Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 1R

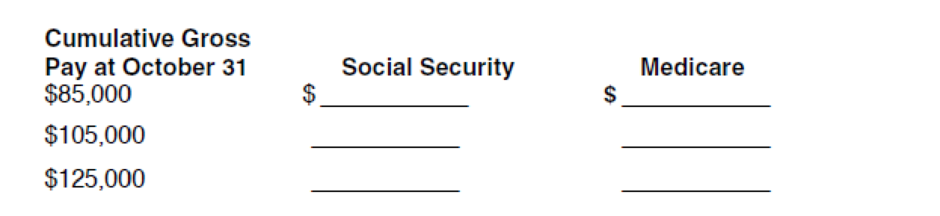

Based on 2011 tax rates provided, use a calculator to compute how much would be withheld from Jones’s November paycheck in the following three cases (round to the nearest penny):

Expert Solution & Answer

To determine

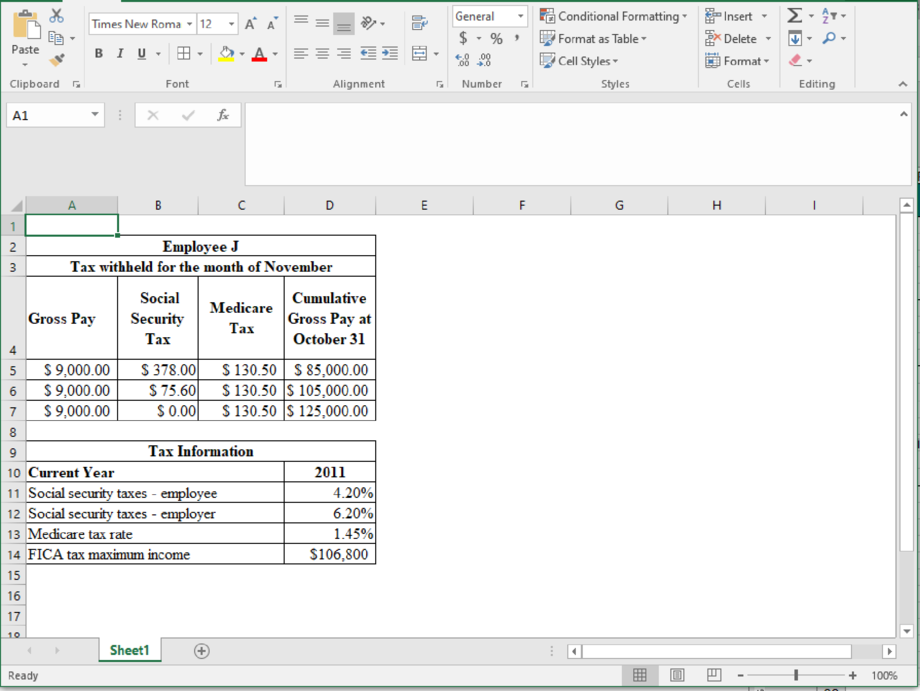

Compute the amount of tax withheld of Employee J for the month of November.

Explanation of Solution

Determine the amount of tax withheld of Employee J for the month of November.

Figure (1)

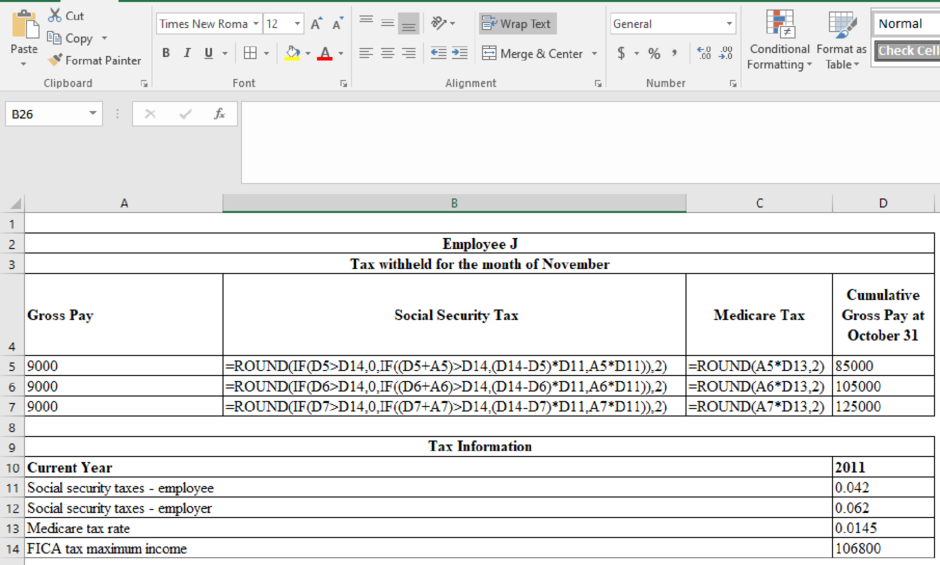

The formulae for the above calculation are as follows:

Figure (2)

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Financial accounting question

Morgan & Co. is currently an all-equity firm with 100,000 shares of stock outstanding at a market price of $30 per share. The company's earnings before interest and taxes are $120,000. Morgan & Co. has decided to add leverage to its financial operations by issuing $750,000 of debt at an 8% interest rate. This $750,000 will be used to repurchase shares of stock. You own 2,500 shares of Morgan & Co. stock. You also loan out funds at an 8% interest rate. How many of your shares of stock in Morgan & Co. must you sell to offset the leverage that the firm is assuming? Assume that you loan out all of the funds you receive from the sale of your stock. Please provide answer

Wilson manufacturing general accounting question

Chapter 10 Solutions

Excel Applications for Accounting Principles

Ch. 10 - Based on 2011 tax rates provided, use a calculator...Ch. 10 - You have been asked to record the November payroll...Ch. 10 - To make the worksheet reusable each month, the...Ch. 10 - Prob. 4RCh. 10 - Prob. 5RCh. 10 - In the space provided below, prepare the journal...Ch. 10 - In the space provided below, prepare the journal...Ch. 10 - Prob. 8RCh. 10 - Click the Chart sheet tab. On the screen is a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Want Answerarrow_forwardMorgan & Co. is currently an all-equity firm with 100,000 shares of stock outstanding at a market price of $30 per share. The company's earnings before interest and taxes are $120,000. Morgan & Co. has decided to add leverage to its financial operations by issuing $750,000 of debt at an 8% interest rate. This $750,000 will be used to repurchase shares of stock. You own 2,500 shares of Morgan & Co. stock. You also loan out funds at an 8% interest rate. How many of your shares of stock in Morgan & Co. must you sell to offset the leverage that the firm is assuming? Assume that you loan out all of the funds you receive from the sale of your stock. Help me with thisarrow_forwardInvesting activities on the statement of cash flow would bearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes; Author: Whats Up Dude;https://www.youtube.com/watch?v=fzK3KDDYCQw;License: Standard Youtube License