LIFO liquidation

• LO8–4, LO8–6

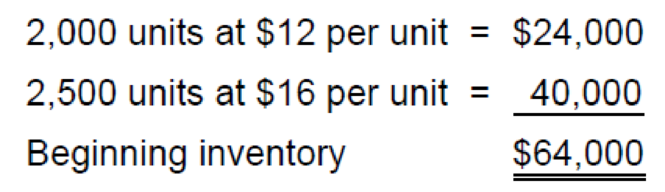

Cansela Corporation uses a periodic inventory system and the LIFO method to value its inventory. The company began 2018 with inventory of 4,500 units of its only product. The beginning inventory balance of $64,000 consisted of the following layers:

During the three years 2018–2020 the cost of inventory remained constant at $18 per unit. Unit purchases and sales during these years were as follows:

| Purchases | Sales | |

| 2018 | 10,000 | 11,000 |

| 2019 | 13,000 | 14,500 |

| 2020 | 12,000 | 13,000 |

Required:

1. Calculate cost of goods sold for 2018, 2019, and 2020.

2. Disregarding income tax, determine the LIFO liquidation profit or loss, if any, for each of the three years.

3. Prepare the company’s LIFO liquidation disclosure note that would be included in the 2020 financial statements to report the effects of any liquidation on cost of goods sold and net income. Assume any liquidation effects are material and that Cansela’s effective income tax rate is 40%. Cansela’s 2020 financial statements include income statements for two prior years for comparative purposes.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Intermediate Accounting

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

- I am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardWhich financial statement reports cash inflows and outflows?A. Balance SheetB. Statement of Cash FlowsC. Income StatementD. Statement of Retained Earningsarrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forward

- No AI Which financial statement reports cash inflows and outflows?A. Balance SheetB. Statement of Cash FlowsC. Income StatementD. Statement of Retained Earningsarrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning