- Pricing tests showed that the physical inventory was overpriced by $2,200.

- Footing and extension errors resulted in a $150 understatement of the physical inventory.

- Direct labor included in the physical inventory amounted to $10,000.

Overhead was included at the rate of 200% of direct labor. You determined that the amount of direct labor was correct and the overhead rate was proper. - The physical inventory included obsolete materials recorded at $250. During December, these materials were removed from the inventory account by a charge to cost of sales.

Your audit also disclosed the following information about the December 31, 2019, inventory.

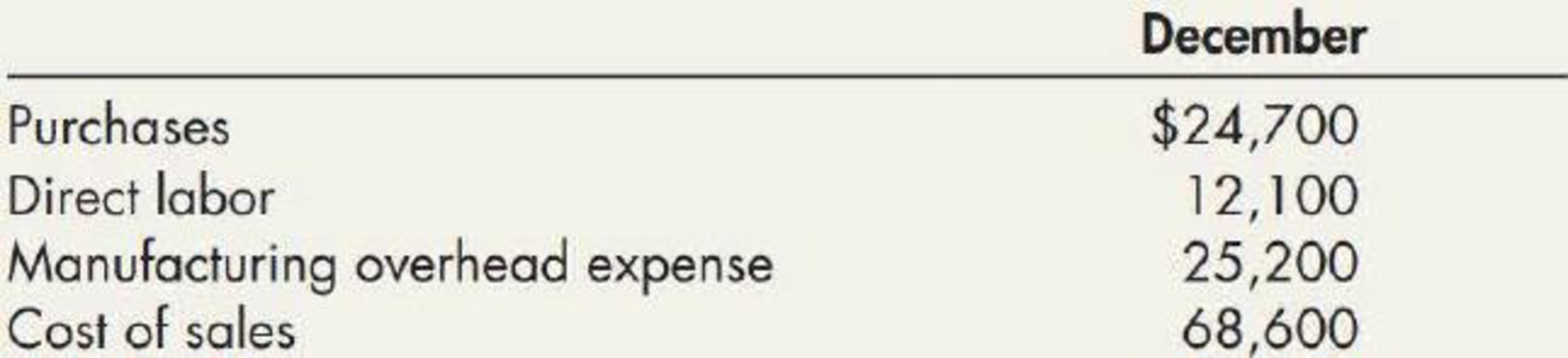

- Total debits to certain accounts during December are:

- The cost of sales of $68,600 included direct labor of $13,800.

- Normal scrap loss on established product lines is negligible. However, a special order started and completed during December had excessive scrap loss of $800 which was charged to Manufacturing Overhead Expense.

Required:

- 1. Compute the correct amount of the physical inventory at November 30, 2019.

- 2. Without prejudice to your solution to Requirement 1, assume that the correct amount of the inventory at November 30, 2019, was $57,700. Compute the amount of the inventory at December 31,2019.

Trending nowThis is a popular solution!

Chapter 7 Solutions

Intermediate Accounting: Reporting And Analysis

- The Blue Jay Corporation has annual sales of $5,200, total debt of $1,500, total equity of $2,800, and a profit margin of 8 percent. What is the return on assets? Don't Use Aiarrow_forwardAt the beginning of the year, manufacturing overhead for the year was estimated to be $810,000. At the end of the year, actual direct labor hours for the year were 40,000 hours, the actual manufacturing overhead for the year was $780,000, and the manufacturing overhead for the year was overapplied by $30,000. If the predetermined overhead rate is based on direct labor hours, then the estimated direct labor hours at the beginning of the year used in the predetermined overhead rate must have been ____ hours. ANSWERarrow_forwardCompute the company's plantwide predetermined overhead rate for the yeararrow_forward

- Suppose in its 2022 annual report that Burger Haven Corporation reports beginning total assets of $32.80 billion, ending total assets of $35.40 billion, net sales of $25.60 billion, and net income of $5.20 billion. What is Burger Haven's return on assets and asset turnover? Need helparrow_forwardSuppose in its 2022 annual report that Burger Haven Corporation reports beginning total assets of $32.80 billion, ending total assets of $35.40 billion, net sales of $25.60 billion, and net income of $5.20 billion. What is Burger Haven's return on assets and asset turnover? Accurate Answerarrow_forwardAccurate answerarrow_forward

- The current ratio of a company is 5:1, and its acid-test ratio is 2:1. If the inventories and prepaid items amount to $450,000, what is the amount of current liabilities? Answer this financial accounting problem. Ansarrow_forwardCullumber Company uses a job order cast system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,000, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102.480 and $132,720, respectively. The following additional events occurred during the month. 1 Purchased additional raw materials of $75,600 on account. 2 Incurred factory labor costs of $58,800. 3 Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardNet sales total $525,000. Beginning and ending accounts receivable are $42,000 and $46,000, respectively. Calculate days' sales in receivables.arrow_forward

- During 2015, the assets of Inspiring Sky increased by $45,000, and the liabilities increased by $20,000. If the owner's equity in Inspiring Sky is $100,000 at the end of 2015, the owner's equity at the beginning of 2015 must have been __. General Accountarrow_forwardDuring 2015, the assets of Inspiring Sky increased by $45,000, and the liabilities increased by $20,000. If the owner's equity in Inspiring Sky is $100,000 at the end of 2015, the owner's equity at the beginning of 2015 must have been __.arrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning