Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 4E

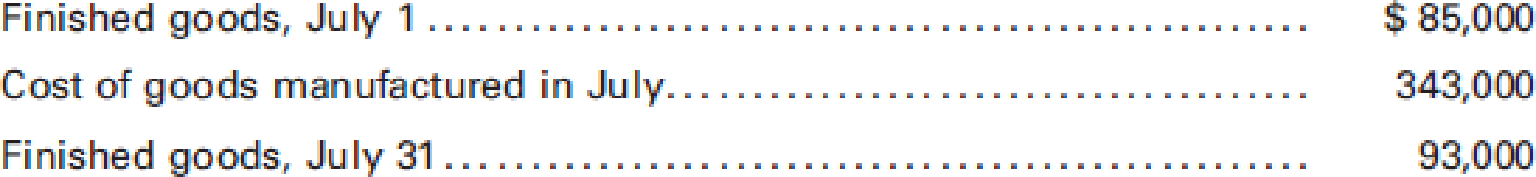

The following data were taken from the general ledger and other data of McDonough Manufacturing on July 31:

Compute the cost of goods sold for the month of July.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is the role of the accounting equation in the analysis of business transactions?

Explain how this theory can help individuals in at least two fields (business, medical, education, etc.) better work in intercultural settings.

Define the theory based on credible sources.

Discuss the development of the theory: how it originated and came to its current status.

Evaluate your scholarly sources, providing a brief comment on the theoretical aspects of each.

Discuss the link(s) between your chosen theory and career field.

Discuss the implications of your case on individuals, society, and the public. How does an increased intercultural understanding affect these different groups?

In 8-10 pages in length. The paper should include support for the topic, your analyses and position(s) by citing course readings, and include at least five credible sources that you chose for your annotated bibliography. A credible source is defined as:

a scholarly or peer-reviewed journal article

which one is correct option?

Chapter 1 Solutions

Principles of Cost Accounting

Ch. 1 - How does the cost accounting function assist in...Ch. 1 - Prob. 2QCh. 1 - Prob. 3QCh. 1 - Prob. 4QCh. 1 - Prob. 5QCh. 1 - Prob. 6QCh. 1 - How is cost accounting information used by...Ch. 1 - Why is unit cost information important to...Ch. 1 - For a manufacturer, what does the planning process...Ch. 1 - How is effective control achieved in a...

Ch. 1 - Define responsibility accounting.Ch. 1 - What criteria must be met for a unit of activity...Ch. 1 - Prob. 13QCh. 1 - Prob. 14QCh. 1 - What actions should a CMA take when the...Ch. 1 - Prob. 16QCh. 1 - Prob. 17QCh. 1 - Prob. 18QCh. 1 - How is cost accounting related to: financial...Ch. 1 - How does the computation of cost of goods sold for...Ch. 1 - How would you describe the following accounts:...Ch. 1 - Prob. 22QCh. 1 - What is the difference between a perpetual...Ch. 1 - What are the basic elements of production cost?Ch. 1 - How would you define the following costs: direct...Ch. 1 - Why have companies such as Harley-Davidson stopped...Ch. 1 - Distinguish prime cost from conversion cost. Does...Ch. 1 - In what way does the accounting treatment of...Ch. 1 - How do cost of goods sold and cost of goods...Ch. 1 - How are nonfactory costs and costs that benefit...Ch. 1 - What is a mark-on percentage?Ch. 1 - Prob. 32QCh. 1 - When is process costing appropriate, and what...Ch. 1 - What are the advantages of accumulating costs by...Ch. 1 - What is a job cost sheet, and why is it useful?Ch. 1 - What are standard costs, and what is the purpose...Ch. 1 - If the factory operations and selling and...Ch. 1 - Study the performance report for Barbaras Bistro...Ch. 1 - Note that Barbaras Bistro in Figure 1-2 prepares...Ch. 1 - Cost of goods soldmerchandiser The following data...Ch. 1 - The following data were taken from the general...Ch. 1 - Prob. 5ECh. 1 - Explain in narrative form the flow of direct...Ch. 1 - The following data are taken from the general...Ch. 1 - The following data are taken from the general...Ch. 1 - The following inventory data relate to Edwards,...Ch. 1 - The following is a list of manufacturing costs...Ch. 1 - Leen Production Co. uses the job order cost system...Ch. 1 - Gerken Fabrication Inc. uses the job order cost...Ch. 1 - Cycle Specialists manufactures goods on a job...Ch. 1 - Prepare a performance report for the dining room...Ch. 1 - The following data were taken from the general...Ch. 1 - The following data were taken from the general...Ch. 1 - Statement of cost of goods manufactured; income...Ch. 1 - The adjusted trial balance for Appleton...Ch. 1 - The post-closing trial balance of Custer Products,...Ch. 1 - Selected account balances and transactions of...Ch. 1 - OReilly Manufacturing Co.s cost of goods sold for...Ch. 1 - Glasson Manufacturing Co. produces only one...Ch. 1 - Sultan, Inc. manufactures goods to special order...Ch. 1 - Spokane Production Co. obtained the following...Ch. 1 - Bangor Products Co. obtained the following...Ch. 1 - Potomac Automotive Co. manufactures engines that...Ch. 1 - Required Ethics Mary Branson is the Division...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Net sales total $438,000. Beginning and ending accounts receivable are $35,000 and $37,000, respectively. Calculate days' sales in receivables. A.27 days B.30 days C.36 days D.31 daysarrow_forwardProvide correct answerarrow_forwardFor the system shown in figure below, the per unit values of different quantities are E-1.2, V 1, X X2-0.4. Xa-0.2 Determine whether the system is stable for a sustained fault. The fault is cleared at 8-60°. Is the system stable? If so find the maximum rotor swing. Find the critical clearing angle. E25 G X'd 08 CB X2 F CB V28 Infinite busarrow_forward

- Geisner Inc. has total assets of $1,000,000 and total liabilities of $600,000. The industry average debt-to-equity ratio is 1.20. Calculate Geisner's debt-to-equity ratio and indicate whether the company's default risk is higher or lower than the average of other companies in the industry.arrow_forwardHy expert give me solution this questionarrow_forwardBaker's Market began the current month with inventory costing $35,250, then purchased additional inventory at a cost of $78,400. The perpetual inventory system indicates that inventory costing $82,500 was sold during the month for $88,250. An inventory count at month-end shows that inventory costing $29,000 is actually on hand. What amount of shrinkage occurred during the month? a) $350 b) $1,150 c) $1,750 d) $2,150arrow_forward

- A pet store sells a pet waste disposal system for $60 each. The cost per unit, including the system and enzyme digester, is $42.50. What is the contribution margin per unit? A. $15.00 B. $17.50 C. $12.25 D. $19.00arrow_forwardNarchie sells a single product for $40. Variable costs are 80% of the selling price, and the company has fixed costs that amount to $152,000. Current sales total 16,000 units. What is the break-even point in units?arrow_forwardA company sells 32,000 units at $25 per unit. The variable cost per unit is $20.50, and fixed costs are $52,000. (a) Determine the contribution margin ratio. (b) Determine the unit contribution margin. (c) Determine the income from operations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License