Del Rio began Rio Enterprises on January 1 with 200 units of inventory. During the year, 500 additional units were purchased, 500 units were sold, and Del ended the year with 200 units. Del is very satisfied with his first year of business although the cost of replacing his inventory rose continually throughout the year. The 500 units sold for a total of $320,000 and the 500 units purchased to replace them cost $256,000, so his cash account has increased by $64,000. Del is concerned however because he has three obligations yet to meet: taxes, dividends, and his wife. Federal and state income taxes will take 40% of his income. His investors are to receive dividends equal to half of any income after taxes are paid. And finally, Del promised his wife a big trip to Hawaii if she let him quit his job as a professor and start his own business. He promised her heʼd “make at least $50,000 after taxes. That will give us $25,000 after paying off the investors.”

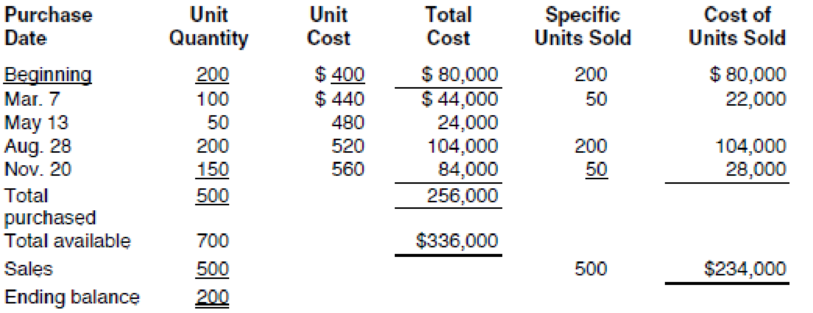

Del kept fairly good records during the year and knows the specific cost of each inventory unit sold. He has prepared the following table to summarize his purchases and sales.

Examine your completed worksheet and answer the following questions:

- a. Which inventory cost flow assumption produces the most net income?

- b. Which inventory cost flow assumption produces the least net income?

- c. What caused the difference between your answers to a and b?

- d. Which inventory cost flow assumption produces the highest ending cash balance?

- e. Which inventory cost flow assumption produces the lowest ending cash balance?

- f. Does the assumption that produces the highest net income also produce the highest cash balance? Explain.

- g. As you recall, Del originally used the specific identification method in his initial calculations when he projected $51,600 net income. According to Delʼs reckoning, that should have left him cash of $25,800 (50% of $51,600) after paying his investors. Why would he only have $3,800 left? Explain.

- h. Which inventory cost flow assumption would you suggest Del use? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Excel Applications for Accounting Principles

- ansarrow_forwardElle Corporation has the following standards for its direct materials: 1. Standard Cost: $3.80 per pound 2. Standard Quantity: 6.00 pounds per product. During the most recent month, the company purchased and used 33,900 pounds of material in manufacturing 5,600 products, at a total cost of $131,900. Compute the materials quantity variance.arrow_forward?arrow_forward

- What is the firm's return on equity on these general accounting question?arrow_forwardAnalyze the role of the accounting function in supporting corporate governance and risk management processes. Consider the ways in which accountants can contribute to the identification, assessment, and mitigation of organizational risks, beyond their traditional financial reporting responsibilities.arrow_forwardPlease provide answer the general accounting questionarrow_forward

- What is the asset turnover ratio on these general accounting question?arrow_forwardHow can the accounting concept of materiality be applied to the recognition and disclosure of contingent liabilities? Explore the factors that accountants should consider when determining the appropriate level of detail to include in financial statements regarding potential future obligations.arrow_forwardDon't use ai given answer accounting questionsarrow_forward

- Tutor please helparrow_forwardFinancial Accountingarrow_forward5.5 PTS Accounting Problem: Red Farms produces three crop grades: Premium sells at twice standard grade Value grade at half standard grade If standard is $8/kg and daily harvest was: Premium: 120kg Standard: 250kg Value: 180kg Calculate daily revenue.arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage