Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9.B, Problem 1E

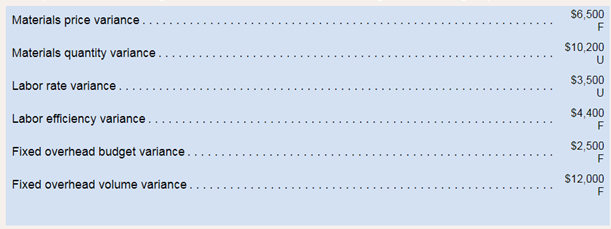

Forsyth Company manufactures one product. it does not maintain any beginning or ending inventories, and its uses a standard cost system. During the year. the company produced and sold 10.000 units at a price of $135 per unit. Its standard cost per unit produced is $105 and its selling and administrative epenscs totaled $235,000. Forsyth does not 460 have any variable  Required:

Required:

- When Forsyth closes its standard cost variances, the cost of goods sold wil1 increase (decrease) by how much?

- Using Exhibit 9B−5 as a guide, prepare an income statement for the year.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please explain the solution to this financial accounting problem using the correct financial principles.

Please help me solve this financial accounting problem with the correct financial process.

Roach and Sulman own a grocery shop. Their first financial year ended on 31 December 19x0.

The following balance were taken from the books on that date.

Capital - Roach R60000, Suleman R48000

Partnership salaries - Roach R9000, Suleman R6000

Drawings - Roach R12860, Suleman R13400

The first net profit for the year was R32840

Interest on capital is to be allowed at 10% per year

Profits and losses are to be shared equally.

From the above, prepare the firms appropriation statement and the partners current accounts

Chapter 9 Solutions

Introduction To Managerial Accounting

Ch. 9.A - Fixed Overhead Variances Primara Corporation has a...Ch. 9.A - Predetermined Overhead Rate: Overhead Variances...Ch. 9.A - Applying Overhead in a Standard Costing System...Ch. 9.A - Prob. 4ECh. 9.A - Using Fixed Overhead Variances The standard cost...Ch. 9.A - Prob. 6ECh. 9.A - Relations Among Fixed Overhead Variances Selected...Ch. 9.A - Applying Overhead; Overhead Variances Lane Company...Ch. 9.A - Applying Overhead; Overhead Variances Chilczuk....Ch. 9.A - Comprehensive Standard Cost Variances "Wonderful!...

Ch. 9.A - Comprehensive Standard Cost Variances Flandro...Ch. 9.A - Selection of a Denominator: Overhead Analysis:...Ch. 9.B - Standard Cost Flows: Income Statement Preparation...Ch. 9.B - Standard Cost Flows: Income Statement Preparation...Ch. 9.B - Standard Cost Flows Bowen Company manufactures one...Ch. 9.B - Standard Cost Flows Hartwell Company manufactures...Ch. 9.B - Transaction Analysis; Income Statement Preparation...Ch. 9.B - Transaction Analysis; Income Statement Preparation...Ch. 9 - What is a static planning budget?Ch. 9 - What is a flexible budget and how does it differ...Ch. 9 - What are some of the possible reasons that actual...Ch. 9 - Why is it difficult to interpret a difference...Ch. 9 - What is a revenue variance and what does it mean?Ch. 9 - What is a spending variance and what does it mean?Ch. 9 - What does a flexible budget enable that a simple...Ch. 9 - How does a flexibe budget based on the cost...Ch. 9 - Prob. 9QCh. 9 - Why are separate price and quantity variances...Ch. 9 - Who is generally responsible for the materials...Ch. 9 - Prob. 12QCh. 9 - Prob. 13QCh. 9 - Our workers are all under labor contracts:...Ch. 9 - Prob. 15QCh. 9 - Prob. 16QCh. 9 - Prob. 17QCh. 9 - The Excel worksheet form that appears below is to...Ch. 9 - Prob. 2AECh. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prob. 2F15Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prob. 4F15Ch. 9 - Prob. 5F15Ch. 9 - Prob. 6F15Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prob. 8F15Ch. 9 - Prob. 9F15Ch. 9 - Prob. 10F15Ch. 9 - Prob. 11F15Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prob. 13F15Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prepare a Flexible Budget Puget Sound Divers is a...Ch. 9 - Prepare a Report Shong Revenue and Spending...Ch. 9 - Prepare a Flexible Budget with More Than One Cost...Ch. 9 - Direct Materials Variances Bandar Industries...Ch. 9 - Prob. 5ECh. 9 - Prob. 6ECh. 9 - Planning Budget Lavage Rapide is a Canadian...Ch. 9 - EXERCISE 98 Flexible Budget L091 Refer to the data...Ch. 9 - Prepare a Report Showing Revenue and Spending...Ch. 9 - Direct Labor and Variable Manufacturing Overhead...Ch. 9 - Prob. 11ECh. 9 - Working with More Than One Cost Driver The...Ch. 9 - Direct Materials and Direct Labor Variances Huron...Ch. 9 - Direct Materials Variances Refer to the data in...Ch. 9 - Prob. 15ECh. 9 - Prob. 16ECh. 9 - Prob. 17ECh. 9 - Comprehensive Variance Analysis Miller Toy Company...Ch. 9 - More than One Cost Driver Milano Pizza is a small...Ch. 9 - Basic Variance Analysis: the Impact of Vanances on...Ch. 9 - Multiple Products. Materials, and Processes...Ch. 9 - Variance Analysis In a Hospital John Fleming,...Ch. 9 - Flexible Budgets and Spending Variances You have...Ch. 9 - Comprehensive Variance Analysis Marvel Parts....Ch. 9 - Direct Materials and Direct Labor Variances:...Ch. 9 - Comprehensive Variance Analysis Highland Company...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I am looking for the correct answer to this financial accounting problem using valid accounting standards.arrow_forwardI am trying to find the accurate solution to this financial accounting problem with appropriate explanations.arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forward

- Henderson Corporation uses the calendar year as its tax year. It acquires and places into service two depreciable assets during 2024: • Asset #1: 7-year property; $940,000 cost; placed into service on January 20. Asset #2: 5-year property; $410,000 cost; placed into service on August 1. View the MACRS half-year convention rates. Read the requirements. Calculate Henderson's depreciation deductions for 2024. (Use MACRS rates to two decimal places, X.XX%. Round the MACRS depreciation to the nearest dollar.) 2024 Depreciation Asset #1 Asset #2 Total depreciation 134,326 82,000 216,326 Calculate Henderson's depreciation deductions for 2025. (Use MACRS rates to two decimal places, X.XX%. Round the MACRS depreciation to the nearest dollar.) 2025 Depreciation Asset #1 Asset #2 Total depreciation 230,206 131,200 361,406 b. What are Henderson's depreciation deductions for 2024 and 2025 if this is the only property it places into service in those years and Henderson elects Sec. 179 expensing for…arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardHenderson Corporation uses the calendar year as its tax year. It acquires and places into service two depreciable assets during 2024: • Asset #1: 7-year property; $940,000 cost; placed into service on January 20. Asset #2: 5-year property; $410,000 cost; placed into service on August 1. View the MACRS half-year convention rates. Read the requirements. Calculate Henderson's depreciation deductions for 2024. (Use MACRS rates to two decimal places, X.XX%. Round the MACRS depreciation to the nearest dollar.) 2024 Depreciation Asset #1 Asset #2 Total depreciation 134,326 82,000 216,326 Calculate Henderson's depreciation deductions for 2025. (Use MACRS rates to two decimal places, X.XX%. Round the MACRS depreciation to the nearest dollar.) 2025 Depreciation Asset #1 Asset #2 Total depreciation 230,206 131,200 361,406 b. What are Henderson's depreciation deductions for 2024 and 2025 if this is the only property it places into service in those years and Henderson elects Sec. 179 expensing for…arrow_forward

- Carlyon Company listed the following items in its December 31, Year 1, financial statements: Investment in Man Company bonds $21,000 Dividends payable: preferred 4,000 Dividends payable: common 50,000 Preferred stock, 8%, $100 par 100,000 Common stock, $10 par 500,000 Additional paid-in capital on preferred stock 20,000 Additional paid-in capital on common stock 262,500 Retained earnings 270,000 During Year 2, the following transactions occurred: Feb. 2 Paid the semiannual dividends declared on December 15, Year 1. Mar. 5 Declared a property dividend, payable to common shareholders on April 5 in Man Company bonds being held to maturity. The bonds (which have a book value of $21,000) have a current market value of $30,000. Apr. 5 Paid the property dividend. Jul. 6 Declared a $4 per share semiannual cash dividend on preferred stock and a $1.10 per share semiannual dividend on common stock, to be paid on August 17. Aug. 17 Paid the cash dividends.…arrow_forwardRequired information [The following information applies to the questions displayed below.] Jarvie loves to bike. In fact, he has always turned down better-paying jobs to work in bicycle shops where he gets an employee discount. At Jarvie's current shop, Bad Dog Cycles, each employee is allowed to purchase four bicycles a year at a discount. Bad Dog has an average gross profit percentage on bicycles of 25 percent. During the current year, Jarvie bought the following bikes: Description Retail Price Specialized road bike $ 4,000 Cost $ 3,600 Employee Price $ 2,800 Rocky Mountain mountain bike 5,000 4,100 4,000 Trek road bike 3,900 3,300 2,730 Yeti mountain bike 4,600 3,400 3,680 b. What amount of deductions is Bad Dog allowed to claim from these transactions? Amount of deductionsarrow_forwardJarvie loves to bike. In fact, he has always turned down better-paying jobs to work in bicycle shops where he gets an employee discount. At Jarvie's current shop, Bad Dog Cycles, each employee is allowed to purchase four bicycles a year at a discount. Bad Dog has an average gross profit percentage on bicycles of 25 percent. During the current year, Jarvie bought the following bikes: Description Retail Price Specialized road bike $ 4,000 Cost $ 3,600 Employee Price $ 2,800 Rocky Mountain mountain bike 5,000 4,100 4,000 Trek road bike 3,900 3,300 2,730 Yeti mountain bike 4,600 3,400 3,680 a. What amount is Jarvie required to include in taxable income from these purchases? Amount to be includedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY