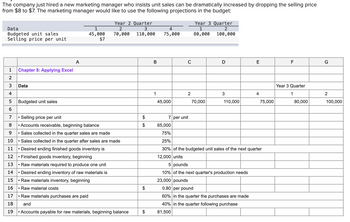

1 Chapter 8: Applying Excel 2 3 Data 4 5 Budgeted unit sales 6 7. Selling price per unit 8. Accounts receivable, beginning balance 9 Sales collected in the quarter sales are made 10. Sales collected in the quarter after sales are made 11 Desired ending finished goods inventory is 12 Finished goods inventory, beginning 13 Raw materials required to produce one unit 14. Desired ending inventory of raw materials is 15. Raw materials inventory, beginning 16 Raw material costs 17 Raw materials purchases are paid 18 . and 19 Accounts payable for raw materials, beginning balance. 20 21 Enter a formula into each of the cells marked with a ? below 22 Review Problem: Budget Schedules 23 24 Construct the sales budget 25 26 Budgeted unit sales 27 Selling price per unit 28 Total sales 29 30 Construct the schedule of expected cash collections 31 32 Accounts receivable, beginning balance 33 First-quarter sales 34 Second-quarter sales 35 Third-quarter sales 36 Fourth-quarter sales 37 Total cash collections 38 39 Construct the production budget 40 41 Budgeted unit sales 42 Add desired finished goods inventory 43 Total needs 44 Less beginning inventory 45 Required production 46 47 Construct the raw materials purchases budget 48 49 Required production (units) 50 Raw materials required to produce one unit 51 Production needs (pounds) 52 Add desired ending inventory of raw materials (pounds) 53 Total needs (pounds) 54 Less beginning inventory of raw materials (pounds) 55 Raw materials to be purchased 56 Cost of raw materials per pound 57 Cost of raw materials to be purchased 58 59 Construct the schedule of expected cash payments 60 61 Accounts payable, beginning balance 62 First-quarter purchases 63 Second-quarter purchases 64 Third-quarter purchases 65 Fourth-quarter purchases 66 Total cash disbursements 67 1 40,000 1 $65,000 75% 25% 30% of the budgeted unit sales of the next quarter 12,000 units 1 5 pounds 10% of the next quarter's production needs 23,000 pounds 1 $8 per unit $0.80 per pound 60% in the quarter the purchases are made 40% in the quarter following purchase $81,500 1 1 ? ? ? ? ? 2 ? ? ? ? 2 ? ? ? ? ? ? ? ▼ ? ? ? Year 2 Quarter 2 60,000 ▼ ? ? ▼ ▼ Year 2 Quarter 2 ? ? ? Year 2 Quarter 2 ? ? ? 3 100,000 ? ? ? ? ? Year 2 Quarter 2 Year 2 Quarter 2 ? 2 ? ? ? ? ? ? ? ? ? Year 2 Quarter 2 ? 3 3 3 3 3 ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? 4 50,000 ▼ ? ? ? ▼ 4 4 4 4 4 ? ? 2 ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ✓ ? ? ? ? ? Year 3 Quarter 1 70.000 Year 3 Quarter 1 2 Year Year Year Year ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? 2 2 ? ? P ? 2 2 80,000 ? ? ? Year 3 Quarter 1 2 ? ? ? 2 ? Year 3 Quarter 1 ? ? ? ?

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

![### Budget Analysis Questions

**a. What are the total expected cash collections for the year under this revised budget?**

- *Input Field*: Expected cash collections for the year: [Input Box]

**b. What is the total required production for the year under this revised budget?**

- *Input Field*: Total required production for the year: [Input Box]

**c. What is the total cost of raw materials to be purchased for the year under this revised budget?**

- *Input Field*: Total cost of raw materials to be purchased for the year: [Input Box]

**d. What are the total expected cash disbursements for raw materials for the year under this revised budget?**

- *Input Field*: Total expected cash disbursements for raw materials for the year: [Input Box]

### Instructions

Each section includes a specific question related to the components of a revised budget, requiring calculations or estimations based on budgetary data. Enter the appropriate figures into the provided input boxes.](https://content.bartleby.com/qna-images/question/84be77e3-7e2a-48d9-923c-45508700aa71/3411dddf-bcd5-4b76-80ed-06b70f2f0e15/4u9145h_thumbnail.png)