Concept explainers

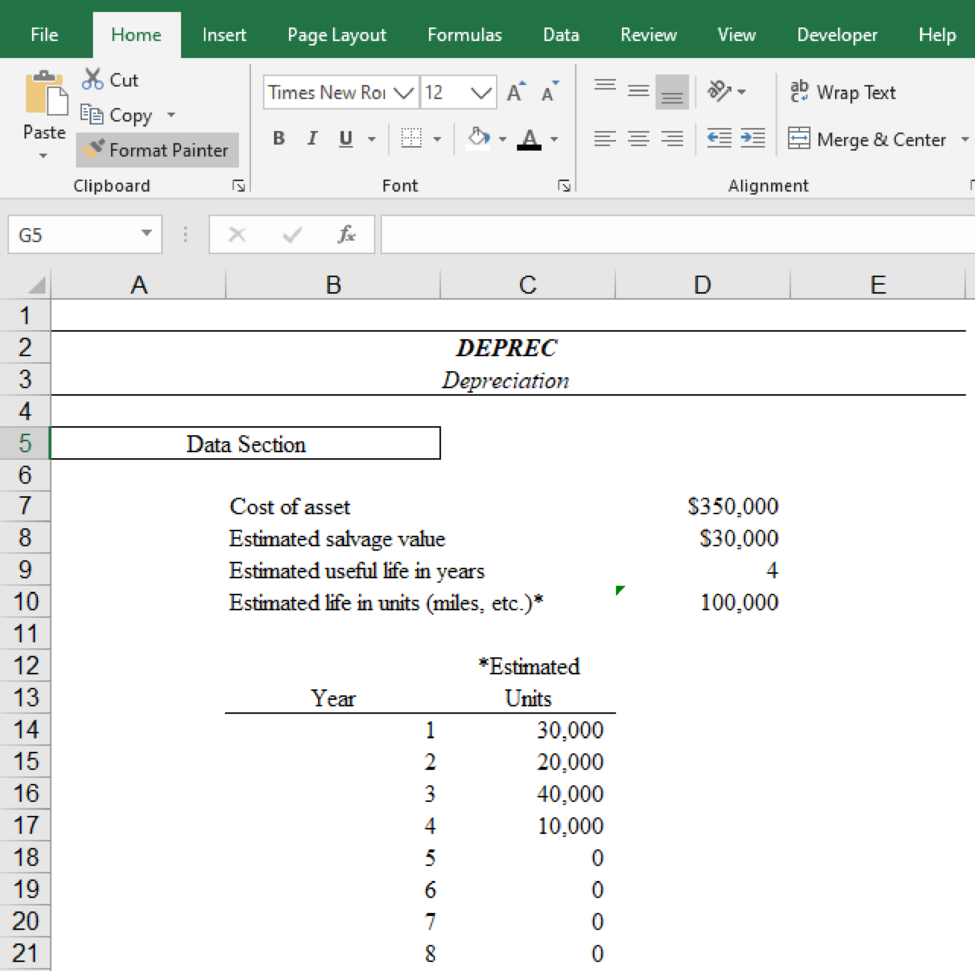

Dunedin Drilling Company recently acquired a new machine at a cost of $350,000. The machine has an estimated useful life of four years or 100,000 hours, and a salvage value of $30,000. This machine will be used 30,000 hours during Year 1, 20,000 hours in Year 2, 40,000 hours in Year 3, and 10,000 hours in Year 4.

Dunedin buys equipment frequently and wants to print a depreciation schedule for each assetʼs life. Review the worksheet called DEPREC that follows these requirements. Since some assets acquired are

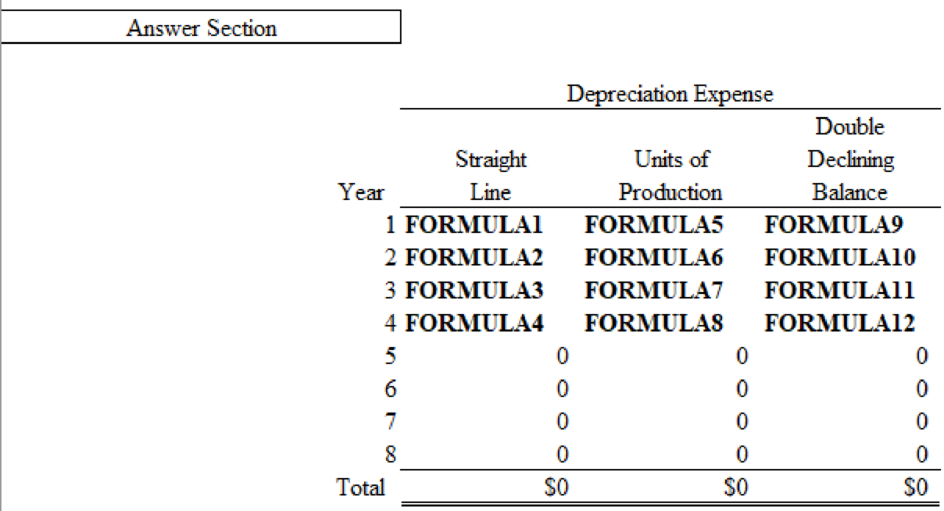

Prepare a worksheet showing the depreciation schedules for the new machine.

Explanation of Solution

Prepare a worksheet showing the depreciation schedules for the new machine:

Table (1)

Want to see more full solutions like this?

Chapter 9 Solutions

Excel Applications for Accounting Principles

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT