Concept explainers

Least-Square. Regression; Scattergraph; Comparison of Activity Bases

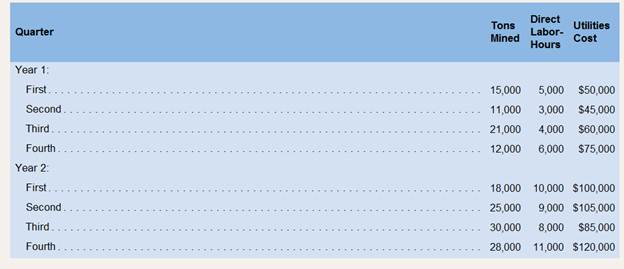

The Hard Rock Mining Company is developing cost formulas for management planning and decision-making purposes. The company’s cost analyst has concluded that utilities cost is a mixed cost, and he is attempting to find a base that correlates with the cost. The controller has suggested that tons mined might be a good base to use in developing a cost formula .The production superintendent disagrees, she thinks that direct labor-hours would be a better base. The cost analyst has decided to try both bases and has assembled the following information:

Required:

1. Using torn mined as the independent variable, prepare a scattergraph that plots tons mined on the horizontal axis and utilities cost on the vertical axis Using the least-squares regression method, estimate the variable utilities cost per ton mined and the total fixed utilities cost per quarter. Express these estimates in the form Y = a + bX.

2. Using direct labor-hours as the independent variable, prepare a scattergraph that plots direct labor-hours on the horizontal axis and utilities cost on the vertical axis. Using the least-squares regression method, estimate the variable utilities cost per direct labor-hour and the total fixed utilities cost per quarter. Express these estimates in the form Y = a+ bX.

3. Would you recommend that the company use tons mined or direct labor-hours as a base for planning utilities cost?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Introduction To Managerial Accounting

- Which of the following is a reason a company would implement activity-based costing? A. The cost of record keeping is high. B. The additional data obtained through traditional allocation are not worth the cost. C. They want to improve the data on which decisions are made. D. A company only has one cost driver.arrow_forwardBecause of high production-changeover time and costs, a director of manufacturing must convince management that a proposed manufacturing method reduces costs before the new method can be implemented. The current production method operates with a mean cost of $220 per hour. A research study will measure the cost of the new method over a sample production period. Develop the null and alternative hypotheses most appropriate for this study. Comment on the conclusion when H0 cannot be rejected. Comment on the conclusion when H0 can be rejected.arrow_forwardExplain how a plantwide overhead rate, using a unit-based driver, can produce distorted product costs. In your answer, identify two major factors that impair the ability of plantwide rates to assign cost accurately.arrow_forward

- What challenges might managers at Neuro Instruments encounter in achieving the target cost? How might they overcome these challenges?arrow_forwardThe manager of the manufacturing unit of a company is responsibie for the costs of the manufacturing unit. The president is in the process of deciding whether to evaluate the manager af the manutacturing unit by the average cast per unit or the vartable cost per unit Quality and umely delivery would be used in coruncton with the cost meesure lo rewerd the maneger. Required: a What problems are associated with using the average cost per unit as a pertormance measure? b. What problems are associated with using the variable cost per unit as a performance measure?arrow_forwardYou have been asked by management to classify the costs associated with the start-up of this new product line. Using the cost information provided below, classify each cost under the appropriate heading according to the chart provided below. Note that some costs may be classified under more than one heading. For example, a cost may be a fixed cost and a period cost. Name of cost Variable Cost Fixed Cost Direct Materials Direct Labor Factory Overhead Period Cost Prime Cost Conversion Cost Carlson “New Product” Cost Information Cost Amount Cost Type Depreciation on Building (annual) $ 10,000 Direct Labor Cost (per unit) $ 75 Direct Materials Cost (per unit) $ 60 Factory Utilities (per unit) $ 8 Indirect Materials (per unit) $ 4 Interest on Investments (annual) $3,000 Machinery Rental (monthly) $ 6,000 Marketing (annual) $ 35,000 Rent from Tenant (annual) $40,000…arrow_forward

- The following data have been extracted from the records of Puzzle Incorporated: Production level, in units Variable costs Fixed costs Mixed costs Total costs Required A Required B Required: a. Calculate the missing costs. b. Calculate the cost formula for mixed cost using the high-low method. c. Calculate the total cost that would be incurred for the production of 12,880 units. d. Identify the two key cost behavior assumptions made in the calculation of your answer to part c. Required C Production level, in units Variable costs Fixed costs Mixed costs Total costs Complete this question by entering your answers in the tabs below. Calculate the missing costs. Note: Do not round intermediate calculations. February 9,200 $ 19,320 ? 16,312 $ 71,532 February 9,200 $ 19,320 $ 2 X 16,312 $ 71,532 Required D August August 20, 240 $? 35,900 ? $ 106,970 Answer is not complete. 20,240 34,255 35,900 52,475 $ 106,970arrow_forwardAs a start-up / ‘new’ manufacturer, one of your tasks as the Operations Manager is to identify the behaviour of manufacturing costs to develop a production cost budget. You know three methods can be used to identify cost behaviour from past data, but past data are not available because this is a start-up. Identify and compare the three known methods of measuring cost behaviour.arrow_forwardGreen Shade manufactures insulated windows. The firm’s repair and maintenance (R&M) cost is mixed and varies most directly with machine hours worked. The following data (on the attached picture) have been gathered from recent operations: a. Use the high–low method to estimate a cost formula for repairs and maintenance. b. Use least squares regression to estimate a cost formula for repairs and maintenance. c. Does the answer to part (a) or to part (b) provide the better estimate of the relation ship between repairs and maintenance costs and machine hours? Why?arrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning