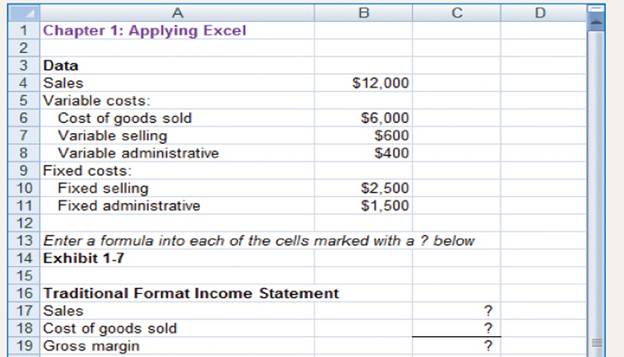

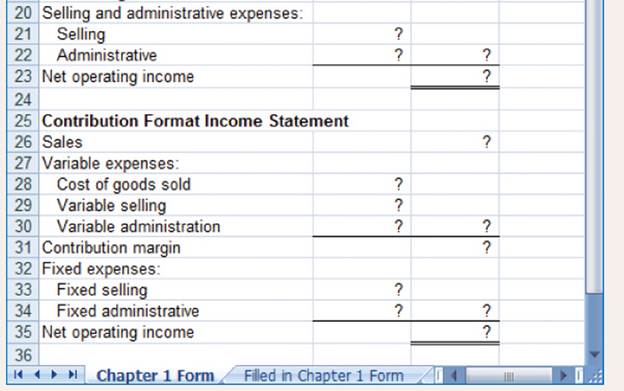

This Excel worksheet form is to be used to recreate Exhibit 1-7. Download the workbook containing this form from Connect, where you will also receive instructions.

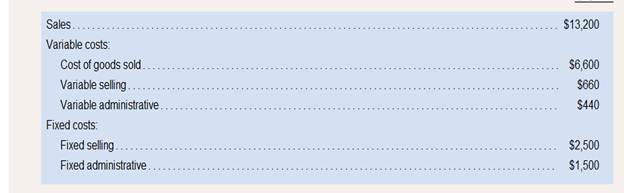

2. Suppose that sales are 10% higher as shown below:

Enter this new data into your worksheet. Make sure that you change all of the data that are different-not just the sales. Print or copy the income statements from your worksheet.

What happened to the variable costs and to the fixed costs when sales increased by 10%? Why? Did the contribution margin increase by 10%? Why or why not? Did the net operating income increase by 10%? Why or why not?

Variable cost, fixed cost, contribution margin, net operating income:

Variable costs are directly related with production process, so it has the changes according to the sales revenue.

Fixed costs are indirectly related with production process, so it hasn’t change according to the sales revenue.

Contribution income is derived after deducting variable costs from sales revenue.

Net operating income is the real income for the company because it has derived after deduction all costs such as variable and fixed costs from sales revenue.

Whether increase of sales by 10% would change the variable costs and fixed costs.

Whether contribution margin increased or not by the new sales revenue (10%).

Whether net operating income increased or not by new sales revenue (10%).

Answer to Problem 2AE

Solution:

| Traditional format income statement |

|

|

| Particulars | Amount | Amount |

| Sales revenue | $13,200 | |

| Less | ||

| Cost of goods sold | $6,600 | |

| Gross margin | $6,600 | |

| Less: Selling and administration expenses | ||

| Selling expenses | $3160 | |

| Administration expenses | $1940 | $5100 |

| Net operating income | $1,500 |

| Contribution Format income statement | ||

| Particulars | Amount | Amount |

| Sales revenue | $13,200 | |

| Less: Variable expenses | ||

| Cost of goods sold | $6600 | |

| Variable selling | $660 | |

| Variable administration | $440 | $7,700 |

| Contribution margin | $5,500 | |

| Less: Fixed expenses | ||

| Selling expenses | $2,500 | |

| Administration Expenses | $1,500 | $4,000 |

| Net operating income | $1,500 |

Formula:

Explanation of Solution

Yes, new sales revenue increased the variable cost by 10%.

Old variable cost:

Increase variable cost:

New variable cost:

Yes, contribution margin increased by 10% due to new sales revenue, new variable costs, if variable

cost has change it reflect the contribution margin.

No, net operating income not increased by 10%, because fixed cost remain unchanged made the net

income increased up to 50%.

Old net operating income:

New net operating income:

Above explanation and calculation stated new sales revenue increased variable cost not the fixed cost and contribution margin also increased by 10% but net operating income not increased by 10%.

Want to see more full solutions like this?

Chapter 1 Solutions

Introduction To Managerial Accounting

- Silver Star Manufacturing has $20 million in sales, an ROE of 15%, and a total assets turnover of 5 times. Common equity on the firm's balance sheet is 30% of its total assets. What is its net income? Round the answer to the nearest cent.arrow_forwardHi expert please give me answer general accounting questionarrow_forwardprovide (P/E ratio)?arrow_forward

- What was xyz corporation's stockholders' equity at the of marcharrow_forward???arrow_forwardHorizon Consulting started the year with total assets of $80,000 and total liabilities of $30,000. During the year, the business recorded $65,000 in service revenues and $40,000 in expenses. Additionally, Horizon issued $12,000 in stock and paid $18,000 in dividends. By how much did stockholders' equity change from the beginning of the year to the end of the year?arrow_forward

- х chat gpt - Sea Content Content × CengageNOW × Wallet X takesssignment/takeAssignmentMax.co?muckers&takeAssignment Session Loca agenow.com Instructions Labels and Amount Descriptions Income Statement Instructions A-One Travel Service is owned and operated by Kate Duffner. The revenues and expenses of A-One Travel Service Accounts (revenue and expense items) < Fees earned Office expense Miscellaneous expense Wages expense Required! $1,480,000 350,000 36,000 875,000 Prepare an income statement for the year ended August 31, 2016 Labels and Amount Descriptions Labels Expenses For the Year Ended August 31, 20Y6 Check My Work All work saved.arrow_forwardEvergreen Corp. began the year with stockholders' equity of $350,000. During the year, the company recorded revenues of $500,000 and expenses of $320,000. The company also paid dividends of $30,000. What was Evergreen Corp.'s stockholders' equity at the end of the year?arrow_forwardEvergreen corp.'s stockholders' equity at the end of the yeararrow_forward

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning