures various machined parts to customer specifications. The company uses a job-order costing system and applies overhead cost to jobs on the basis of machine-hours. At the beginning of the year, the company used a cost formula to estimate that it would incur $4,210,600 in manufacturing overhead cost at an activity level of 569,000 machine-hours. The company spent the entire month of January working on a large order for 12,800 custom-made machined parts. The company had no work in process at the beginning of January. Cost data relating to January follow: a. Raw materials purchased on account, $312,000. b. Raw materials used in production, $255,000 (80% direct materials and 20% indirect materials). c. Labor cost accrued in the factory, $171,000 (one-third direct labor and two-thirds indirect labor). d. Depreciation recorded on factory equipment, $63,100. e. Other manufacturing overhead costs incurred on account, $85,500. f. Manufacturing overhead cost was applied…arrow_forwardDillon Products manufactures various machined parts to customer specifications. The company uses a job-order costing system and applies overhead cost to jobs on the basis of machine-hours. At the beginning of the year, the company used a cost formula to estimate that it would incur $4,252,500 in manufacturing overhead cost at an activity level of 567,000 machine-hours. The company spent the entire month of January working on a large order for 12,800 custom-made machined parts. The company had no work in process at the beginning of January. Cost data relating to January follow: a. Raw materials purchased on account, $325,000. b. Raw materials used in production, $265,000 (80% direct materials and 20% indirect materials). c. Labor cost accrued in the factory, $156,000 (one-third direct labor and two-thirds indirect labor). d. Depreciation recorded on factory equipment, $63,500. e. Other manufacturing overhead costs incurred on account, $85,700. f. Manufacturing overhead cost was applied…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY