Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 10.23E

Various cost-behavior patterns. (CPA, adapted).

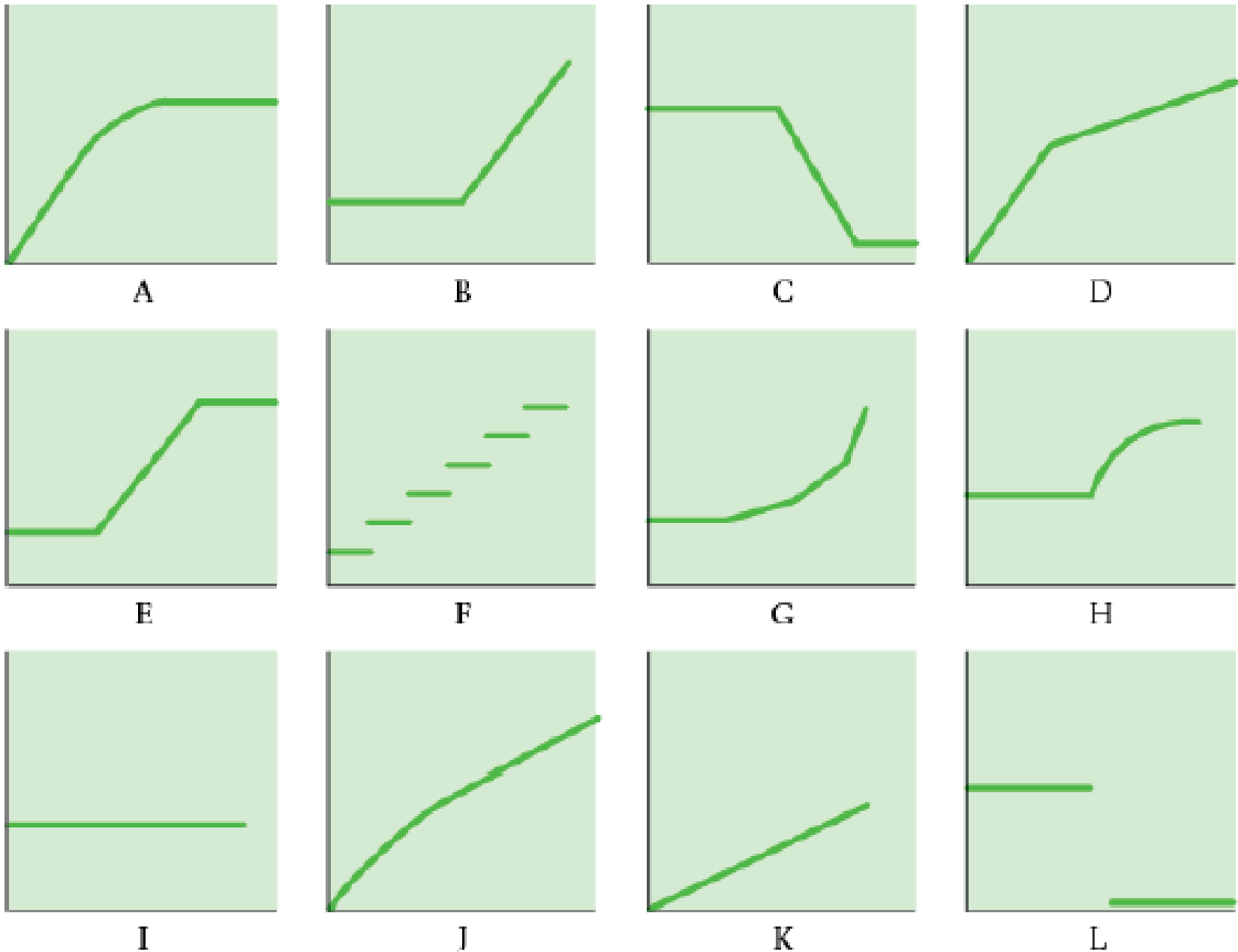

The vertical axes of the graphs below represent total cost, and the horizontal axes represent units produced during a calendar year. In each case, the zero point of dollars and production is at the intersection of the two axes.

Select the graph that matches the numbered

Required

- 1. Annual

depreciation of equipment where the amount of depreciation charged is computed by the machine-hours method. - 2. Electricity bill—a flat fixed charge, plus a variable cost after a certain number of kilowatt-hours are used, in which the quantity of kilowatt-hours used varies proportionately with quantity of units produced.

- 3. City water bill, which is computed as follows:

| First 1,000,000 gallons or less | $1,000 flat fee |

| Next 10,000 gallons | $0.003 per gallon used |

| Next 10,000 gallons | $0.006 per gallon used |

| Next 10,000 gallons | $0.009 per gallon used |

| and so on | and so on |

The gallons of water used vary proportionately with the quantity of production output.

- 4. Cost of direct materials, where direct material cost per unit produced decreases with each pound of material used (for example, if 1 pound is used, the cost is $10; if 2 pounds are used, the cost is $19.98; if 3 pounds are used, the cost is $29.94), with a minimum cost per unit of $9.20.

- 5. Annual depreciation of equipment, where the amount is computed by the straight-line method. When the depreciation schedule was prepared, it was anticipated that the obsolescence factor would be greater than the wear-and-tear factor.

- 6. Rent on a manufacturing plant donated by the city, where the agreement calls for a fixed-fee payment unless 200,000 labor-hours are worked, in which case no rent is paid.

- 7. Salaries of repair personnel, where one person is needed for every 1,000 machine-hours or less (that is, 0 to 1,000 hours requires one person, 1,001 to 2,000 hours requires two people, and so on).

- 8. Cost of direct materials used (assume no quantity discounts).

- 9. Rent on a manufacturing plant donated by the county, where the agreement calls for rent of $100,000 to be reduced by $1 for each direct manufacturing labor-hour worked in excess of 200,000 hours, but a minimum rental fee of $20,000 must be paid.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The partnership of Keenan and Kludlow paid the following wages during this year:

Line Item Description

Amount

M. Keenan (partner)

$108,000

S. Kludlow (partner)

96,000

N. Perry (supervisor)

54,700

T. Lee (factory worker)

35,100

R. Rolf (factory worker)

27,200

D. Broch (factory worker)

6,300

S. Ruiz (bookkeeper)

26,000

C. Rudolph (maintenance)

5,200

In addition, the partnership owed $250 to Rudolph for work he performed during December. However, payment for this work will not be made until January of the following year. The state unemployment tax rate for the company is 2.95% on the first $9,000 of each employee's earnings. Compute the following:

ound your answers to the nearest cent.

a. Net FUTA tax for the partnership for this year

b. SUTA tax for this year

Given answer financial accounting question

What is the true answer? ?

Chapter 10 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 10 - What two assumptions are frequently made when...Ch. 10 - Describe three alternative linear cost functions.Ch. 10 - What is the difference between a linear and a...Ch. 10 - High correlation between two variables means that...Ch. 10 - Name four approaches to estimating a cost...Ch. 10 - Describe the conference method for estimating a...Ch. 10 - Describe the account analysis method for...Ch. 10 - List the six steps in estimating a cost function...Ch. 10 - When using the high-low method, should you base...Ch. 10 - Describe three criteria for evaluating cost...

Ch. 10 - Define learning curve. Outline two models that can...Ch. 10 - Discuss four frequently encountered problems when...Ch. 10 - Prob. 10.13QCh. 10 - All the independent variables in a cost function...Ch. 10 - Multicollinearity exists when the dependent...Ch. 10 - HL Co. uses the high-low method to derive a total...Ch. 10 - A firm uses simple linear regression to forecast...Ch. 10 - In regression analysis, the coefficient of...Ch. 10 - A regression equation is set up, where the...Ch. 10 - What would be the approximate value of the...Ch. 10 - Estimating a cost function. The controller of the...Ch. 10 - Identifying variable-, fixed-, and mixed-cost...Ch. 10 - Various cost-behavior patterns. (CPA, adapted)....Ch. 10 - Matching graphs with descriptions of cost and...Ch. 10 - Account analysis, high-low. Stein Corporation...Ch. 10 - Account analysis method. Gower, Inc., a...Ch. 10 - Prob. 10.27ECh. 10 - Estimating a cost function, high-low method. Lacy...Ch. 10 - Linear cost approximation. Dr. Young, of Young and...Ch. 10 - Cost-volume-profit and regression analysis....Ch. 10 - Regression analysis, service company. (CMA,...Ch. 10 - High-low, regression. May Blackwell is the new...Ch. 10 - Learning curve, cumulative average-time learning...Ch. 10 - Learning curve, incremental unit-time learning...Ch. 10 - High-low method. Wayne Mueller financial analyst...Ch. 10 - High-low method and regression analysis. Market...Ch. 10 - High-low method; regression analysis. (CIMA,...Ch. 10 - Regression, activity-based costing, choosing cost...Ch. 10 - Interpreting regression results. Spirit...Ch. 10 - Cost estimation, cumulative average-time learning...Ch. 10 - Cost estimation, incremental unit-time learning...Ch. 10 - Regression; choosing among models. Apollo Hospital...Ch. 10 - Multiple regression (continuation of 10-42). After...Ch. 10 - Cost estimation. Hankuk Electronics started...Ch. 10 - Prob. 10.45PCh. 10 - Interpreting regression results, matching time...Ch. 10 - Purchasing department cost drivers, activity-based...Ch. 10 - Purchasing department cost drivers, multiple...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY