Concept explainers

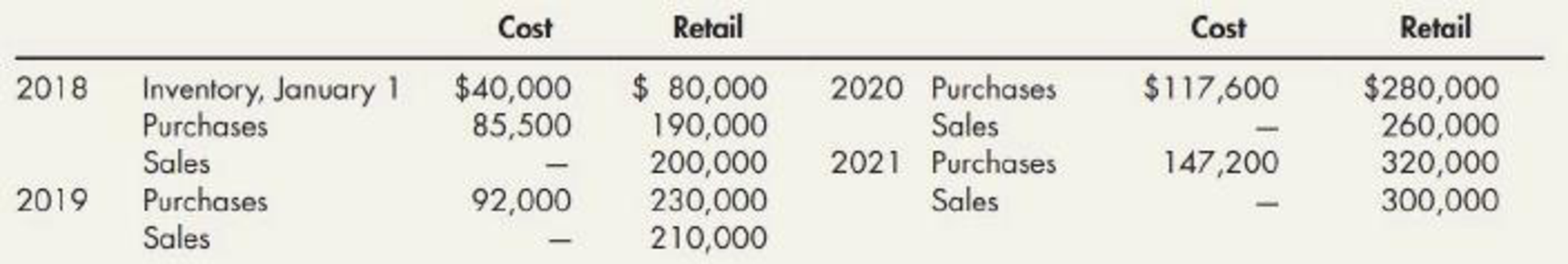

Dollar-Value LIFO Retail Intella Inc. adopted the dollar-value retail LIFO method on January 1, 2018. The following data apply to the 4 subsequent years:

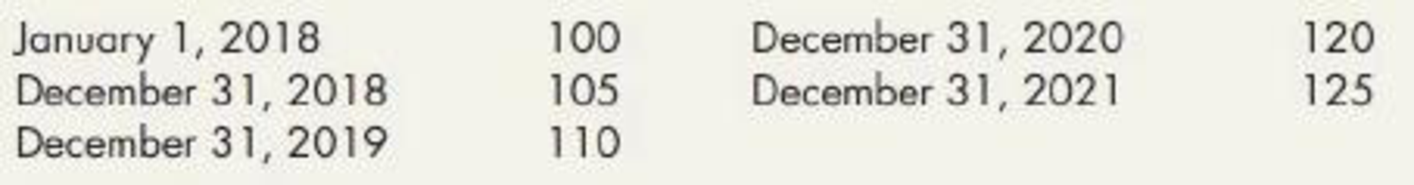

In addition, the following price indexes are available:

Required:

Compute the inventory at the end of each of the 4 years. Round the cost-to-retail ratio to 3 decimal places.

Calculate the cost of ending inventory for 2018, 2019, 2020, and 2021 years by using dollar-value LIFO retail method.

Explanation of Solution

Dollar-Value-LIFO: This method shows all the inventory figures at dollar price rather than units. Under this inventory method, the units that are purchased last are sold first. Thus, it starts from the selling of the units recently purchased and ending with the beginning inventory.

Calculate the cost of ending inventory for 2018, 2019, 2020, and 2021 years by using dollar-value LIFO retail method:

For the year 2018:

Step 1: Calculate the amount of estimated ending inventory at retail.

| I Incorporation | ||

| Ending Inventory Under DVL Retail Method | ||

| For the Year 2018 | ||

| Details | Cost ($) | Retail ($) |

| Beginning inventory | 40,000 | 80,000 |

| Add: Net purchase | 85,500 | 190,000 |

| Goods available for sale – Excluding beginning inventory | 85,500 | 190,000 |

| Goods available for sale – Including beginning inventory | 125,500 | 270,000 |

| Less: Net sales | (200,000) | |

| Estimated ending inventory at retail for 2018 | $70,000 | |

Table (1)

Step 2: Calculate ending inventory at retail at base-year prices.

Step 3: Calculate inventory change at retail at base year prices.

Step 4: Calculate the change at retail at relevant current costs.

Step 5: Calculate the change at relevant current costs.

Step 6: Calculate ending inventory at cost.

Hence, the ending inventory at cost for 2018 is $33,333.

Working note 1:

Calculate cost-to-retail ratio.

Working note 2:

Calculate cost-to-retail ratio.

For the year 2019:

Step 1: Calculate the amount of estimated ending inventory at retail.

| I Incorporation | ||

| Ending Inventory Under DVL Retail Method | ||

| For the Year 2019 | ||

| Details | Cost ($) | Retail ($) |

| Beginning inventory | 33,333 | 70,000 |

| Add: Net purchase | 92,000 | 230,000 |

| Goods available for sale – Excluding beginning inventory | 92,000 | 230,000 |

| Goods available for sale – Including beginning inventory | 125,333 | 300,000 |

| Less: Net sales | (210,000) | |

| Estimated ending inventory at retail for 2019 | $90,000 | |

Table (1)

Step 2: Calculate ending inventory at retail at base-year prices.

Step 3: Calculate inventory change at retail at base year prices.

Step 4: Calculate the change at retail at relevant current costs.

Step 5: Calculate the change at relevant current costs.

Step 6: Calculate ending inventory at cost.

Hence, the ending inventory at cost for 2019 is $39,999.

Working note 1:

Calculate cost-to-retail ratio.

For the year 2020:

Step 1: Calculate the amount of estimated ending inventory at retail.

| I Incorporation | ||

| Ending Inventory Under DVL Retail Method | ||

| For the Year 2020 | ||

| Details | Cost ($) | Retail ($) |

| Beginning inventory | 39,999 | 90,000 |

| Add: Net purchase | 117,600 | 280,000 |

| Goods available for sale – Excluding beginning inventory | 117,600 | 280,000 |

| Goods available for sale – Including beginning inventory | 157,599 | 370,000 |

| Less: Net sales | (260,000) | |

| Estimated ending inventory at retail for 2020 | $110,000 | |

Table (3)

Step 2: Calculate ending inventory at retail at base-year prices.

Step 3: Calculate inventory change at retail at base year prices.

Step 4: Calculate the change at retail at relevant current costs.

Step 5: Calculate the change at relevant current costs.

Step 6: Calculate ending inventory at cost.

Hence, the ending inventory at cost for 2020 is $44,963.

Working note 1:

Calculate cost-to-retail ratio.

For the year 2021:

Step 1: Calculate the amount of estimated ending inventory at retail.

| I Incorporation | ||

| Ending Inventory Under DVL Retail Method | ||

| For the Year 2021 | ||

| Details | Cost ($) | Retail ($) |

| Beginning inventory | 44,963 | 110,000 |

| Add: Net purchase | 147,200 | 320,000 |

| Goods available for sale – Excluding beginning inventory | 147,200 | 320,000 |

| Goods available for sale – Including beginning inventory | 192,163 | 430,000 |

| Less: Net sales | (300,000) | |

| Estimated ending inventory at retail for 2021 | $130,000 | |

Table (4)

Step 2: Calculate ending inventory at retail at base-year prices.

Step 3: Calculate inventory change at retail at base year prices.

Step 4: Calculate the change at retail at relevant current costs.

Step 5: Calculate the change at relevant current costs.

Step 6: Calculate ending inventory at cost.

Hence, the ending inventory at cost for 2021 is $52,054.

Working note 1:

Calculate cost-to-retail ratio.

Want to see more full solutions like this?

Chapter 8 Solutions

Intermediate Accounting: Reporting And Analysis

- Need help with this question solution general accountingarrow_forwardPlease Solve this problemarrow_forwardAs part of your Portfolio Project due in Module 8, your job is to identify new opportunities for your company water purification products in underserved international markets. . Describe the company and the products and services created by this company. Part of your employment responsibility includes completing the following two reports to support your recommendation for an international expansion: Conduct a Market Intelligence Assessment: This is a broad overview of the target country. The overview should include information about its political, legal, cultural, economic, and technological characteristics. Provide supporting statistics and indicators for each component of the macroenvironment. Conduct a Business Environment Analysis: To do so, determine key national characteristics that will affect the marketing of the product. Comment on any potential ethical implications.arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning