Flow of costs and income statement

R-Tunes Inc. is in the business of developing, promoting, and selling musical talent online and with compact discs (CDs). The company signed a new group, called Cyclone Panic, on January 1, 20Y8. For the first six months of 20Y8, the company spent $1,000,000 on a media campaign for Cyclone Panic and $175,000 in legal costs. The CD production began on April 1, 20Y8. R-Tunes uses a

The production process is straightforward. First, the blank CDs are brought to a production area where the digital soundtrack is copied onto the CD. The copying machine can copy 3,600 CDs per hour.

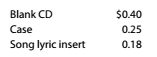

After the CDs are copied, they are brought to an assembly area where an employee packs the CD with a case and song lyric insert. The direct labor cost is $0.37 per CD.

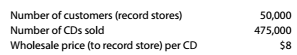

The CDs are sold to record stores. Each record store is given promotional materials, such as posters and aisle displays. Promotional materials cost $30 per record store. In addition, shipping costs average $0.28 per CD.

Total completed production was 500,000 CDs during the year. Other information is as follows:

Instructions

Prepare an annual income statement for the Cyclone Panic CD, including supporting calculations, from the information above.

Trending nowThis is a popular solution!

Chapter 10 Solutions

Survey of Accounting (Accounting I)

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

- I need guidance with this general accounting problem using the right accounting principles.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forward

- Can you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardCurrent Attempt in Progress The following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025. 1. 2. Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business. Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3. 4. 5. 6. In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years. Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. Oriole incurred $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining…arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning