Concept explainers

Del Rio began Rio Enterprises on January 1 with 200 units of inventory. During the year, 500 additional units were purchased, 500 units were sold, and Del ended the year with 200 units. Del is very satisfied with his first year of business although the cost of replacing his inventory rose continually throughout the year. The 500 units sold for a total of $320,000 and the 500 units purchased to replace them cost $256,000, so his cash account has increased by $64,000. Del is concerned however because he has three obligations yet to meet: taxes, dividends, and his wife. Federal and state income taxes will take 40% of his income. His investors are to receive dividends equal to half of any income after taxes are paid. And finally, Del promised his wife a big trip to Hawaii if she let him quit his job as a professor and start his own business. He promised her heʼd “make at least $50,000 after taxes. That will give us $25,000 after paying off the investors.”

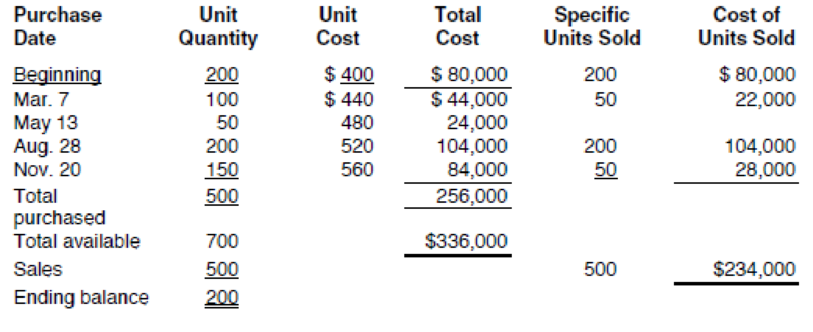

Del kept fairly good records during the year and knows the specific cost of each inventory unit sold. He has prepared the following table to summarize his purchases and sales.

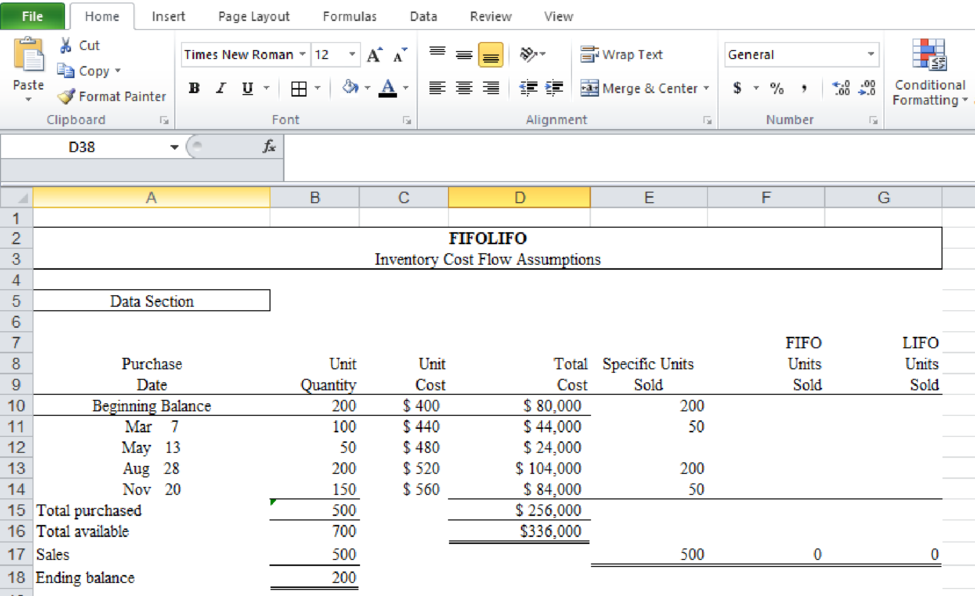

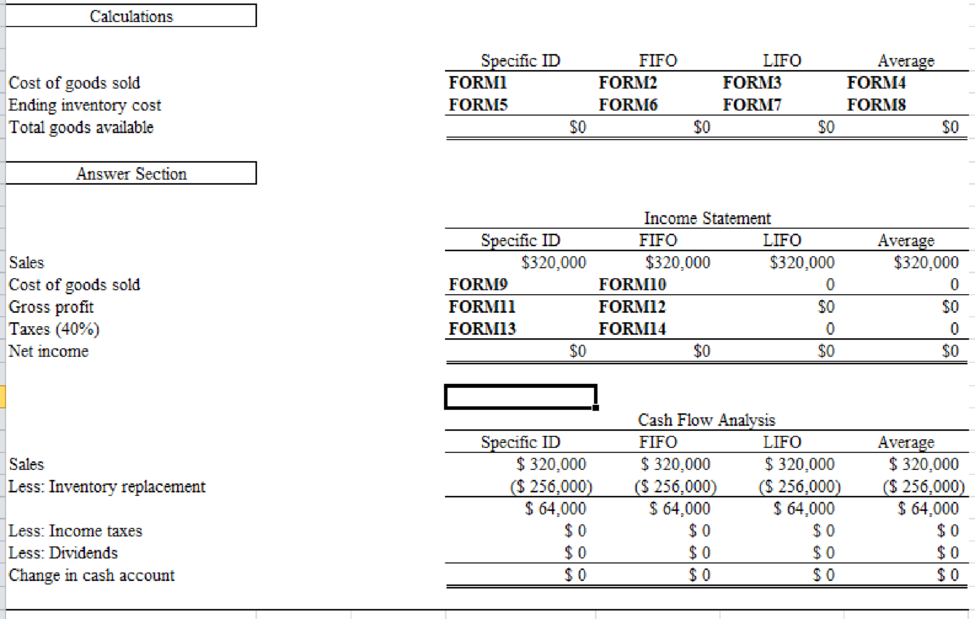

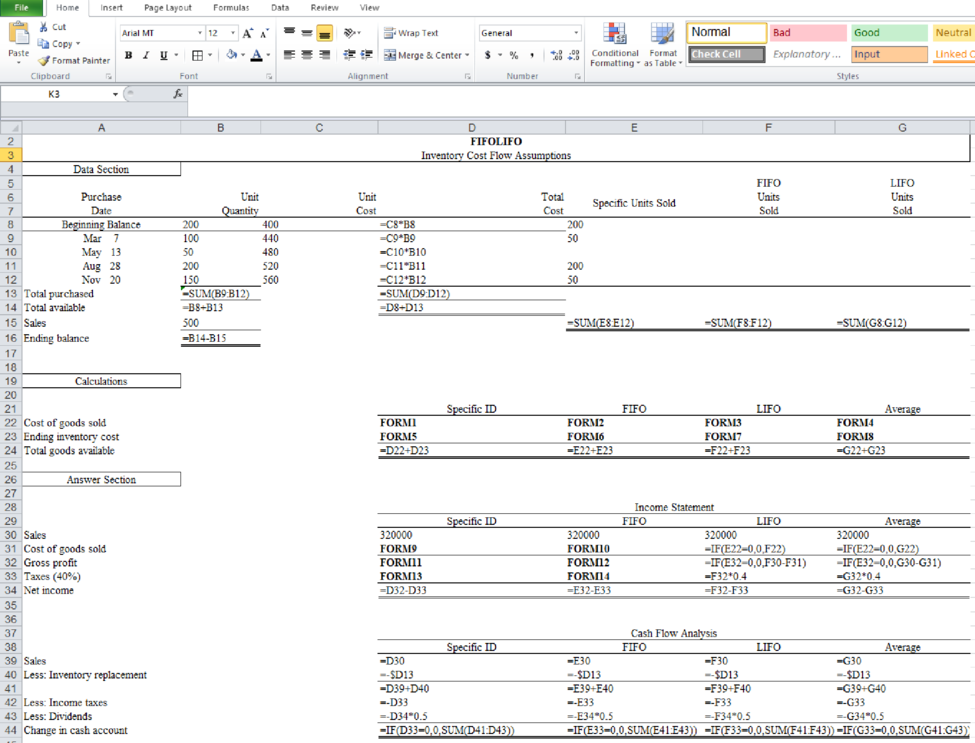

Del has heard that the choice of an inventory cost flow assumption can have a significant effect on net income and taxes. He asks you to show him the differences between the specific identification method and the cost flow assumptions of FIFO, LIFO, and weighted average methods. Review the worksheet FIFOLIFO that follows these requirements. Note that all of the problem data have been entered in the Data Section of the worksheet.

Prepare a worksheet to show the differences between the specific identification method and the cost flow assumptions of FIFO, LIFO, and weighted average methods.

Explanation of Solution

Prepare a worksheet to show the differences between the specific identification method and the cost flow assumptions of FIFO, LIFO, and weighted average methods.

Table (1)

The formulae for the calculation are as follows:

Want to see more full solutions like this?

Chapter 7 Solutions

Excel Applications for Accounting Principles

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage