Concept explainers

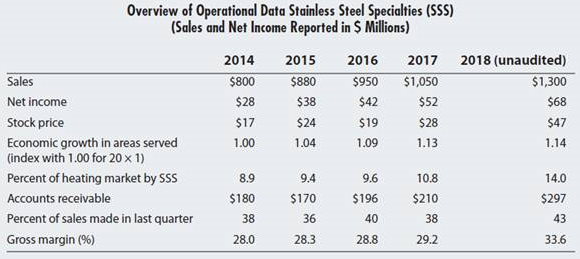

Stainless Steel Specialties (SSS) is a manufacturer of hot water—based heating systems for homes and commercial businesses. The company has grown about 10% in each of the past five years. The company has not made any acquisitions. Following are some statistics for the company:

Additional information available to the auditor includes:

- The company has touted its new and improved technology for the increase both in sales and in gross margin.

- The company claims to have decreased administrative expenses, thus increasing net profits.

- The company has reorganized its sales process to a more centralized approach and has empowered individual sales managers to negotiate better prices to drive sales as long as the amounts are within corporate guidelines.

- The company has changed its salesperson compensation by increasing the commission on sales to new customers.

- Sales commissions are no longer affected by returned goods if the goods are returned more than 90 days after sale and/or by not collecting the receivables. SSS has justified the changes in sales commissions on the following grounds:

- The salesperson is not responsible for quality issues—the main reason that customers return products.

- The salesperson is not responsible for approving credit; rather credit approval is under the direction of the global sales manager.

a. What is the importance of the information about salesperson compensation to the audit of receivables and revenue? Explain how the auditor would use this information in planning analytical procedures.

b. Perform planning analytical procedures using the data included in the table and the information about the change in performance. For each year, you will most likely want to focus on the % change of the various statistics over the prior year. Focus on Steps 3, 4, and 5 of the planning analytical procedures process. What are the important insights that the auditor should gain from performing such procedures?

c. Why should the auditor be interested in a company’s stock price when performing an audit, as stock price is dependent, at least in part, on audited financial reports?

d. What information about SSS might the auditor consider as fraudrisk factors?

e. Identify specific substantive

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Auditing: A Risk Based-Approach to Conducting a Quality Audit

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning