Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 7F15

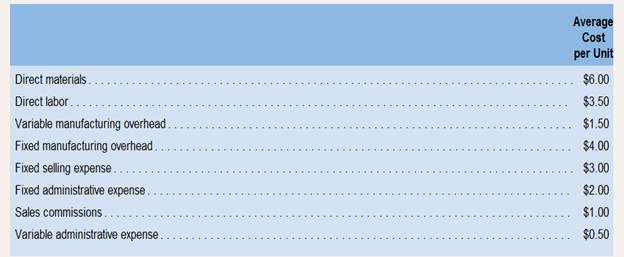

Martinez Company’s relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows:

Required:

7. If 8,000 units are produced, what is the average fixed

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the direct materials quantity variance on these general accounting question?

Cullumber Company uses a job-order cost system in each of its three manufacturing departments. Manufacturing overhead is applied

to jobs on the basis of direct labour cost in Department D, direct labour hours in Department E, and machine hours in Department K.

In establishing the predetermined overhead rates for 2022, the following estimates were made for the year.

Department

D

E

K

Manufacturing overhead

$1,280,000 $1,500,000 $840,000

Direct labour costs

$1,600,000 $1,312,500 $472,500

Direct labour hours

105,000

125,000

42,000

Machine hours

420,000

525,000

120,000

The following information pertains to January 2022 for each manufacturing department.

Department

D

E

K

Direct materials used

Direct labour costs

$147,000 $132,300 $81,900

$126,000 $115,500 $39,375

Manufacturing overhead incurred

$103,950 $128,600 $73,950

Direct labour hours

8,400

11,550

3,675

Machine hours

35,700

47,250

10,380

Your answer is partially correct.

Calculate the predetermined overhead rate for each department.…

General Accounting Question

Chapter 1 Solutions

Introduction To Managerial Accounting

Ch. 1 - What are the three major types of product costs in...Ch. 1 - Define the following: (a) Direct materials, (b)...Ch. 1 - Explain the difference between a product cost and...Ch. 1 - Distinguish between (a) a variable cost, (b) a...Ch. 1 - What effect does an increase in the activity level...Ch. 1 - Define the following terms: (a) Costbehavior and...Ch. 1 - What is meant by an activity base when dealing...Ch. 1 - Managers often assume a strictly linear...Ch. 1 - Distinguish between discretionary fixed costs and...Ch. 1 - Does the concept of the relevant range apply to...

Ch. 1 - What is the difference between a traditional...Ch. 1 - Prob. 12QCh. 1 - Define the following terms: differential cost,...Ch. 1 - Only variable costs can be differential costs. Do...Ch. 1 - Prob. 1AECh. 1 - This Excel worksheet form is to be used to...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Prob. 4F15Ch. 1 - Prob. 5F15Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Prob. 8F15Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Prob. 15F15Ch. 1 - Identifying Direct and Indirect Costs Northwest...Ch. 1 - Prob. 2ECh. 1 - Classifying Costs as Product or Period Costs...Ch. 1 - Prob. 4ECh. 1 - Prob. 5ECh. 1 - Traditional and Contribution Format Income...Ch. 1 - Direct and Indirect CostsKubin Company’s relevant...Ch. 1 - Product Costs and Period Costs; Variable and Fixed...Ch. 1 - Fixed, Variable, and Mixed Costs Refer to the data...Ch. 1 - Differential Costs and Sunk Costs Refer to the...Ch. 1 - Cost Behavior; Contribution Format Income...Ch. 1 - Product and Period Cost Flows The Devon Motor...Ch. 1 - Prob. 13ECh. 1 - Cost Classification Wollogong Group Ltd. of New...Ch. 1 - Traditional and Contribution Format Income...Ch. 1 - Cost Classifications for Decision Making Warner...Ch. 1 - Classifying Variable and Fixed Costs and Product...Ch. 1 - PROBLEM 1—18 Direct and Indirect Costs; Variable...Ch. 1 - Traditional and Contribution Format Income...Ch. 1 - Variable and Fixed Costs; Subtleties of Direct and...Ch. 1 - Traditional and Contribution Format Income...Ch. 1 - Cost Terminology; Contribution Format Income...Ch. 1 - Cost Classification Listed below are costs found...Ch. 1 - Different Cost Classifications for Different...Ch. 1 - Traditional and Contribution Format Income...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the cost of the unsold merchandise on these financial accounting question?arrow_forwardWhat are the proceeds to Brighton on these financial accounting question?arrow_forwardBigco Corporation is one of the nation's leading distributors of food and related products to restaurants, universities, hotels, and other customers. A simplified version of its recent income statement contained the following items (in millions). Cost of sales es Interest expense Income taxes Net earnings Sales Earnings before income taxes Selling, general, and administration expense Other revenues Total expenses (excluding income taxes) Total revenues $ 11,601 249 39 1,378 16,330 1,627 3,493 430 15,133 16,760 Prepare an income statement for the year ended June 30, current year. (Hint: First order the items as they would appear on the income statement and then confirm the values of the subtotals and totals.) Note: Enter your answers in millions rather than in dollars (for example, 5,000 million should be entered as 5,000 rather than 5,000,000). Revenues: Total revenues Expenses: BIGCO CORPORATION Income Statement (in millions) $ 0arrow_forward

- What is the coat of the merchandise assuming the discount is taken on these financial accounting question?arrow_forwardHow many direct labor hours were estimated for the year on these general accounting question?arrow_forwardYou have been asked by the owner of your company to advise her on the process of purchasing some expensive long-term equipment for your company. • Give a discussion of the different methods she might use to make this capital investment decision. • Explain each method and its strengths and weaknesses. • Indicate which method you would prefer to use and why.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License