Traditional and Contribution Format Income Statements.

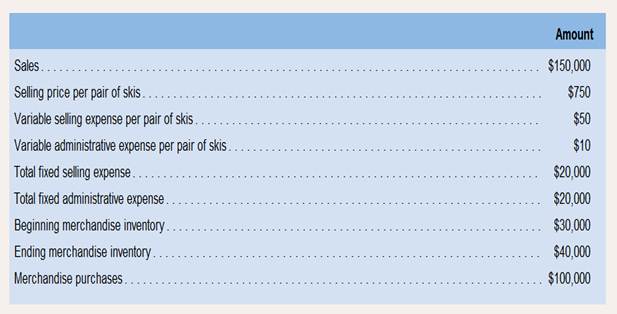

The Alpine House, Inc., is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31:

Required:

1. Prepare a traditional income statement for the quarter ended March 31.

2. Prepare a contribution format income statement for the quarter ended March 31.

3. What was the contribution margin per unit?

1)

Traditional Income Statement

- Traditional Income Statement records the costs of goods manufactured for a particular reporting period by classifying the costs into direct and indirect costs

- Direct costs are variable in nature. Examples: Direct Materials, Direct Labor etc.

- Indirect costs are costs incurred for selling and administrative purposes such as Salary of staff, warehouse rent etc.

- The profit or loss of operations is carried forward to the next period

To Prepare:

Traditional Income Statement for the quarter ended 31 March

Answer to Problem 15E

Solution:

| Particulars | Amount | Particulars | Amount |

| Beginning Merchandise Inventory | $30,000 | Sales | $150,000 |

| Merchandise Purchases | $100,000 | Ending Merchandise Inventory | $40,000 |

| Variable Selling Expense | $10,000 | ||

| Fixed Selling Expense | $20,000 | ||

| Variable Administrative Expense | $2,000 | ||

| Fixed Administrative Expense | $20,000 | ||

| Profit | $8,000 | ||

| $190,000 | $190,000 |

Explanation of Solution

- Given: Sales = $150,000

Sales Price per unit = $750

Variable Selling Expense per unit = $50

Variable Administrative Expense per unit = $10

Formula Used:

- Calculations:

Variable Selling Expense = 200 @$50 = $10,000

Variable Administrative Expense = 200 @$10 = $2,000

- Variable costs are costs that are impacted by the volume of goods produced and have a direct correlation with the number of goods produced.

- Fixed costs are costs that have to be incurred irrespective of the volume of goods produced.

- The costs and revenues are recorded in the income statement for the quarter ended 31 March

- The costs consist of the Variable as well as Fixed costs and the cost of purchases

- The difference in the Beginning and Ending Inventory is also considered for calculation of Profit or Loss

Hence the traditional income statement for the quarter ended 31 March is prepared.

2)

Contribution and Fixed and Variable Costs in Manufacturing

- Variable costs refer to the costs of manufacture that have a direct co-relation with the volume of the goods manufactured, i.e. the costs increase with an increase in the goods produced.

- Examples are costs of direct material and direct labor.

- Fixed costs refer to the costs of manufacture that have an inverse co-relation with the volume of the goods manufactured, i.e. the costs decrease with an increase in the goods produced.

- Examples are costs of factory rent, depreciation on plant and equipment

- Manufacturing costs are costs that are directly incurred in connection with manufacture of goods.

- Examples are Direct materials and Manufacturing Overhead

- Contribution is the difference between the Sales revenue and the Variable cost per unit. This is an indicator of the contribution of the goods manufactured to the profit and bottom line of the organization.

To Prepare:

Contribution Income statement for the quarter ended 31 March

Answer to Problem 15E

Solution:

| Particulars | Per unit | Total |

| Sales | 750 | 150000 |

| Direct Materials | 500 | $100,000 |

| Variable Selling Expense | 50 | $10,000 |

| Variable Administrative Expense | 10 | $2,000 |

| Contribution | 190 | $38,000 |

| Fixed Selling Expense | $20,000 | |

| Fixed Administrative Expense | $20,000 | |

| Profit / (Loss) | ($2,000) |

Explanation of Solution

- Given:

Sales = $150,000

Sales Price per unit = $750

Variable Selling Expense per unit = $50

Variable Administrative Expense per unit = $10 Purchases = $100,000

- Formula Used:

Calculations:

- Variable Selling Expense = 200 @$50 = $10,000

Variable Administrative Expense = 200 @$10 = $2,000

Direct Materials = $100,000 / 200 = $500 per unit

Contribution = $150,000 - $100,000 - $10,000 - $2,000 = $38,000

- Variable costs are costs that are impacted by the volume of goods produced and have a direct correlation with the number of goods produced.

- Fixed costs are costs that have to be incurred irrespective of the volume of goods produced.

- The costs considered for calculation of contribution are variable costs.

- Contribution is the difference between the Sales and Variable Costs including cost of Materials

Hence the contribution format income statement has been prepared for the quarter ended 31 March.

3)

Contribution and Fixed and Variable Costs in Manufacturing

- Variable costs refer to the costs of manufacture that have a direct co-relation with the volume of the goods manufactured, i.e. the costs increase with an increase in the goods produced.

- Examples are costs of direct material and direct labor.

- Fixed costs refer to the costs of manufacture that have an inverse co-relation with the volume of the goods manufactured, i.e. the costs decrease with an increase in the goods produced.

- Examples are costs of factory rent, depreciation on plant and equipment

- Manufacturing costs are costs that are directly incurred in connection with manufacture of goods.

- Examples are Direct materials and Manufacturing Overhead

- Contribution is the difference between the Sales revenue and the Variable cost per unit. This is an indicator of the contribution of the goods manufactured to the profit and bottom line of the organization.

Contribution Margin Per unit

Answer to Problem 15E

Solution:

The contribution Margin per unit is $190

Explanation of Solution

Sales = $150,000

Sales Price per unit = $750

Variable Selling Expense per unit = $50

Variable Administrative Expense per unit = $10 Purchases = $100,000

Formula Used:

Calculations:

- Variable Selling Expense = 200 @ $50 = $10,000

Variable Administrative Expense = 200 @$10 = $2,000

Direct Materials = $100,000 / 200 = $500 per unit

Contribution = $150,000 - $100,000 - $10,000 - $2,000 = $38,000

| Particulars | Per unit | Total |

| Sales | 750 | 150000 |

| Direct Materials | 500 | $100,000 |

| Variable Selling Expense | 50 | $10,000 |

| Variable Administrative Expense | 10 | $2,000 |

| Contribution | 190 | $38,000 |

- The costs considered for calculation of contribution are variable costs.

- Contribution is the difference between the Sales and Variable Costs including cost of Materials

- Contribution per unit is the total Contribution divided by the Units Produced.

Hence the Contribution margin per unit is calculated.

Want to see more full solutions like this?

Chapter 1 Solutions

Introduction To Managerial Accounting

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,