Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 1F15

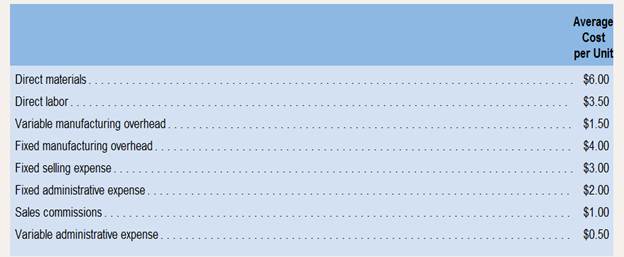

Martinez Company’s relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows:

Required:

1. For financial accounting purposes, what is the total amount of product costs incurred to make 10,000 units?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please given solution general accounting

Please given answer

Calculate the amount of gross profit

Chapter 1 Solutions

Introduction To Managerial Accounting

Ch. 1 - What are the three major types of product costs in...Ch. 1 - Define the following: (a) Direct materials, (b)...Ch. 1 - Explain the difference between a product cost and...Ch. 1 - Distinguish between (a) a variable cost, (b) a...Ch. 1 - What effect does an increase in the activity level...Ch. 1 - Define the following terms: (a) Costbehavior and...Ch. 1 - What is meant by an activity base when dealing...Ch. 1 - Managers often assume a strictly linear...Ch. 1 - Distinguish between discretionary fixed costs and...Ch. 1 - Does the concept of the relevant range apply to...

Ch. 1 - What is the difference between a traditional...Ch. 1 - Prob. 12QCh. 1 - Define the following terms: differential cost,...Ch. 1 - Only variable costs can be differential costs. Do...Ch. 1 - Prob. 1AECh. 1 - This Excel worksheet form is to be used to...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Prob. 4F15Ch. 1 - Prob. 5F15Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Prob. 8F15Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Martinez Company’s relevant range of production is...Ch. 1 - Prob. 15F15Ch. 1 - Identifying Direct and Indirect Costs Northwest...Ch. 1 - Prob. 2ECh. 1 - Classifying Costs as Product or Period Costs...Ch. 1 - Prob. 4ECh. 1 - Prob. 5ECh. 1 - Traditional and Contribution Format Income...Ch. 1 - Direct and Indirect CostsKubin Company’s relevant...Ch. 1 - Product Costs and Period Costs; Variable and Fixed...Ch. 1 - Fixed, Variable, and Mixed Costs Refer to the data...Ch. 1 - Differential Costs and Sunk Costs Refer to the...Ch. 1 - Cost Behavior; Contribution Format Income...Ch. 1 - Product and Period Cost Flows The Devon Motor...Ch. 1 - Prob. 13ECh. 1 - Cost Classification Wollogong Group Ltd. of New...Ch. 1 - Traditional and Contribution Format Income...Ch. 1 - Cost Classifications for Decision Making Warner...Ch. 1 - Classifying Variable and Fixed Costs and Product...Ch. 1 - PROBLEM 1—18 Direct and Indirect Costs; Variable...Ch. 1 - Traditional and Contribution Format Income...Ch. 1 - Variable and Fixed Costs; Subtleties of Direct and...Ch. 1 - Traditional and Contribution Format Income...Ch. 1 - Cost Terminology; Contribution Format Income...Ch. 1 - Cost Classification Listed below are costs found...Ch. 1 - Different Cost Classifications for Different...Ch. 1 - Traditional and Contribution Format Income...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Anjali Brewery has estimated budgeted costs of $72,600, $78,900, and $85,200 for the manufacture of 4,000, 5,000, and 6,000 gallons of beer, respectively, next quarter. What are the variable and fixed manufacturing costs in the flexible budget for Anjali Brewery?arrow_forwardDetermine the depreciationarrow_forwardHello tutor please help me this questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License