Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 5P

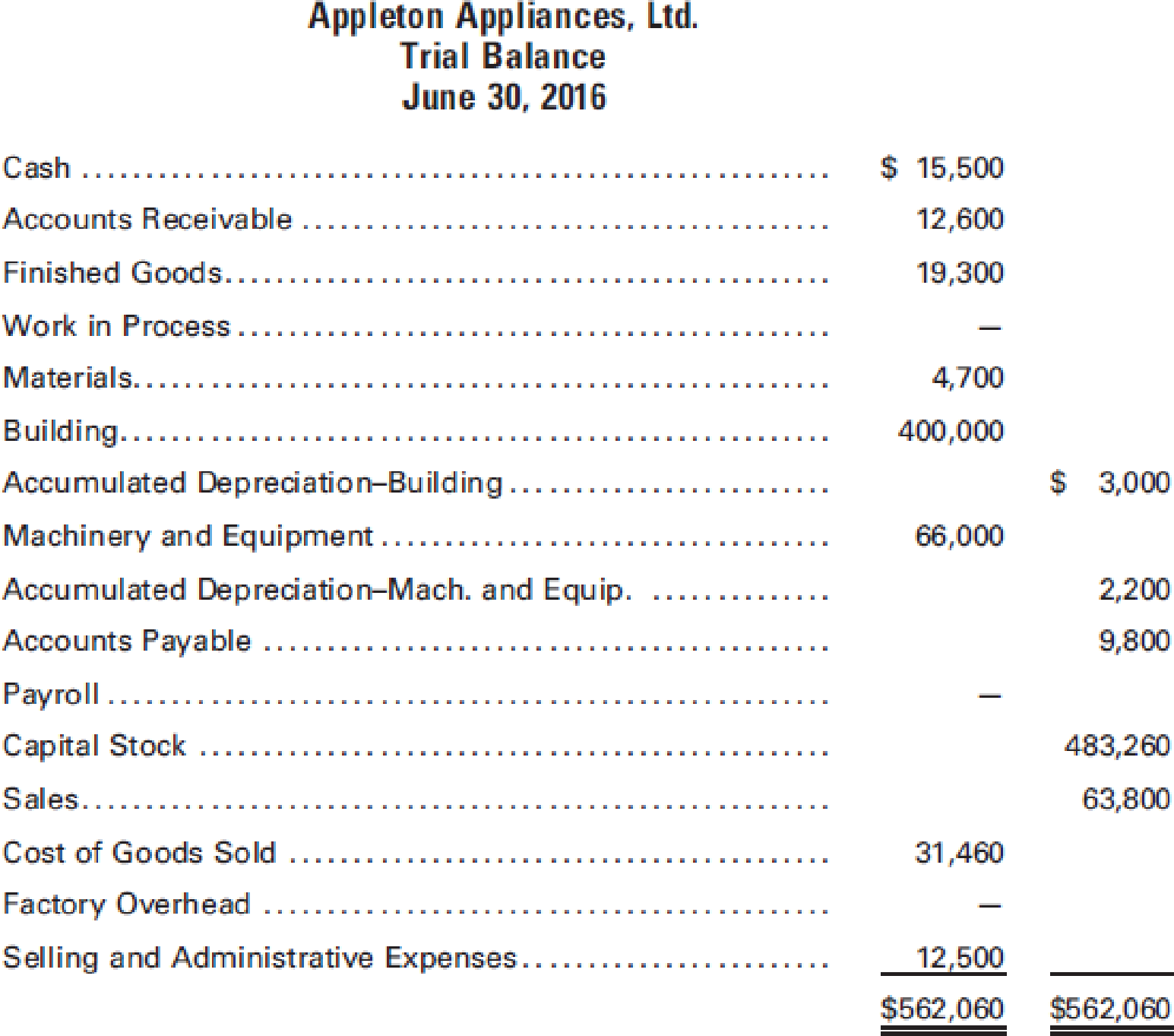

The adjusted

The general ledger reveals the following additional data:

- a. There were no beginning inventories.

- b. Materials purchases during the period were $23,000.

- c. Direct labor cost was $18,500.

- d.

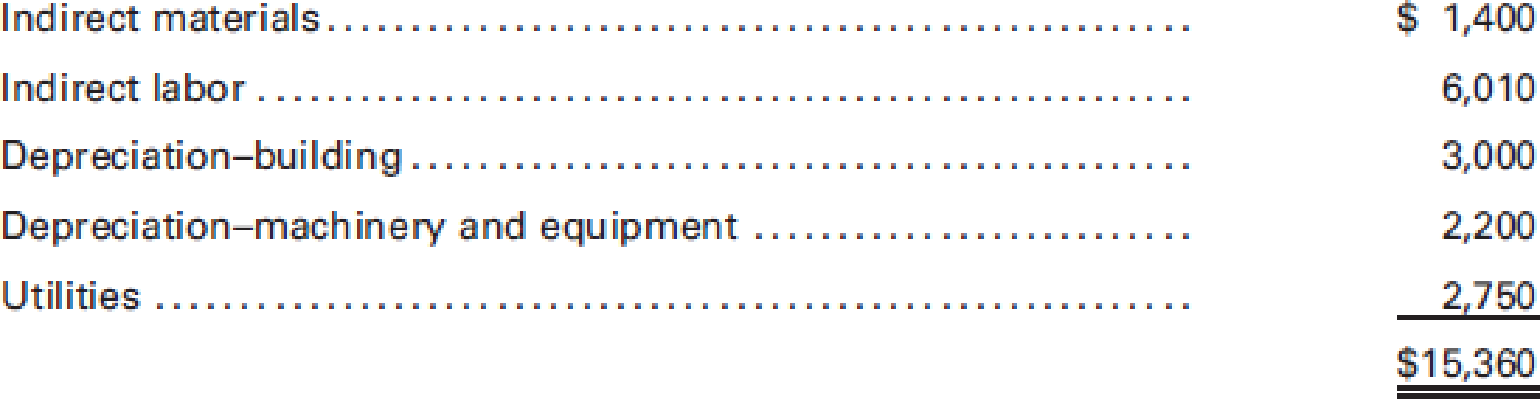

Factory overhead costs were as follows:

Required:

- 1. Prepare a statement of cost of goods manufactured for June.

- 2. Prepare an income statement for June. (Hint: Check to be sure that your figure for Cost of Goods Sold equals the amount given in the trial balance.)

- 3. Prepare a

balance sheet as of June 30. (Hint: Do not forgetRetained Earnings .)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

End information

General Accounting

correct answer please

Chapter 1 Solutions

Principles of Cost Accounting

Ch. 1 - How does the cost accounting function assist in...Ch. 1 - Prob. 2QCh. 1 - Prob. 3QCh. 1 - Prob. 4QCh. 1 - Prob. 5QCh. 1 - Prob. 6QCh. 1 - How is cost accounting information used by...Ch. 1 - Why is unit cost information important to...Ch. 1 - For a manufacturer, what does the planning process...Ch. 1 - How is effective control achieved in a...

Ch. 1 - Define responsibility accounting.Ch. 1 - What criteria must be met for a unit of activity...Ch. 1 - Prob. 13QCh. 1 - Prob. 14QCh. 1 - What actions should a CMA take when the...Ch. 1 - Prob. 16QCh. 1 - Prob. 17QCh. 1 - Prob. 18QCh. 1 - How is cost accounting related to: financial...Ch. 1 - How does the computation of cost of goods sold for...Ch. 1 - How would you describe the following accounts:...Ch. 1 - Prob. 22QCh. 1 - What is the difference between a perpetual...Ch. 1 - What are the basic elements of production cost?Ch. 1 - How would you define the following costs: direct...Ch. 1 - Why have companies such as Harley-Davidson stopped...Ch. 1 - Distinguish prime cost from conversion cost. Does...Ch. 1 - In what way does the accounting treatment of...Ch. 1 - How do cost of goods sold and cost of goods...Ch. 1 - How are nonfactory costs and costs that benefit...Ch. 1 - What is a mark-on percentage?Ch. 1 - Prob. 32QCh. 1 - When is process costing appropriate, and what...Ch. 1 - What are the advantages of accumulating costs by...Ch. 1 - What is a job cost sheet, and why is it useful?Ch. 1 - What are standard costs, and what is the purpose...Ch. 1 - If the factory operations and selling and...Ch. 1 - Study the performance report for Barbaras Bistro...Ch. 1 - Note that Barbaras Bistro in Figure 1-2 prepares...Ch. 1 - Cost of goods soldmerchandiser The following data...Ch. 1 - The following data were taken from the general...Ch. 1 - Prob. 5ECh. 1 - Explain in narrative form the flow of direct...Ch. 1 - The following data are taken from the general...Ch. 1 - The following data are taken from the general...Ch. 1 - The following inventory data relate to Edwards,...Ch. 1 - The following is a list of manufacturing costs...Ch. 1 - Leen Production Co. uses the job order cost system...Ch. 1 - Gerken Fabrication Inc. uses the job order cost...Ch. 1 - Cycle Specialists manufactures goods on a job...Ch. 1 - Prepare a performance report for the dining room...Ch. 1 - The following data were taken from the general...Ch. 1 - The following data were taken from the general...Ch. 1 - Statement of cost of goods manufactured; income...Ch. 1 - The adjusted trial balance for Appleton...Ch. 1 - The post-closing trial balance of Custer Products,...Ch. 1 - Selected account balances and transactions of...Ch. 1 - OReilly Manufacturing Co.s cost of goods sold for...Ch. 1 - Glasson Manufacturing Co. produces only one...Ch. 1 - Sultan, Inc. manufactures goods to special order...Ch. 1 - Spokane Production Co. obtained the following...Ch. 1 - Bangor Products Co. obtained the following...Ch. 1 - Potomac Automotive Co. manufactures engines that...Ch. 1 - Required Ethics Mary Branson is the Division...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- need help this questions cost accountingarrow_forwardWhat is the firm's ROAarrow_forwardDuring its first year of operations, Saboori Manufacturing paid $13,200 for direct materials and $11,500 for production workers' wages. Lease payments and utilities on the production facilities amounted to $10,400, while general, selling, and administrative expenses totaled $5,200. The company produced 6,200 units and sold 4,000 units at a price of $8.50 per unit. What is Saboori Manufacturing's cost of goods sold for the year?arrow_forward

- provide correct answer plzarrow_forwardNeed answerarrow_forwardJason Corp. bought equipment for $150,000 on January 1, 2018. Jason estimated the useful life to be 12 years with no salvage value, and the straight-line method of depreciation will be used. On January 1, 2019, Jason decides that the business will use the equipment for a total of 14 years. What is the revised depreciation expense for 2019?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License