Concept explainers

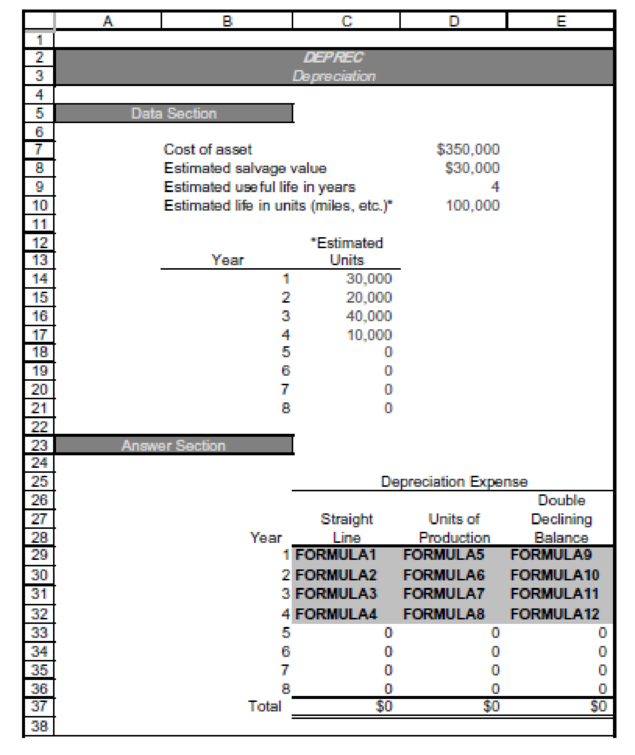

Dunedin Drilling Company recently acquired a new machine at a cost of $350,000. The machine has an estimated useful life of four years or 100,000 hours, and a salvage value of $30,000. This machine will be used 30,000 hours during Year 1, 20,000 hours in Year 2, 40,000 hours in Year 3, and 10,000 hours in Year 4.

With DEPREC5 still on the screen, click the Chart sheet tab. This chart shows the

Series 1 _____________________

Series 2 _____________________

Series 3 _____________________

When the assignment is complete, close the file without saving it again.

Worksheet. The problem thus far has assumed that assets are

Hint: Insert the month in row 6 of the Data Section specifying the month by a number (e.g., April is the fourth month of the year). Redo the formulas for Years 1 and 2. For the

Chart. Using the DEPREC5 file, prepare a line chart or XY chart that plots annual depreciation expense under all three depreciation methods. No Chart Data Table is needed; use the range B29 to E36 on the worksheet as a basis for preparing the chart if you prepare an XY chart. Use C29 to E36 if you prepare a line chart. Enter your name somewhere on the chart. Save the file again as DEPREC5. Print the chart.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Excel Applications for Accounting Principles

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College