Del Rio began Rio Enterprises on January 1 with 200 units of inventory. During the year, 500 additional units were purchased, 500 units were sold, and Del ended the year with 200 units. Del is very satisfied with his first year of business although the cost of replacing his inventory rose continually throughout the year. The 500 units sold for a total of $320,000 and the 500 units purchased to replace them cost $256,000, so his cash account has increased by $64,000. Del is concerned however because he has three obligations yet to meet: taxes, dividends, and his wife. Federal and state income taxes will take 40% of his income. His investors are to receive dividends equal to half of any income after taxes are paid. And finally, Del promised his wife a big trip to Hawaii if she let him quit his job as a professor and start his own business. He promised her heʼd “make at least $50,000 after taxes. That will give us $25,000 after paying off the investors.”

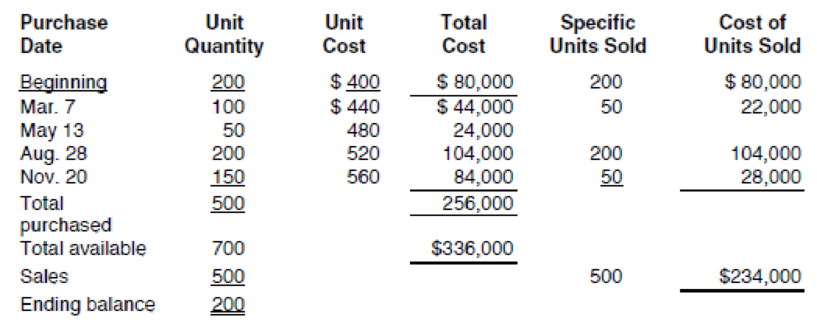

Del kept fairly good records during the year and knows the specific cost of each inventory unit sold. He has prepared the following table to summarize his purchases and sales.

Reset the purchase prices to their original values (cells C11 through C14). Suppose Del had purchased 250 units on November 20 rather than 150. Enter 250 in cell C14 and alter column G in the Data Section. Explain what happens to net income under each inventory cost flow assumption and why. Also, what “management” implications might this have for Del?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Excel Applications for Accounting Principles

- Torre Corporation incurred the following transactions. 1. Purchased raw materials on account $46,300. 2. Raw Materials of $36,000 were requisitioned to the factory. An analysis of the materials requisition slips indicated that $6,800 was classified as indirect materials. 3. Factory labor costs incurred were $55,900, of which $51,000 pertained to factory wages payable and $4,900 pertained to employer payroll taxes payable. 4. Time tickets indicated that $50,000 was direct labor and $5,900 was indirect labor. 5. Overhead costs incurred on account were $80,500. 6. Manufacturing overhead was applied at the rate of 150% of direct labor cost. 7. Goods costing $88,000 were completed and transferred to finished goods. 8. Finished goods costing $75,000 to manufacture were sold on account for $103,000. Instructions Journalize the transactions.arrow_forwardChapter 15 Assignment of direct materials, direct labor and manufacturing overhead Stine Company uses a job order cost system. During May, a summary of source documents reveals the following. Job Number Materials Requisition Slips Labor Time Tickets 429 430 $2,500 3,500 $1,900 3,000 431 4,400 $10,400 7,600 $12,500 General use 800 1,200 $11,200 $13,700 Stine Company applies manufacturing overhead to jobs at an overhead rate of 60% of direct labor cost. Instructions Prepare summary journal entries to record (i) the requisition slips, (ii) the time tickets, (iii) the assignment of manufacturing overhead to jobs,arrow_forwardSolve accarrow_forward

- Solve fastarrow_forwardAssume that none of the fixed overhead can be avoided. However, if the robots are purchased from Tienh Inc., Crane can use the released productive resources to generate additional income of $375,000. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Direct materials Direct labor Variable overhead 1A Fixed overhead Opportunity cost Purchase price Totals Make A Buy $ SA Net Income Increase (Decrease) $ Based on the above assumptions, indicate whether the offer should be accepted or rejected? The offerarrow_forwardThe following is a list of balances relating to Phiri Properties Ltd during 2024. The company maintains a memorandum debtors and creditors ledger in which the individual account of customers and suppliers are maintained. These were as follows: Debit balance in debtors account 01/01/2024 66,300 Credit balance in creditors account 01/01/2024 50,600 Sunday credit balance on debtors ledger Goods purchased on credit 724 257,919 Goods sold on credit Cash received from debtors Cash paid to suppliers Discount received Discount allowed Cash purchases Cash sales Bad Debts written off Interest on overdue account of customers 323,614 299,149 210,522 2,663 2,930 3,627 5,922 3,651 277 Returns outwards 2,926 Return inwards 2,805 Accounts settled by contra between debtors and creditors ledgers 1,106 Credit balances in debtors ledgers 31/12/2024. 815 Debit balances in creditors ledger 31/12/2024.698 Required: Prepare the debtors control account as at 31/12/2024. Prepare the creditors control account…arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage