Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 1R

On June 1 of the current year, Wilson Wood opened Woodyʼs Web Services. This sole proprietorship had the following transactions during June.

- a. Opened a business checking account and made a deposit, $9,000.

- b. Paid rent for June for office space and computer equipment, $3,000.

- c. Purchased office supplies (stamps, pens, etc.) on account, $1,980.

- d. Received cash for services rendered, $4,500.

- e. Paid creditor for office supplies purchased on account, $1,400.

- f. Purchased office supplies for cash, $420.

- g. Billed clients for consultations performed on account, $4,600.

- h. Paid monthly internet service bill of $360.

- i. Paid the secretaryʼs salary of $2,400.

- j. Returned $300 of office supplies purchased in transaction f. Received a full refund.

- k. Received cash from clients previously billed, $3,000.

- l. Cash was withdrawn for ownerʼs personal use, $2,000.

REQUIREMENT

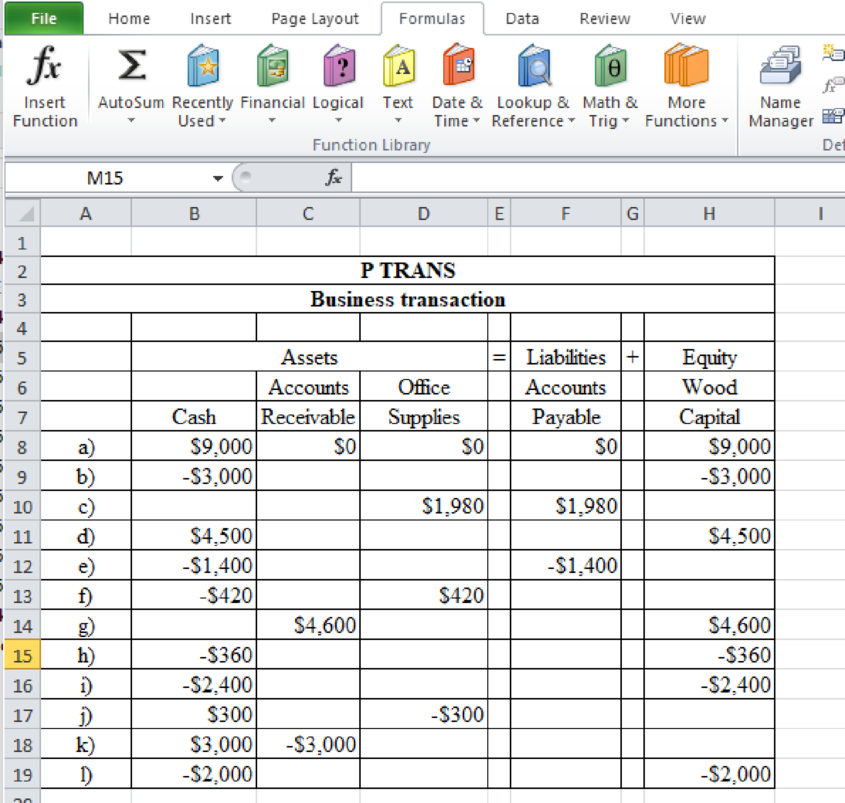

1. Review the printout of the worksheet PTRANS. You have been asked to complete the worksheet by recording these transactions.

Expert Solution & Answer

To determine

Show the printout of worksheet of PTRANS.

Explanation of Solution

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

The current ratio of a company is 5:1, and its acid-test ratio is 2:1. If the inventories and prepaid items amount to $450,000, what is the amount of current liabilities? Answer this financial accounting problem. Ans

Cullumber Company uses a job order cast system and applies overhead to production on the basis of direct labor costs. On

January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct

materials $16,800, direct labor $10,000, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at

a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory

account on January 1.

During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs

49 and 50 were sold on account during the month for $102.480 and $132,720, respectively. The following additional events

occurred during the month.

1

Purchased additional raw materials of $75,600 on account.

2

Incurred factory labor costs of $58,800.

3

Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…

Net sales total $525,000. Beginning and ending accounts receivable are $42,000 and $46,000, respectively. Calculate days' sales in receivables.

Chapter 1 Solutions

Excel Applications for Accounting Principles

Ch. 1 - On June 1 of the current year, Wilson Wood opened...Ch. 1 - On June 1 of the current year, Wilson Wood opened...Ch. 1 - On June 1 of the current year, Wilson Wood opened...Ch. 1 - On June 1 of the current year, Wilson Wood opened...Ch. 1 - On June 1 of the current year, Wilson Wood opened...Ch. 1 - On June 1 of the current year, Wilson Wood opened...Ch. 1 - Prob. 7R

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During 2015, the assets of Inspiring Sky increased by $45,000, and the liabilities increased by $20,000. If the owner's equity in Inspiring Sky is $100,000 at the end of 2015, the owner's equity at the beginning of 2015 must have been __. General Accountarrow_forwardDuring 2015, the assets of Inspiring Sky increased by $45,000, and the liabilities increased by $20,000. If the owner's equity in Inspiring Sky is $100,000 at the end of 2015, the owner's equity at the beginning of 2015 must have been __.arrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forward

- Determine the amount to be paid in full settlement of each invoice, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period. Freight Paid Returns and Merchandise by Seller Freight Terms Allowances a. $9,400 $282 FOB Shipping Point, 1/10, net 30 $900 b. $8,600 $60 FOB Destination, 2/10, net 45 $1,900 a. $ b. $arrow_forwardTravis Company purchased merchandise on account from a supplier for $13,200, terms 2/10, net 30 on December 26. Travis Company paid for the merchandise on December 31, within the discount period. Required: Under a perpetual inventory system, record the journal entries required for the above transactions. Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forward

- Cullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardGeneral Accounting questionarrow_forwardWhat Is the correct answer A B ?? General Accounting questionarrow_forward

- Cullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardAccounting questionarrow_forwardNot need ai solution please correct answer general Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub  Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY