Concept explainers

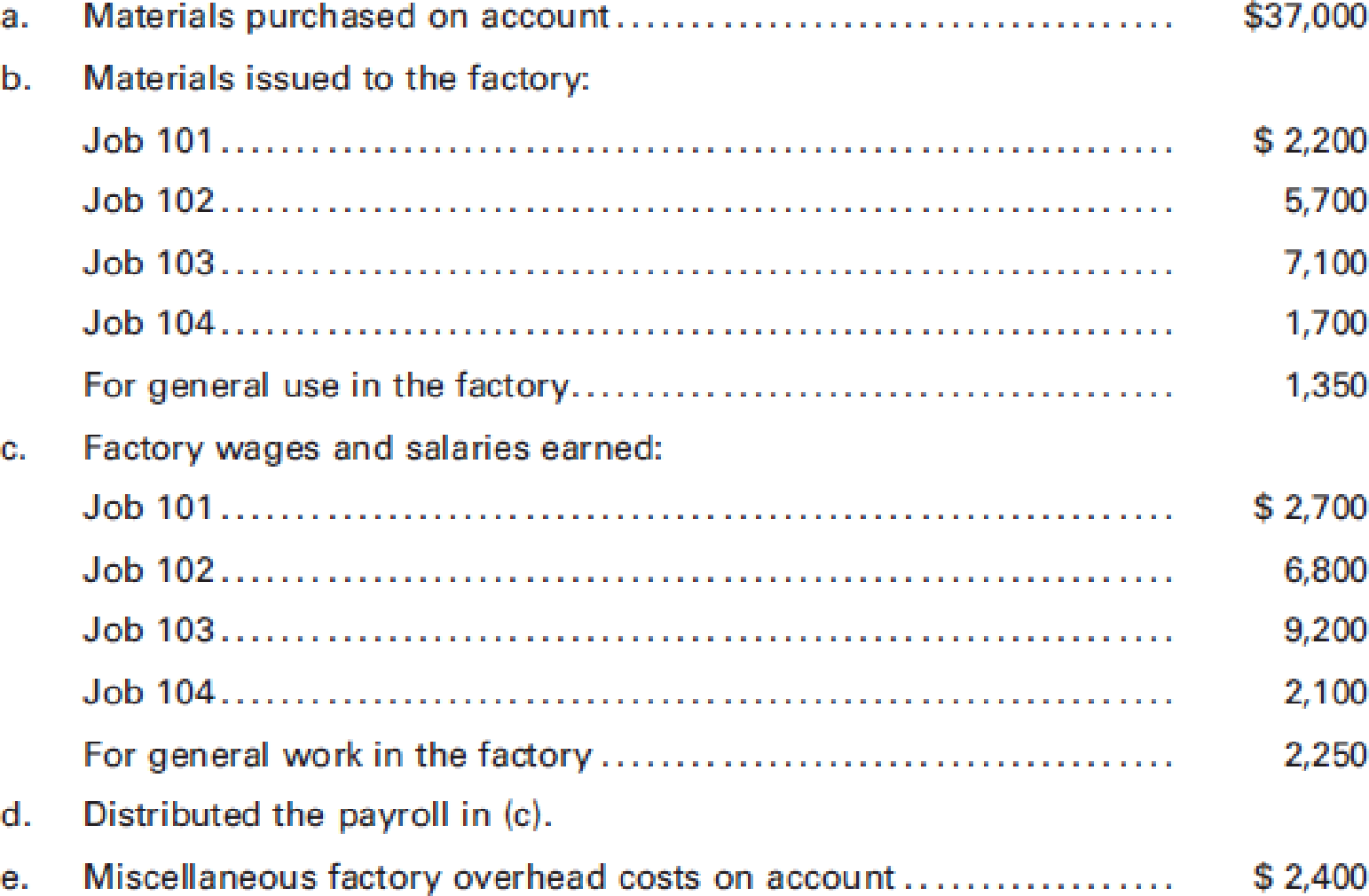

Sultan, Inc. manufactures goods to special order and uses a

Required:

- 1. Prepare a schedule reflecting the cost of each of the four jobs.

- 2. Prepare

journal entries to record the transactions. - 3. Compute the ending balance in Work in Process.

- 4. Compute the ending balance in Finished Goods.

1.

Prepare a schedule that reflects the cost of all four jobs.

Explanation of Solution

Prepare a schedule that reflects the cost of all four jobs.

| Particulars |

Job 101 ($) | Job 102 ($) | Job 103 ($) |

Job 104 ($) |

Total Cost ($) |

| Direct Materials | 2,200 | 5,700 | 7,100 | 1,700 | 16,700 |

| Direct Labor | 2,700 | 6,800 | 9,200 | 2,100 | 20,800 |

| Factory Overhead | 1,200 | 2,000 | 3,800 | 1,000 | 8,000 |

| Total | 6,100 | 14,500 | 20,100 | 4,800 | 45,500 |

Table (1)

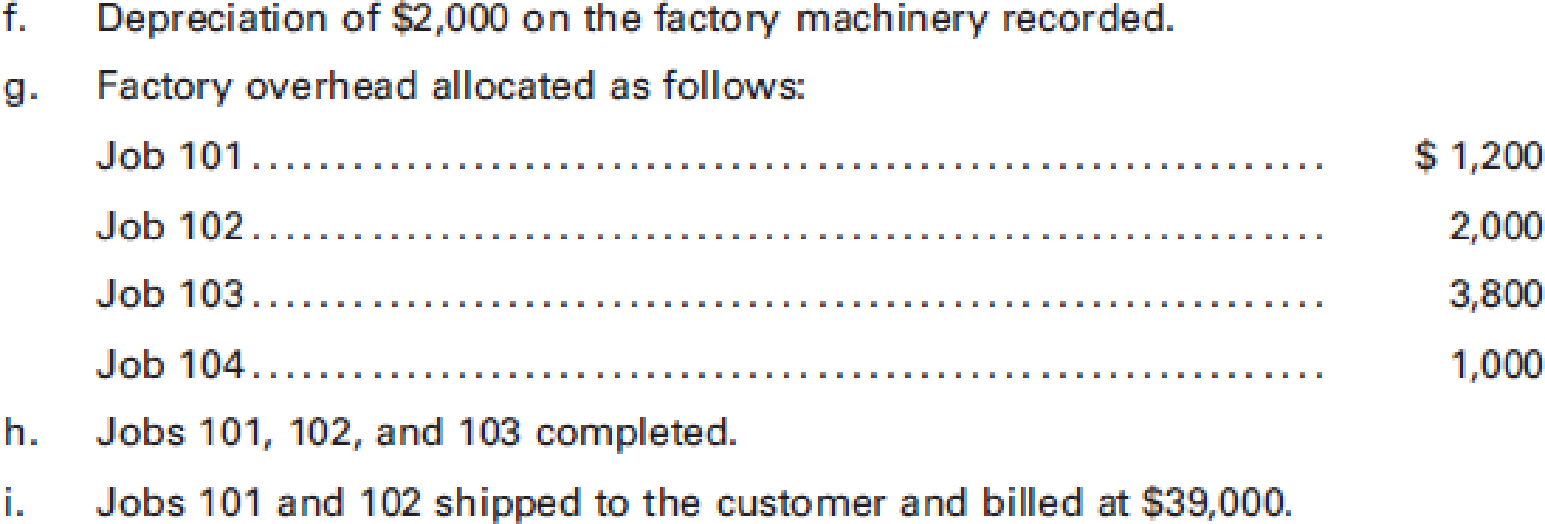

2.

Provide journal entry to record the given transactions.

Explanation of Solution

Provide journal entry to record the given transactions.

| Date | Accounts title and explanation | Debit ($) | Credit ($) |

| a | Materials | 37,000 | |

| Accounts payable | 37,000 | ||

| (To record materials purchased on account) | |||

| b | Work in Process | 16,700 | |

| Factory overhead | 1,350 | ||

| Materials | 18,050 | ||

| (To record issue of direct materials and indirect materials) | |||

| c | Payroll | 23,050 | |

| Wages Payable | 23,050 | ||

| (To record factory wages and salaries) | |||

| d | Work in Process | 20,800 | |

| Factory overhead | 2,250 | ||

| Payroll | 23,050 | ||

| (To record payment of wages to the labor) | |||

| e | Factory overhead | 2,400 | |

| Accounts payable | 2,400 | ||

| (To record factory overhead costs on account) | |||

| f. | Factory overhead | 2,000 | |

| Accumulated Depreciation - Machinery | 2,000 | ||

| (To record depreciation on factory machine) | |||

| g. | Work in Process | 8,000 | |

| Factory Overhead | 8,000 | ||

| (To record transfer of factory overhead to Work-in process) | |||

| h. | Finished Goods (1) | 40,700 | |

| Work in Process | 40,700 | ||

| (To record the transfer of cost of completed work to finished goods) | |||

| i | Accounts receivable | 39,000 | |

| Sales | 39,000 | ||

| (To record the sale made on account) | |||

| Cost of goods sold (2) | 20,600 | ||

| Finished goods | 20,600 | ||

| (To record the cost of goods sold) |

Table (2)

Working note 1: Calculate the cost of completed work (finished goods).

Working note 2: Calculate the cost of goods sold.

3.

Calculate the ending balance in work-in process.

Explanation of Solution

Calculate the ending balance in work-in process.

Hence, the ending balance in work-in process is $4,800.

4.

Calculate the ending balance in finished goods.

Explanation of Solution

Calculate the ending balance in finished goods.

Hence, the ending balance in finished goods is $20,100.

Want to see more full solutions like this?

Chapter 1 Solutions

Principles of Cost Accounting

- If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forwardWhich of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- No chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardWhat type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenueneed helparrow_forwardno ai What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersno aiarrow_forward

- Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customerhelo mearrow_forwardHelp Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College