Concept explainers

Regression; choosing among models. Apollo Hospital specializes in outpatient surgeries for relatively minor procedures. Apollo is a nonprofit institution and places great emphasis on controlling costs in order to provide services to the community in an efficient manner.

Apollo’s CFO, Julie Chen, has been concerned of late about the hospital’s consumption of medical supplies. To better understand the behavior of this cost, Julie consults with Rhett Bratt, the person responsible for Apollo’s cost system. After some discussion, Julie and Rhett conclude that there are two potential cost drivers for the hospital’s medical supplies costs. The first driver is the total number of procedures performed. The second is the number of patient-hours generated by Apollo. Julie and Rhett view the latter as a potentially better cost driver because the hospital does perform a variety of procedures, some more complex than others.

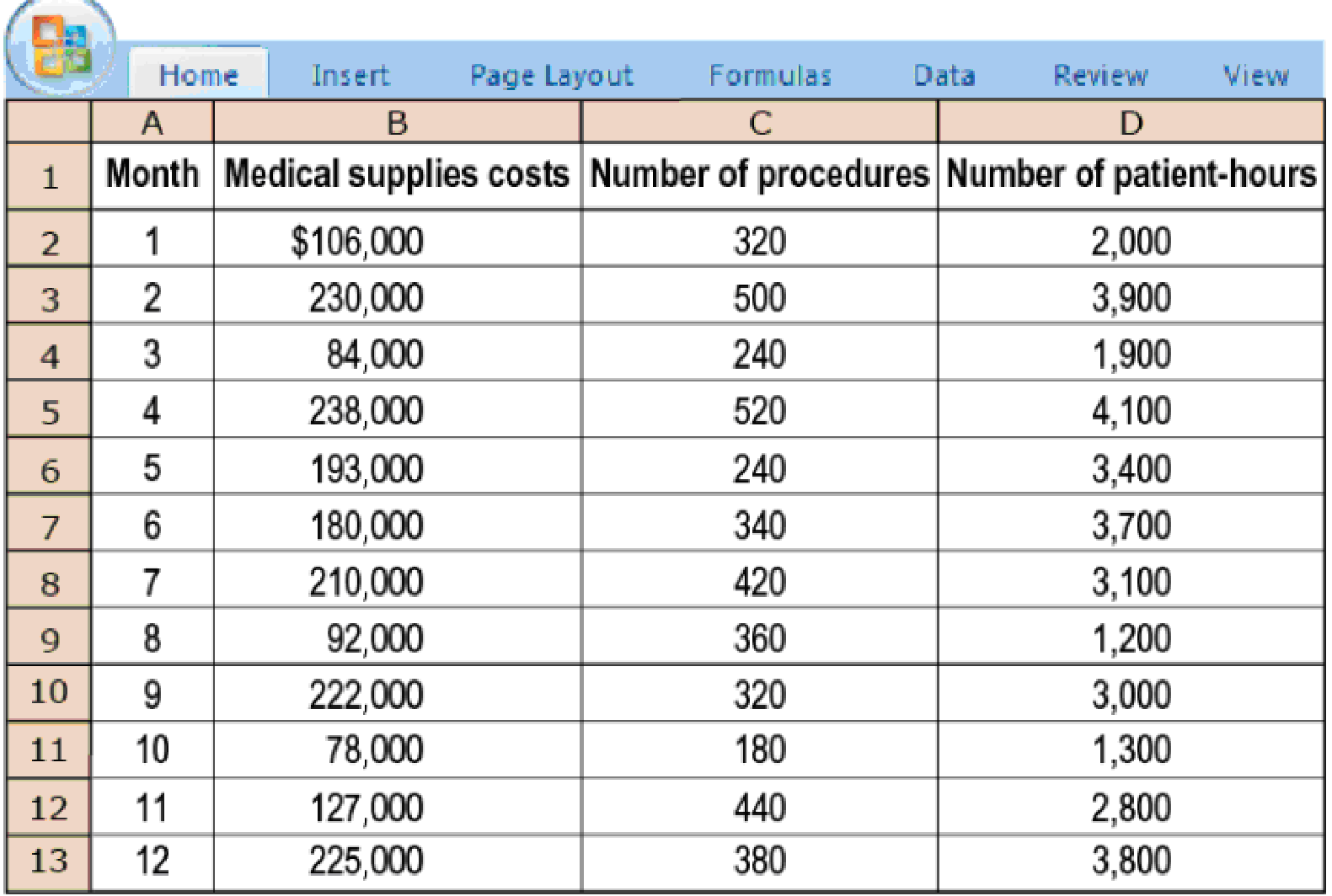

Rhett provides the following data relating to the past year to Julie.

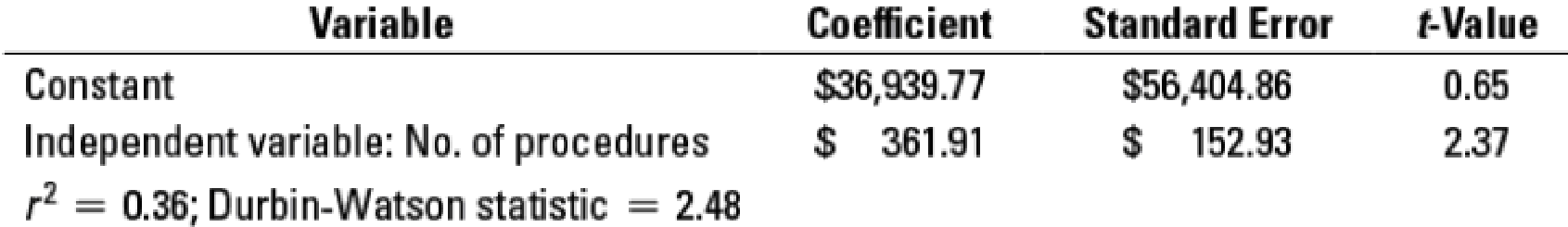

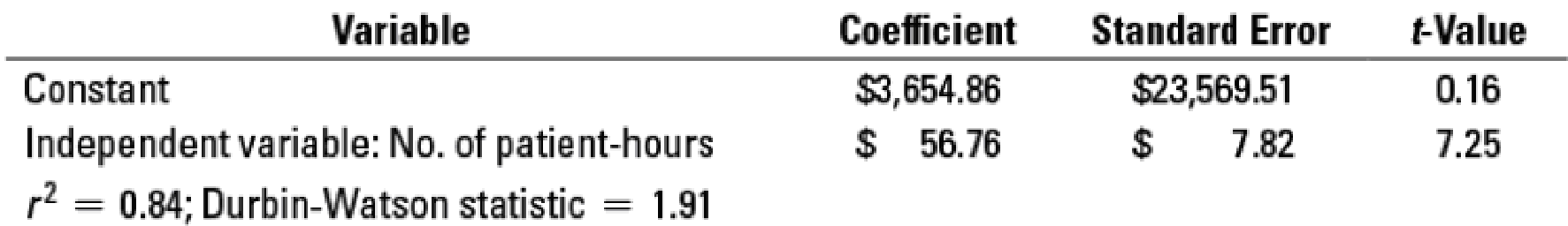

- 1. Estimate the regression equation for (a) medical supplies costs and number of procedures and (b) medical supplies costs and number of patient-hours. You should obtain the following results:

Required

Regression 1: Medical supplies costs = a + (b × Number of procedures)

Regression 2: Medical supplies costs = a + (b × Number of patient-hours)

- 2. On different graphs plot the data and the regression lines for each of the following cost functions:

- a. Medical supplies costs = a + (b × Number of procedures)

- b. Medical supplies costs = a + (b × Number of patient-hours)

- 3. Evaluate the regression models for “Number of procedures” and “Number of patient-hours” as the cost driver according to the format of Figure 10-18 (page 406).

- 4. Based on your analysis, which cost driver should Julie Chen adopt for Apollo Hospital? Explain your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- What is it's degree of operating leverage on these financial accounting question?arrow_forwardWhat distinguishes information hierarchy from data collection? (a) All data holds equal importance (b) Structured relationships determine reporting significance (c) Collection methods define value (d) Hierarchies create confusionarrow_forwardGeneral Accountarrow_forward

- On January 1, 2013, R Corporation leased equipment to Hela Company. The lease term is 9 years. The first payment of $452,000 was made on January 1, 2013. Remaining payments are made on December 31 each year, beginning with December 31, 2013. The equipment cost R Corporation $2,457,400. The present value of the minimum lease payments is $2,697,400. The lease is appropriately classified as a sales-type lease. Assuming the interest rate for this lease is 12%, what will be the balance reported as a liability by Hela in the December 31, 2014, balance sheet?arrow_forwardWhat is the cost of goods manufactured for the year?arrow_forwardPlease give me correct answer this general accounting questionarrow_forward

- Nonearrow_forward1.25.12-Pacific Coast Hotel's laundry department uses load optimization tracking. Each washer has 25kg capacity. Today's loads averaged: Morning 22kg, Afternoon 19kg, Evening 23kg. What is the unutilized capacity percentage? Accountingarrow_forwardThe actual cost of direct materials is $48.25 per pound, while the standard cost per pound is $50.75. During the current period, 4,800 pounds were used in production. What is the direct materials price variance?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning