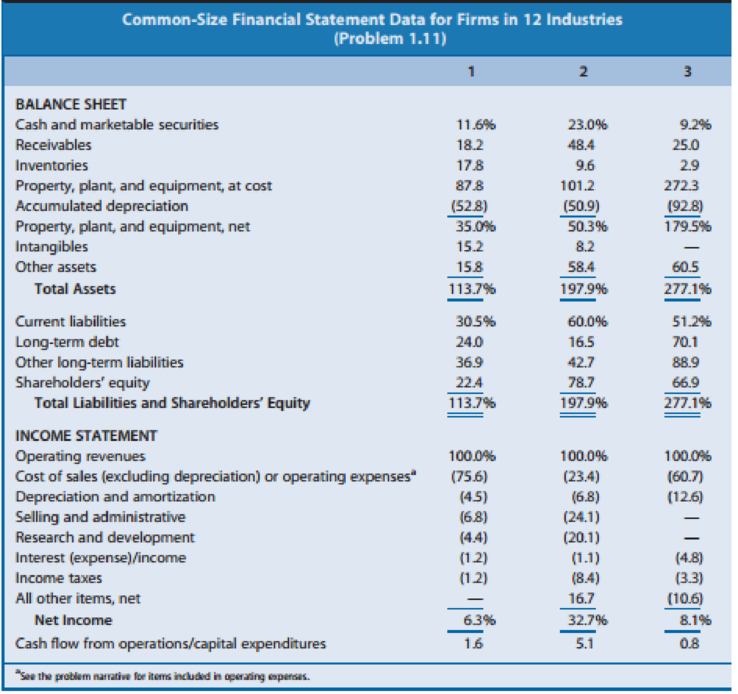

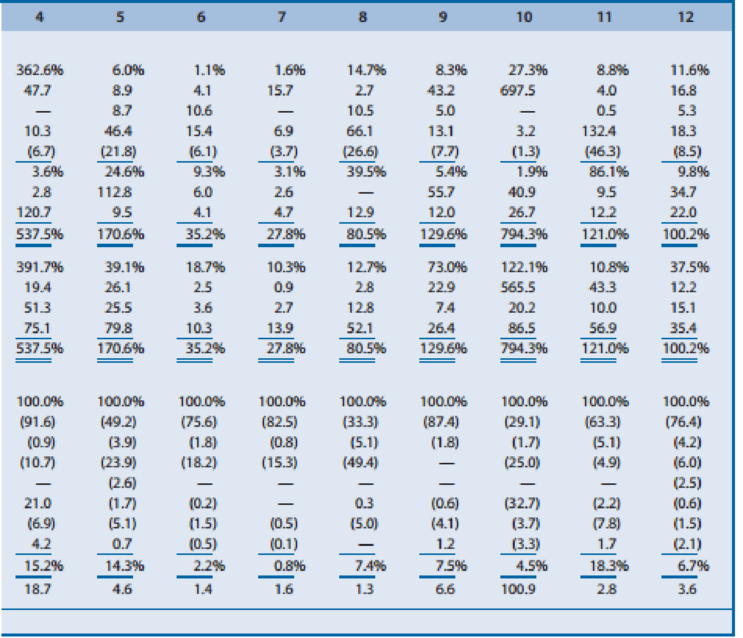

Effect of Industry Characteristics on Financial Statement Relations. Effective financial statement analysis requires an understanding of a firm’s economic characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.23 (pages 62–63) presents common-size condensed

A dash for a particular financial statement item does not necessarily mean the amount is zero. It merely indicates that the amount is not sufficiently large for the firm to disclose it. A list of the 12 companies and a brief description of their activities follow.

- A. Abercrombie & Fitch: Sells retail apparel primarily through stores to the fashionconscious young adult and has established itself as a trendy, popular player in the specialty retailing apparel industry.

- B. Allstate Insurance: Sells property and casualty insurance, primarily on buildings and automobiles. Operating revenues include insurance premiums from customers and revenues earned from investments made with cash received from customers before Allstate pays customers’ claims. Operating expenses include amounts actually paid or expected to be paid in the future on insurance coverage outstanding during the year.

- C. Best Buy: Operates a chain of retail stores selling consumer electronic and entertainment equipment at competitively low prices.

- D. E. I. du Pont de Nemours: Manufactures chemical and electronics products.

- E. Hewlett-Packard: Develops, manufactures, and sells computer hardware. The firm outsources manufacturing of many of its computer components.

- F. HSBC Finance: Lends money to consumers for periods ranging from several months to several years. Operating expenses include provisions for estimated uncollectible loans (

bad debts expense). - G. Kelly Services: Provides temporary office services to businesses and other firms. Operating revenues represent amounts billed to customers for temporary help services, and operating expenses include amounts paid to the temporary help employees of Kelly.

- H. McDonald’s: Operates fast-food restaurants worldwide. A large percentage of McDonald’s restaurants are owned and operated by franchisees. McDonald’s frequently owns the restaurant buildings of franchisees and leases them to franchisees under long-term leases.

- I. Merck: A leading research-driven pharmaceutical products and services company. Merck discovers, develops, manufactures, and markets a broad range of products to improve human and animal health directly and through its joint ventures.

- J. Omnicom Group: Creates advertising copy for clients and is the largest marketing services firm in the world. Omnicom purchases advertising time and space from various media and sells it to clients. Operating revenues represent commissions and fees earned by creating advertising copy and selling media time and space. Operating expenses includes employee compensation.

- K. Pacific Gas & Electric: Generates and sells power to customers in the western United States.

- L. Procter & Gamble: Manufactures and markets a broad line of branded consumer products.

REQUIRED

Use the ratios to match the companies in Exhibit 1.23 with the firms listed above.

Trending nowThis is a popular solution!

Chapter 1 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

- [The following information applies to the questions displayed below.] The Albertville City Council decided to pool the investments of its General Fund with Albertville Schools and Richwood Township in an investment pool to be managed by the city. Each of the pool participants had reported its investments at fair value as of the end of 2022. At the date of the creation of the pool, February 15, 2023, the fair value of the investments of each pool participant was as follows: Investments 12/31/22 2/15/23 City of Albertville General Fund $ 897,000 $ 935,000 Albertville Schools 4,214,000 4,394,500 Richwood Township 4,030,000 4,020,500 Total $ 9,141,000 $ 9,350,000 On June 15, Richwood Township decided to withdraw $3,080,000 for a capital projects payment. At the date of the withdrawal, the fair value of the Treasury notes had increased by $37,000. Assume that the trust fund was able to redeem the CDs necessary to complete…arrow_forwardStevens Textile Corporation's 2019 financial statements are shown below Balance Sheet as of December 31, 2019 (Thousands of Dollars) Cash $ 1,080 Accounts payable $ 4,320 Receivables 6,480 Accruals 2,880 Inventories 9,000 Line of credit 0 Total current assets $16,560 Notes payable 2,100 Net fixed assets 12,600 Total current liabilities $ 9,300 Mortgage bonds 3,500 Common stock 3,500 Retained earnings 12,860 Total assets $29,160 Total liabilities and equity $29,160 Income Statement for December 31, 2019 (Thousands of Dollars) Sales $36,000 Operating costs 34,000 Earnings before interest and taxes $ 2,000 Interest 160 Pre-tax earnings $ 1,840 Taxes (25%) 460 Net income $ 1,380 Dividends (40%) $ 552 Addition to retained earnings $ 828 Stevens grew rapidly in 2019 and financed the growth with notes payable and long-term bonds. Stevens expects sales to grow by 20% in the next year but will finance…arrow_forwardAt year-end 2019, Wallace Landscaping’s total assets were $2.30 million, and its accounts payable were $430,000. Sales, which in 2019 were $2.9 million, are expected to increase by 20% in 2020. Total assets and accounts payable are proportional to sales, and that relationship will be maintained. Wallace typically uses no current liabilities other than accounts payable. Common stock amounted to $630,000 in 2019, and retained earnings were $330,000. Wallace has arranged to sell $180,000 of new common stock in 2020 to meet some of its financing needs. The remainder of its financing needs will be met by issuing new long-term debt at the end of 2020. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Its net profit margin on sales is 5%, and 50% of earnings will be paid out as dividends. What was Wallace's total long-term debt in 2019? Round your answer to the nearest dollar. $ What were Wallace's total liabilities in…arrow_forward

- Solve quicklyarrow_forwardSmiley Corporation's current sales and partial balance sheet are shown below. This year Sales $ 10,000 Balance Sheet: Liabilities Accounts payable $ 2,000 Notes payable $ 2,000 Accruals $ 1,400 Total current liabilities $ 5,400 Long-term bonds $ 2,000 Total liabilities $ 7,400 Common stock $ 1,000 Retained earnings $ 2,500 Total common equity $ 3,500 Total liabilities & equity $ 10,900 Sales are expected to grow by 8% next year. Assuming no change in operations from this year to next year, what are the projected spontaneous liabilities? Do not round intermediate calculations. Round your answer to the nearest dollar.arrow_forwardDiscuss in detail the similarities and differences between Preferred Stock and Common Stock. As an investor, which would you rather invest in if you goal is long term wealth maximization?arrow_forward

- Answer itarrow_forwardQUESTION #1: A) What is the Net Operating Profit After Tax (NOPAT) for 2024?B) What is the Operating Cash Flow for 2024? C) What is the Free Cash Flow for 2024? Note: Marketable securities are non-operating current assets, and short-term debt (bank loan) is a non-operating current liability. Both of these items are excluded from the calculation of net operating working capital. D) If the stock trades for $85 per share at the end of 2024, and there are 315,000 shares outstanding, what is the MVA in 2024? E) Given that the firm’s WACC is 14%, what is the EVA during 2024? F) Create common size income statement and balance sheet for 2024, 2023 and 2022. G) Using 2022 as the base year, create income statement and balance sheet percentage change analysis for 2024 and 2023. QUESTION #2: In addition to the AAA Ltd. financial statements in Problem One, you are given more information as follows. Sales are forecast to increase by 80% in 2025. Short-term Debt, Long-term Debt, and Common…arrow_forwardBrightwoodę Furniture provides the following financial data for a given enod: Sales Less Variable E Contribwaon Margin Less Fixed Expenses et Income - Aount ($) Per Unit ($) 150,000 3 L96,000 13 10 35,000 25,000 a. What is the company's CM ratio? b. If quarterly sales increase by $5,200 and there is no change in fixed expenses, by how much would you expect quarterly net operating income to increase?arrow_forward

- If image is blurr then comment i will write values in comment . dont amswer with unclear data i will give unhelarrow_forwardQUESTION #1: ABC Inc. is debating the purchase of a new digital printer that will replace an older printer. The printer they acquired 2 years ago for $500,000 is worth $220,000 today and will have a salvage value of $80,000 after 5 more years. The printer generates revenues of $750,000 per year. The costs of operating the printer are $480,000 per year. The company currently has $110,000 invested in net operating working capital. The investment in net operating working capital will remain at this level for the remaining 5 years of the project. The new printer will cost $830,000. It will cost $60,000 to install the new printer. The new printer will generate revenues of $1,120,000 per year. In addition, the costs of operating the new printer will be $550,000 per year. The company will have to increase its investment in net operating working capital to $175,000 at time zero. The investment in operating new working capital will remain at this level for the remaining 5 years of the…arrow_forwardQUESTION #1: ABC Inc. is debating the purchase of a new digital printer that will replace an older printer. The printer they acquired 2 years ago for $500,000 is worth $220,000 today and will have a salvage value of $80,000 after 5 more years. The printer generates revenues of $750,000 per year. The costs of operating the printer are $480,000 per year. The company currently has $110,000 invested in net operating working capital. The investment in net operating working capital will remain at this level for the remaining 5 years of the project. The new printer will cost $830,000. It will cost $60,000 to install the new printer. The new printer will generate revenues of $1,120,000 per year. In addition, the costs of operating the new printer will be $550,000 per year. The company will have to increase its investment in net operating working capital to $175,000 at time zero. The investment in operating new working capital will remain at this level for the remaining 5 years of the…arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning