Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

11th Edition

ISBN: 9781259727788

Author: Hilton & Platt

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 41P

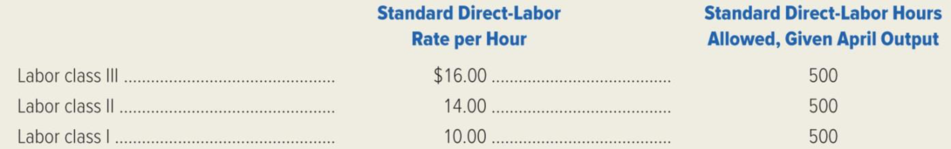

The director of cost management for Portland Instrument Corporation compares each month’s actual results with a monthly plan. The standard direct-labor rates for the year just ended and the standard hours allowed, given the actual output in April, are shown in the following schedule.

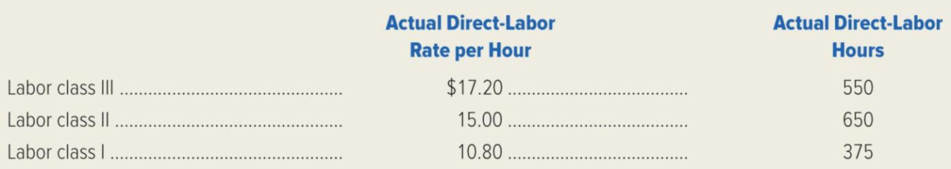

A new union contract negotiated in March resulted in actual wage rates that differed from the standard rates. The actual direct-labor hours worked and the actual direct-labor rates per hour experienced for the month of April were as follows:

Required:

- 1. Compute the following variances for April. Indicate whether each is favorable or unfavorable.

- a. Direct-labor rate variance for each labor class.

- b. Direct-labor efficiency variance for each labor class.

- 2. Discuss the advantages and disadvantages of a standard-costing system in which the standard direct-labor rates are not changed during the year to reflect such events as a new labor contract.

- 3. Build a spreadsheet: Construct an Excel spreadsheet to solve requirements (1) above. Show how the solution will change if the following information changes: the actual labor rates were $16.95, $15.10, and $10.60 for labor classes III, II, and I, respectively.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The accountant for Barry Ltd compares each month’s actual results with a monthly plan. The standarddirect labour rates and the standard hours allowed, given the actual output in April, are shown in thefollowing schedule:

standard direct labour per hour

standard direct labour hours allowed given april output

labour class III

$26

1000

labour class II

$22

1000

labour class I

$12

1000

A new union contract negotiated in March resulted in actual wage rates that differed from thestandard rates. The actual direct labour hours worked and the actual direct labour rates per hour forApril were as follows.

actual direct labour per hour

actual direct labour hour

labour class 3

$28

110

labour class 2

$23

130

labour class 1

$14

750

Required:a) Calculate the following variances for April, indicating whether each is favourable or unfavourable:i direct labour rate variance for each labour class. ii direct labour efficiency variance for each labour class. b) Discuss two…

The accountant for Barry Ltd compares each month’s actual results with a monthly plan. The standarddirect labor rates and the standard hours allowed, given the actual output in April, are shown in thefollowing schedule:Standard direct labor rate per hour Standard direct labor hours allowed,given April outputLabour class III $26.00 1,000Labour class II $22.00 1,000Labour class I $12.00 1,000A new union contract negotiated in March resulted in actual wage rates that differed from thestandard rates. The actual direct labor hours worked and the actual direct labor rates per hour forApril was as follows.Actual direct labor rate per hour Actual direct labor hoursLabour class III $28.00 1,100Labour class II $23.00 1,300Labour class I $14.00 750Required:a) Calculate the following variances for April, indicating whether each is favorable or unfavorable:I direct labor rate variance for each labor class.ii direct labor efficiency variance for each labor class.b) Discuss two advantages and two…

The accountant for Barry Ltd compares each month's actual results with a monthly plan. The standard

direct labour rates and the standard hours allowed, given the actual output in April, are shown in the

following schedule:

Standard direct labour rate per hour

Labour class III

Labour class II

Labour class I

Standard direct labour hours allowed,

given April output

1,000

1,000

1,000

$26.00

$22.00

$12.00

A new union contract negotiated in March resulted in actual wage rates that differed from the

standard rates. The actual direct labour hours worked and the actual direct labour rates per hour for

April were as follows.

Actual direct labour rate per hour

Actual direct labour hours

Labour class II

$28.00

1,100

Labour class II

$23.00

1,300

Labour class I

$14.00

750

Required:

a) Calculate the following variances for April, indicating whether each is favourable or unfavourable:

i direct labour rate variance for each labour class.

ii direct labour efficiency variance for each labour class.

b)…

Chapter 10 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

Ch. 10 - Prob. 1RQCh. 10 - What is meant by the phrase management by...Ch. 10 - Prob. 3RQCh. 10 - Prob. 4RQCh. 10 - Prob. 5RQCh. 10 - Prob. 6RQCh. 10 - What is the interpretation of the direct-material...Ch. 10 - What manager is usually in the best position to...Ch. 10 - What is the interpretation of the direct-material...Ch. 10 - Prob. 10RQ

Ch. 10 - Prob. 11RQCh. 10 - What is the interpretation of the direct-labor...Ch. 10 - What manager is generally in the best position to...Ch. 10 - What is the interpretation of the direct-labor...Ch. 10 - What manager is generally in the best position to...Ch. 10 - Prob. 16RQCh. 10 - Describe five factors that managers often consider...Ch. 10 - Discuss several ways in which standard-costing...Ch. 10 - Describe how standard costs are used for product...Ch. 10 - Prob. 20RQCh. 10 - Prob. 21RQCh. 10 - Saskatewan Can Company manufactures recyclable...Ch. 10 - Refer to the data in the preceding exercise. Use...Ch. 10 - Cayuga Hardwoods produces handcrafted jewelry...Ch. 10 - During June, Danby Companys material purchases...Ch. 10 - Refer to the data in the preceding exercise. Draw...Ch. 10 - The director of cost management for Odessa Company...Ch. 10 - Due to evaporation during production, Plano...Ch. 10 - Prob. 30ECh. 10 - Refer to the data in Exercise 1022, regarding...Ch. 10 - Saskatewan Can Company manufactures recyclable...Ch. 10 - New Jersey Valve Company manufactured 7,800 units...Ch. 10 - Prob. 34PCh. 10 - During May, Joliet Fabrics Corporation...Ch. 10 - Sal Amato operates a residential landscaping...Ch. 10 - Santa Rosa Industries uses a standard-costing...Ch. 10 - The following data pertain to Colgate-Palmolives...Ch. 10 - Orion Corporation has established the following...Ch. 10 - Associated Media Graphics (AMG) is a rapidly...Ch. 10 - The director of cost management for Portland...Ch. 10 - Ogwood Companys Johnstown Division is a small...Ch. 10 - Quincy Farms produces items made from local farm...Ch. 10 - Schiffer Corporation manufactures agricultural...Ch. 10 - Aqua float Corporation manufactures rafts for use...Ch. 10 - Rocky Mountain Camping Equipment, Inc. has...Ch. 10 - Springsteen Company manufactures guitars. The...Ch. 10 - Springsteen Company manufactures guitars. The...Ch. 10 - European Styles, Inc. manufactures womens blouses...Ch. 10 - MacGyver Corporation manufactures a product called...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: Box Springs estimates there will be four orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forwardPlease use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: It estimates there will be five orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forwardThe cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forward

- Q) The accountant for Barry ltd compares each month's actual results with a monthly plan. The standard direct labour rates and the standard hours allowed, given the actual output in April, are shown in the following schedule: Standard direct labour rate per hour Standard direct labour hours allowed, given April output Labour class III $26 1,000 Labour class II $22 1,000 Labour class I $12 1,000 A new union contract negotiated in March resulted in actual wage rates that differed from the standard rates. The actual direct labour hours worked and the actual direct labour rates per hour for April were as follows. Actual direct labour rate per hour Actual direct labour hours Labour class III $28 1,100 Labour class II $23 1,300 Labour class I $14 750 Required: (a) Calculate the following variances for April, indicating whether each is favourable or unfavourable: (i) direct labour rate variance for each labour class. (ii) direct labour efficiency variance for…arrow_forwardThe accountant for Barry Ltd compares each month's actual results with a monthly plan. The standard direct labour rates and the standard hours allowed, given the actual output in April, are shown in the following schedule: Standard direct labour rate per hour Standard direct labour hours allowed, given April output 1,000 1,000 1,000 Labour class II $26.00 Labour class || Labour class I $22.00 $12.00 A new union contract negotiated in March resulted in actual wage rates that differed from the standard rates. The actual direct labour hours worked and the actual direct labour rates per hour for April were as follows. Actual direct labour rate per hour Actual direct labour hours Labour class III $28.00 1,100 www m Labour class || $23.00 1,300 Labour class I $14.00 750 Required: a) Calculate the following variances for April, indicating whether each is favourable or unfavourable: i direct labour rate variance for each labour class. ii direct labour efficiency variance for each labour class.…arrow_forwardThe accountant for Barry Ltd compares each month’s actual results with a monthly plan. The standard direct labour rates and the standard hours allowed, given the actual output in April, are shown in the following schedule:Standard direct labour rate per hour Standard direct labour hours given April output allowed, Labour class III $26.00 1,000Labour class II $22.00 1,000Labour class I $12.00 1,000A new union contract negotiated in March resulted in actual wage rates that differed from the standard rates. The actual direct labour hours worked and the actual direct labour rates per hour for April were as follows. Actual direct labour rate per hour Actual direct labour hoursLabour class III $30.00 1,100Labour class II…arrow_forward

- The production department supervisor receives biweekly reports of the standard cost of theworkforce. The following is the most recent report: Total labor applied to production $91 650 Total wages paid $107 200 Unfavorable variation $ 15 550 Hours applied 9 300 Actual hours worked 11 750 Based on the experience of the past months, the supervisor has been asked to explain the reasons that originated the unfavorable variations obtained: a) Calculate the standard and actual rates for the period b) Determine the variation in labor rate c) Find the variation in labor efficiency.arrow_forwardTech Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 97,500 direct labor-hours would be required for the period's estimated level of client service. The company also estimated $1,316,250 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm's actual overhead cost for the year was $1,337,350 and its actual total direct labor was 101,100 hours. Required: 1. Compute the predetermined overhead rate. 2. During the year, Tech Solutions started and completed the Xavier Company engagement. The following information was available with respect to this job: Direct materials Direct labor cost Direct labor-hours worked Compute the total job cost for the Xavier Company engagement. $ 41,700 $ 28,800 390 Complete this question by entering your answers in the tabs below. Required Required 2 Compute the predetermined overhead rate. (Round your answer to 2…arrow_forwardREQUIREMIENTS: What is the predetermined overhead rate? What is the amount of overhead applied for February? If the actual overhead for February is $64,700, what is the overhead variance and is it overapplied or underapplied?arrow_forward

- A company estimates its manufacturing overhead will be $525,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? When required, round your answers to nearest cent. A. Budgeted direct labor hours: 42,000 per direct labor hour B. Budgeted direct labor expense: $1,050,000 per direct labor dollar C. Estimated machine hours: 70,000 per machine hourarrow_forwardTech Solutions is a consulting firm that uses a job-order costing system. Its direct materials consist of hardware and software that it purchases and installs on behalf of its clients. The firm's direct labor includes salaries of consultants that work at the client's job site, and its overhead consists of costs such as depreciation, utilities, and insurance related to the office headquarters as well as the office supplies that are consumed serving clients. Tech Solutions computes its predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 57,500 direct labor-hours would be required for the period's estimated level of client service. The company also estimated $345,000 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm's actual overhead cost for the year was $365,300 and its actual total direct labor was 64,000 hours. Required: 1. Compute the predetermined overhead…arrow_forwardEmKay Company is divided into two departments for accounting purposes. The direct labor hours and overhead costs for the last year are as follows: What selling price should the company quote on Job Order A54 if thefollowing conditions apply? Raw material costs are estimated as $750. Estimated direct labor hours required in Departments A and B are 25 hours and 50 hours, respectively. Workers in both departments earn $15 per hour. Overhead costs in each department are allocated based on an overhead rate per direct labor hour. Profit is to be 25% of total cost.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY