Concept explainers

Analyzing

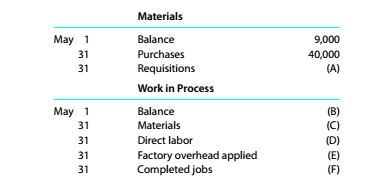

Summer Boards Company manufactures surf boards in a wide variety of sizes and styles. The following incomplete ledger accounts refer to transactions that are summarized for May:

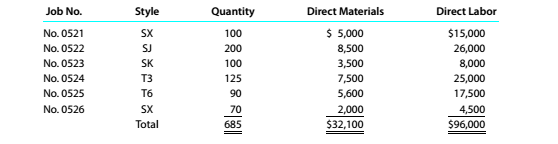

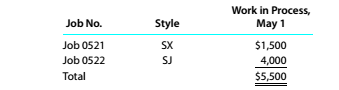

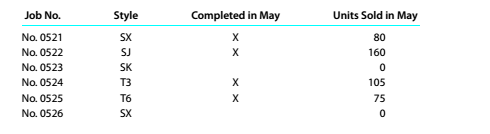

In addition, the following information is available:

- Materials and direct labor were applied to six jobs in May:

b.Factory

c.The May 1 Work in Process balance consisted of two jobs, as follows:

d. Customer jobs completed and units sold in May were as follows:

Instructions

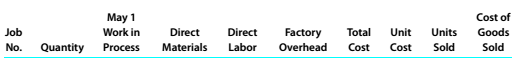

Determine the missing amounts associated with each letter. Provide supporting calculations by completing a table with the following headings:

Concept Introduction:

Direct Cost:

The cost which is directly related to the product and affects those items directly which contribute to the revenue generation in the business is referred as direct cost.It makes a direct relation to the manufacturing cost.

Indirect Cost:

The cost which is not directly related to the product and does not affect those items directly which contribute to the revenue generation in the business is referred as indirect cost. These can be fixed costs or such costs that are incurred as a whole and cannot be related to manufacturing cost.

The missing items in regard to the manufacturing costs SB Company.

Answer to Problem 10.4.1P

The following table represents items in regard to the manufacturing costs SB Company:

| Job no. | Quantity | May work in process | Direct Material | Direct Labor | Factory overhead | Total cost | Unit cost | Units sold | Cost of goods sold |

Explanation of Solution

The material requisition will be the cost of direct material incurred during the year. So, the material requisition is

The work in process at the beginning is given which is

The material work in process balance will be the cost of direct material incurred during the year for the jobs not completed i.e. job no.

The direct labor work in process balance will be the cost of direct labor incurred during the year for the jobs not completed i.e. job no.

The factory overhead work in process balance will be the factory overhead incurred during the year for the jobs not completed i.e. job no.

The factory overhead balance applied in total will be the factory overhead incurred during the year i.e.

| Job no. | Quantity | Units sold | Unsold quantity | Direct Material | Direct Labor | Factory overhead | Total cost | Unit cost | Cost of goods sold |

The balance of completed jobs is

| Job no. | Quantity | Total cost | Unit cost | Units sold | Cost of goods sold |

The balance of cost of goods sold of finished goods is

The balance of indirect labor to be transferred to the factory overhead will be the difference of the total wages payable and the direct labor i.e.

Want to see more full solutions like this?

Chapter 10 Solutions

Survey of Accounting (Accounting I)

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,