Concept explainers

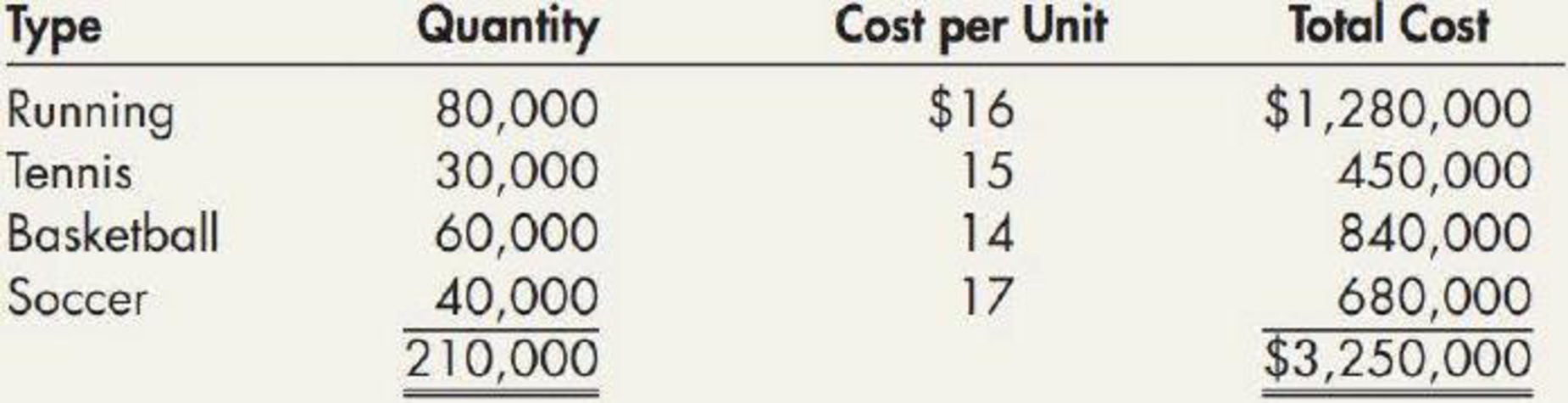

Inventory Pools Stone Shoe Company adopted dollar-value LIFO on January 1, 2019. The company produces four products and uses a single inventory pool. The company’s beginning inventory consists of the following:

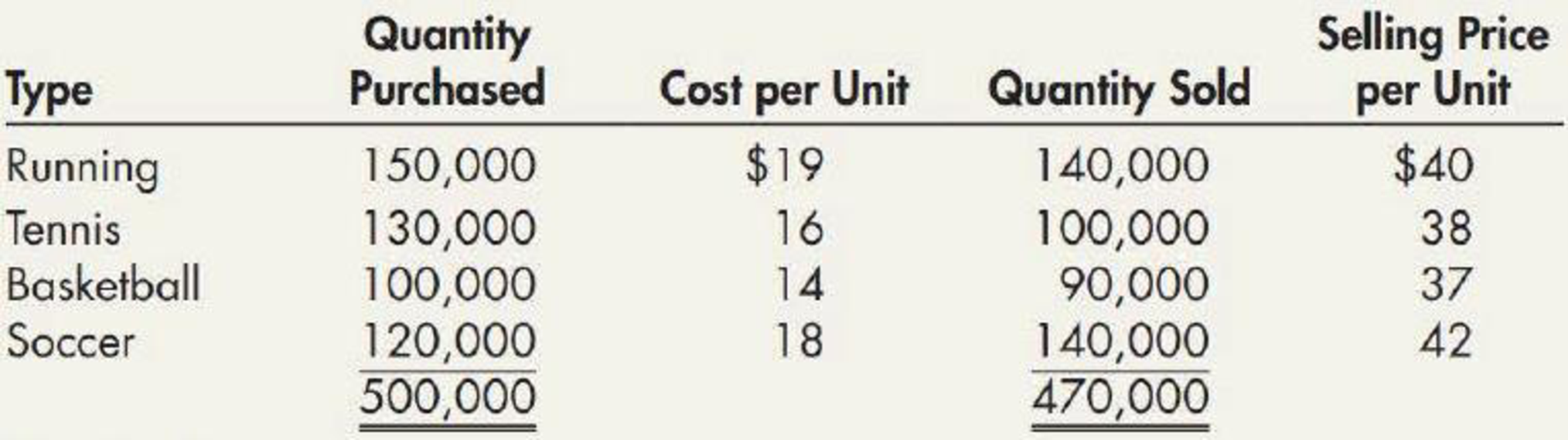

During 2019, the company has the following purchases and sales:

Required:

- 1. Compute the dollar-value LIFO cost of the ending inventory. Round the cost index to 4 decimal places and all other amounts to the nearest dollar.

- 2. Next Level By how much would the company’s gross profit differ if it had used four pools instead of a single pool?

1.

Calculate the dollar value LIFO cost of the ending inventory.

Explanation of Solution

Dollar-value LIFO method: In this method, the valuation of inventory is calculated on the monetary value of units instead of quantity of units held. The dollar value LIFO method uses the cost indexes to convert the current cost of inventory to the base year cost.

Calculate the dollar value of LIFO ending inventory:

Therefore, the dollar value LIFO cost of ending inventory is $3,699,209.

Working note 1: Determine the ending inventory costs for previous year (2018) and current year (2019):

| Particulars | Product R | Product T | Product B | Product S |

| Beginning inventory (in units) | 80,000 | 30,000 | 60,000 | 40,000 |

| Add: Purchases (in units) | 150,000 | 130,000 | 100,000 | 120,000 |

| 230,000 | 160,000 | 160,000 | 160,000 | |

| Less: Quantity sold (in units) | (140,000) | (100,000) | (90,000) | (140,000) |

| Ending inventory (in units) (a) | 90,000 | 60,000 | 70,000 | 20,000 |

| Cost per unit for Year 2018 (b) | $16 | $15 | $14 | $17 |

| Ending inventory for previous year costs | $1,440,000 | $900,000 | $980,000 | $340,000 |

| Cost per unit for Year 2019 (d) | $19 | $16 | $14 | $18 |

| Ending inventory for current year costs | $1,710,000 | $960,000 | $980,000 | $360,000 |

Table (1)

Working note 2: Determine the cost index:

Working note 3: Calculate the costs of inventory at base year:

Given: The current cost of inventory of 2019 is $4,010,000 and the cost index for 2018 is 100. The cost index for 2019 is 109.5628.

Working note 4: Calculate the increase in relevant current costs:

The total cost at the beginning of year is $3,250,000. The change in base costs is determined by deducting ending inventory at base year cost from total cost at the beginning of year.

2.

Compute the difference in amount of company’s gross profit if it had used four pools rather than single pool.

Explanation of Solution

If the company had used four cost pools rather than one, there would have been a LIFO liquidation profit on the Product S of $20,000

Want to see more full solutions like this?

Chapter 7 Solutions

Intermediate Accounting: Reporting And Analysis

- I am trying to find the accurate solution to this financial accounting problem with the correct explanation.arrow_forward19. What does a classified balance sheet show?A. Net cash from operationsB. Revenue by categoryC. Assets and liabilities in current and long-term sectionsD. Owners' drawingsarrow_forwardPlease explain the correct approach for solving this financial accounting question.arrow_forward

- Book value of an asset equals:A. Market valueB. Cost minus accumulated depreciationC. Net incomeD. Sale pricearrow_forwardPlease provide the correct answer to this financial accounting problem using accurate calculations.arrow_forwardBook value of an asset equals:A. Market valueB. Cost minus accumulated depreciationC. Net incomeD. Sale pricearrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College