Flow of costs and income statement

R-Tunes Inc. is in the business of developing, promoting, and selling musical talent online and with compact discs (CDs). The company signed a new group, called Cyclone Panic, on January 1, 20Y8. For the first six months of 20Y8, the company spent $1,000,000 on a media campaign for Cyclone Panic and $175,000 in legal costs. The CD production began on April 1, 20Y8. R-Tunes uses a

The production process is straightforward. First, the blank CDs are brought to a production area where the digital soundtrack is copied onto the CD. The copying machine can copy 3,600 CDs per hour.

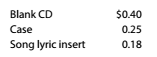

After the CDs are copied, they are brought to an assembly area where an employee packs the CD with a case and song lyric insert. The direct labor cost is $0.37 per CD.

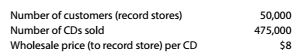

The CDs are sold to record stores. Each record store is given promotional materials, such as posters and aisle displays. Promotional materials cost $30 per record store. In addition, shipping costs average $0.28 per CD.

Total completed production was 500,000 CDs during the year. Other information is as follows:

Instructions

Determine the balances in the work-in-process and finished goods inventories for the Cyclone Panic CD on December 31, 20Y8.

Trending nowThis is a popular solution!

Chapter 10 Solutions

Survey of Accounting (Accounting I)

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning