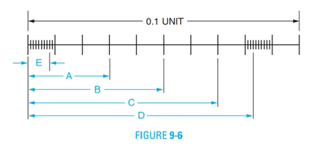

Find the decimal value of each of the distances A, B, C, D, and E in Figure 9−6. Note the total unit value of the lines.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Mathematics For Machine Technology

- a) prove that if (x) is increasing then (x~) is bounded below and prove if (is decrasing then (xn) is bounded above- 6) If Xn is bounded and monotone then (Xa) is Convergent. In particular. i) if (xn) is bounded above and incrasing then lim xn = sups xn: ne№3 n700 ii) if (X) is bounded below and decrasing then I'm Xn = inf\x₂,neN} 4500 143arrow_forwardAt a local college, for sections of economics are taught during the day and two sections are taught at night. 70 percent of the day sections are taught by full time faculty. 20 percent of the evening sections are taught by full time faculty. If Jane has a part time teacher for her economics course, what is the probability that she is taking a night class?arrow_forwardNo chatgpt pls will upvotearrow_forward

- Please help with a detailed explaintion on how to answer this questionarrow_forwardPlease help with a detailed explaintion on how to answer this questionarrow_forwardGiven f(x) =k(3-x), find the value ofk if f-1 (6) = 1 Please help with a detailed explaintion on how to answer this questionarrow_forward

Elementary Geometry For College Students, 7eGeometryISBN:9781337614085Author:Alexander, Daniel C.; Koeberlein, Geralyn M.Publisher:Cengage,

Elementary Geometry For College Students, 7eGeometryISBN:9781337614085Author:Alexander, Daniel C.; Koeberlein, Geralyn M.Publisher:Cengage, College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning

College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning, Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGALAlgebra & Trigonometry with Analytic GeometryAlgebraISBN:9781133382119Author:SwokowskiPublisher:Cengage

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGALAlgebra & Trigonometry with Analytic GeometryAlgebraISBN:9781133382119Author:SwokowskiPublisher:Cengage Algebra: Structure And Method, Book 1AlgebraISBN:9780395977224Author:Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. ColePublisher:McDougal Littell

Algebra: Structure And Method, Book 1AlgebraISBN:9780395977224Author:Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. ColePublisher:McDougal Littell