Concept explainers

Classifying costs

The following is a list of costs that were incurred in the production and sale of all-terrain vehicles (ATVs).

a.Attorney fees for drafting a new lease for headquarters offices.

b.Cash paid to outside firm for janitorial services for factory.

c. Commissions paid to sales representatives, based on the number of ATVs sold.

d.Cost of advertising in a national magazine.

e.Cost of boxes used in packaging ATVs.

f. Electricity used to run the robotic machinery.

g.Engine oil used in engines prior to shipment. h. Factory cafeteria cashier's wages.

i. Filler for spray gun used to paint the ATVs.

j. Gasoline engines used for ATVs.

k.Hourly wages of operators of robotic machinery used in production.

I. License fees for use of patent for transmission assembly, based on the number of ATVs produced.

m. Maintenance costs for new robotic factory equipment, based on hours of usage.

n. Paint used to coat the ATVs.

o.Payroll taxes on hourly assembly line employees.

p.Plastic for outside housing of ATVs.

q.Premiums on insurance policy for factory buildings.

r. Properly taxes on the factory building and equipment.

s.Salary of factory supervisor.

t. Salary of quality control supervisor who inspects each ATV before it is shipped.

u.Salary of vice president of marketing.

v. Steering wheels for ATVs.

w. Straight-line

x.Steel used in producing the ATVs.

y.Telephone charges for company controller's office.

z.Tires for ATVs.

Instructions

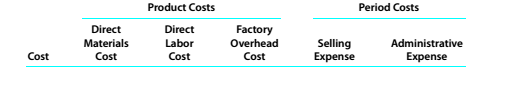

Classify each cost as either a product cost or a period cost. Indicate whether each product cost is a direct materials cost, a direct labor cost, or a

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Survey of Accounting (Accounting I)

- Please provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning