Concept explainers

Activity-based costing in an insurance company

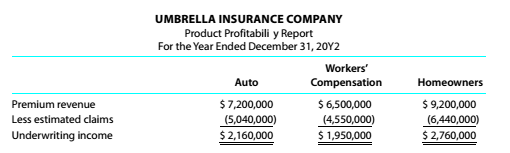

Umbrella Insurance Company carries three major lines of insurance: auto, workers' compensation, and homeowners. The company has prepared the following report for 20Y2:

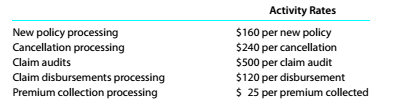

Management is concerned that the administrative expenses may make some of the insurance lines unprofitable. However, the administrative expenses have not been allocated to the insurance lines. The controller has suggested that the administrative expenses could be assigned to the insurance lines using activity-based costing. The administrative expenses are comprised of five activities. The activities and their rates are as follows:

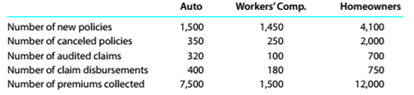

Activity-base usage data for each line of insurance were retrieved from the corporate records and are shown below.

a.Complete the product profitability report through the administrative activities.

b.Determine the underwriting income as a percent of premium revenue.

C.Determine the Operating income as a percent of premium revenue, rounded to one decimal place.

d.Interpret the report.

(a)

Concept Introduction:

Activity based costing is one of the costing method that identify the important activities in the organisation and accordingly identify their cost drivers. Then cost is allocated on the basis of activities used by each product.

Through administrative activities complete the product profitability report.

Answer to Problem 10.25E

The product profitability report through the administrative activities is given in table below.

Explanation of Solution

The product profitability report through the administrative activities is below:

| Particulars | Auto (in $) | Worker compensation (in $) | Homeowner (in $) |

| New policy processing per new policy | | | |

| Cancellation processing per cancellation | | | |

| Claim audit per claim audit | 13y13 | Y13y3 | |

| Claim disbursement per claim disbursement | | | |

| Premium collection processing per premium | | | |

| Total administrative cost | | | |

Preparation of Income statement is as follows:

| Particulars | Auto (in $) | Worker compensation (in $) | Homeowner (in $) |

| Underwriting income before administrative expenses | | | |

| Less: Administrative expenses | | | |

| Underwriting net Income | | | |

(b)

Concept Introduction:

Activity based costing is one of the costing method that identify the important activities in the organisation and accordingly identify their cost drivers. Then cost is allocated on the basis of activities used by each product.

To compute:

The underwriting income as a percent of premium revenue.

Answer to Problem 10.25E

The underwriting income as a percent of premium revenue is

Explanation of Solution

Calcultion of underwriting income as a percent of premium revenue are as follows:

Underwriting income as a percent of premium revenue is:

So, the answer is

(c)

Concept Introduction:

Activity based costing is one of the costing method that identify the important activities in the organisation and accordingly identify their cost drivers. Then cost is allocated on the basis of activities used by each product.

The operating income as a percent of premium revenue.

Answer to Problem 10.25E

Operating income as a percent of premium revenue is

Explanation of Solution

Calculation of operating income as a percent of premium revenue is as follows:

Operating income as a percent of premium revenue

So, the answer is

(d)

Concept Introduction:

Activity based costing is one of the costing method that identify the important activities in the organisation and accordingly identify their cost drivers. Then cost is allocated on the basis of activities used by each product.

The interpretation of report.

Answer to Problem 10.25E

The premium revenue's significant part is used in the administrative expenses.

Explanation of Solution

Underwriting income as a percent of premium revenue after reducing administrative expenses is

So, this clearly shows that important part of premium revenue is used in administrative expenses, which helps company in profitability.

Want to see more full solutions like this?

Chapter 10 Solutions

Survey of Accounting (Accounting I)

- Zanzibar Limited entered into a lease agreement on July 1 2016 to lease somehighly customized hydraulic equipment to Kaizen Limited. The fair value of theequipment as at that date was $ 700,000. The terms of the lease agreement were: Note: the lease is cancellable but only with Zanzibar’s permission At the end of the lease term, the equipment is to be returned to Zanzibar Limited.On July 1, 2016, Zanzibar incurred $12,000 in legal fees for setting up the lease. Theannual rental payment includes $10, 000 to reimburse the lessor for maintenancefees incurred on behalf of the lessee. Requirements:a) Discuss the nature of the lease using the appropriate criteria. Justify youranswer using calculations where applicable b) Prepare the lease schedule for the Kaizen Limited c) Prepare Kaizen’s journal entries for 2016 & 2017 d) If the lease agreement could be cancelled at any time without penalty.Wouldyour answer in parts a & b change? If yes, explain how and why.arrow_forwardSuppose Chrysler Motors has 720 million shares outstanding with a share price of $68.25, and $30 billion in debt. If in three years, Chrysler has 750 million shares outstanding trading for $76 per share, how much debt will Chrysler have if it maintains a constant debt-equity ratio? Correct Answerarrow_forwardHow much is Henry Enterprises break even point?arrow_forward

- Suppose Chrysler Motors has 720 million shares outstanding with a share price of $68.25, and $30 billion in debt. If in three years, Chrysler has 750 million shares outstanding trading for $76 per share, how much debt will Chrysler have if it maintains a constant debt-equity ratio? Accounting Answerarrow_forwardGive me Answerarrow_forwardCompute the company's plantwide predetermined overhead rate for the yeararrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning