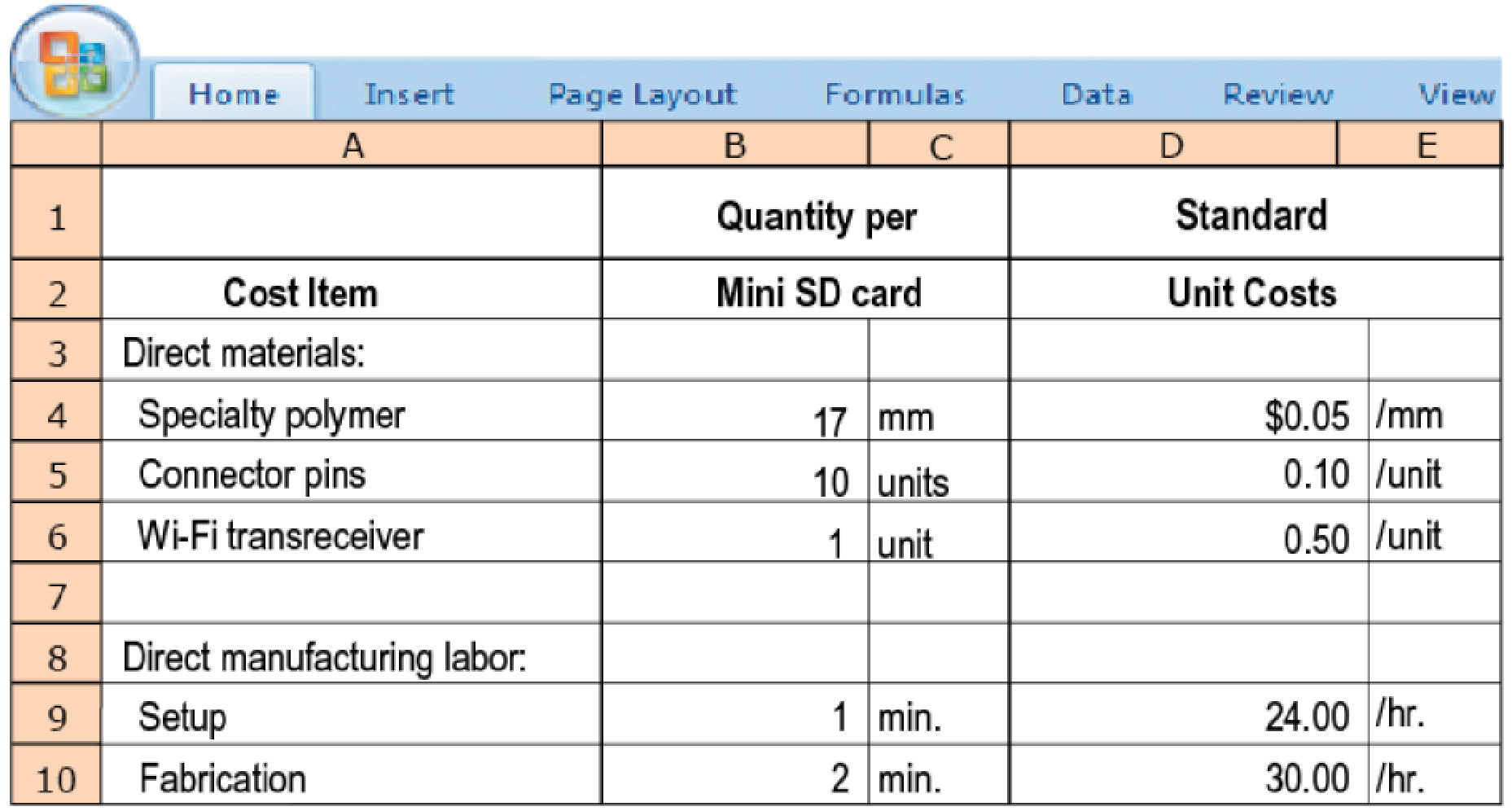

Direct-cost and selling price variances. MicroDisk is the market leader in the Secure Digital (SD) card industry and sells memory cards for use in portable devices such as mobile phones, tablets, and digital cameras. Its most popular card is the Mini SD, which it sells through outlets such as Target and Walmart for an average selling price of $8. MicroDisk has a standard monthly production level of 420,000 Mini SDs in its Taiwan facility. The standard input quantities and prices for direct-cost inputs are as follows:

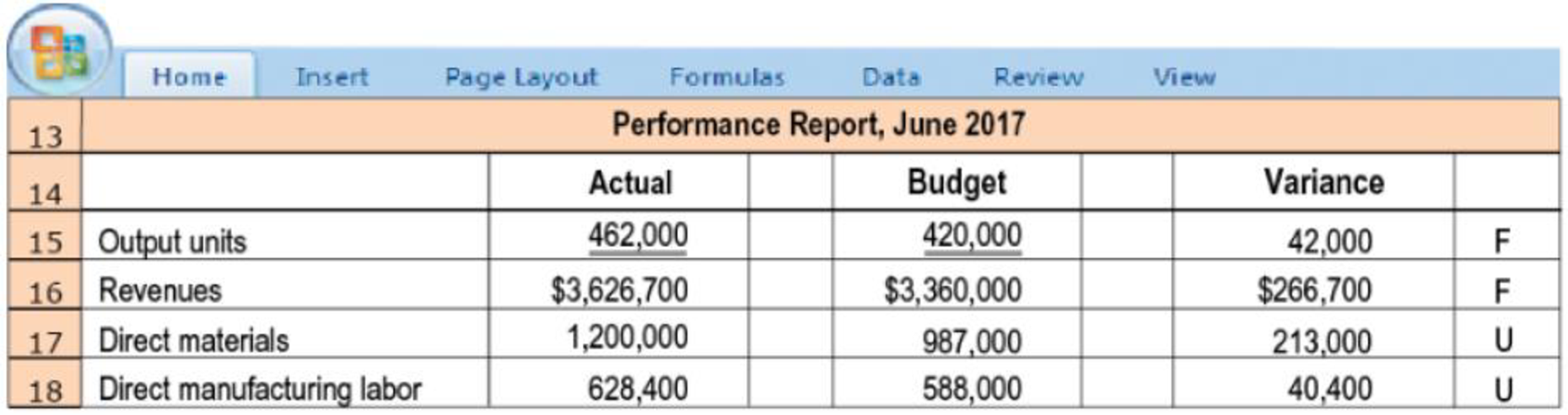

Phoebe King, the CEO, is disappointed with the results for June 2017, especially in comparison to her expectations based on the

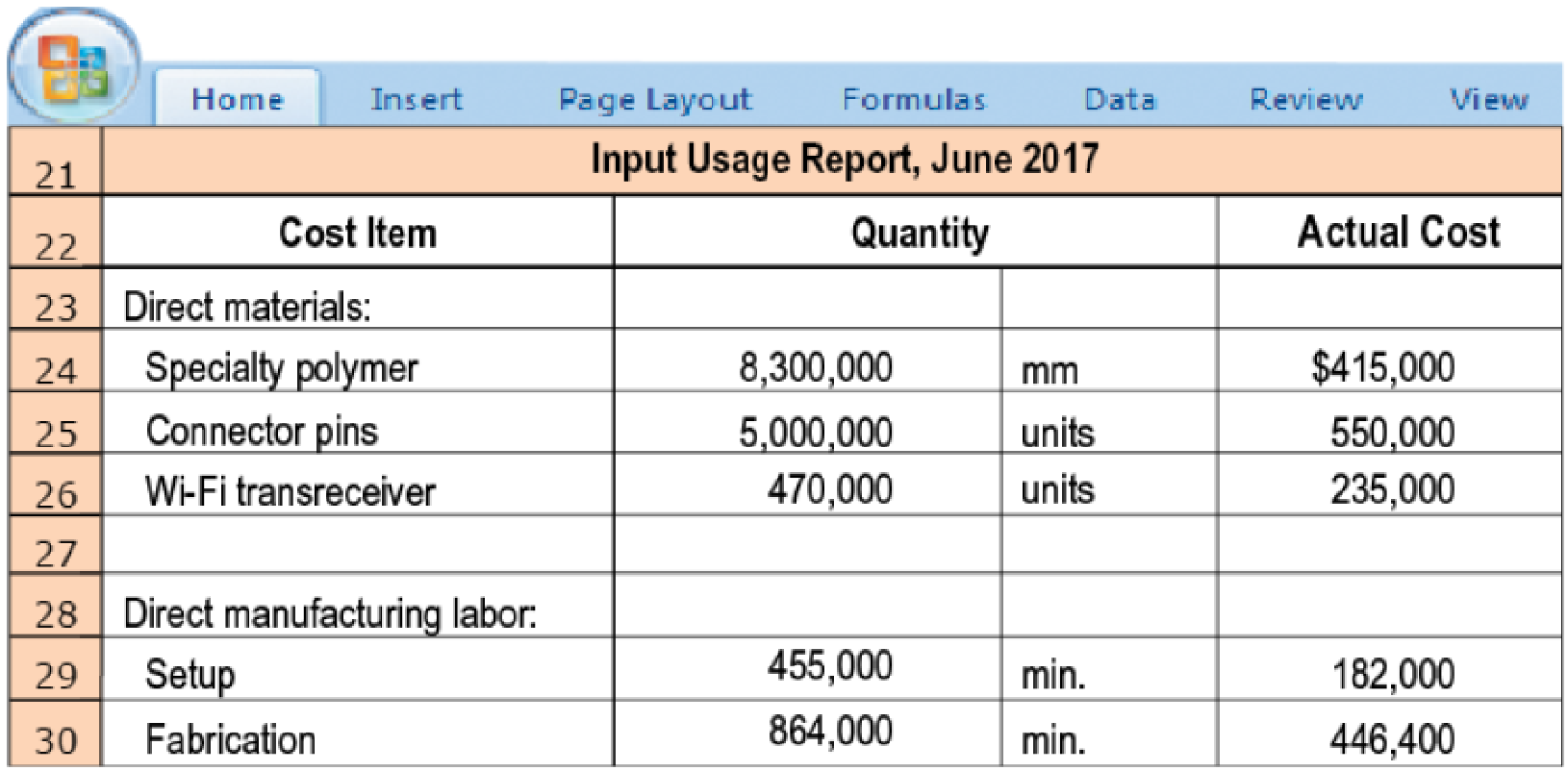

King observes that despite the significant increase in the output of Mini SDs in June, the product’s contribution to the company’s profitability has been lower than expected. She gathers the following information to help analyze the situation:

Calculate the following variances. Comment on the variances and provide potential reasons why they might have arisen, with particular attention to the variances that may be related to one another:

- 1. Selling-price variance

- 2. Direct materials price variance, for each category of materials

- 3. Direct materials efficiency variance, for each category of materials

- 4. Direct manufacturing labor price variance, for setup and fabrication

- 5. Direct manufacturing labor efficiency variance, for setup and fabrication

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Horngren's Cost Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (16th Edition)

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education