Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 14F15

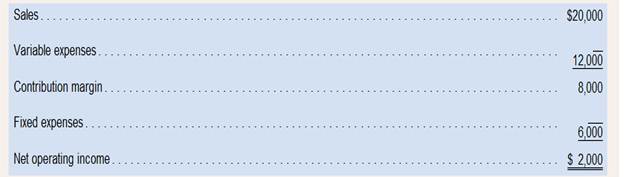

Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units):

Required:

(Answer each question independently and always refer to the original data unless instructed otherwise.)

Assume that the amounts of the company’s total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $6000 and the total fixed expenses are $12000. Under this scenario and assuming that total sales remain the same, what is the degree of operating leverage?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Required information

[The following information applies to the questions displayed below.]

Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the

relevant range of production is 500 units to 1,500 units):

Sales

Variable expenses

Contribution margin

Fixed expenses

$ 15,000

9,000

6,000

3,120

$ 2,880

Net operating income

and total fixed expenses were reversed. In other words, assume

14. Assume that the amounts of the company's total variable expe

that the total variable expenses are $3,120 and the total fixed expenses are $9,000. Under this scenario and assuming that total sales

remain the same, what is the degree of operating leverage? (Round your answer to 2 decimal places.)

Degree of operating leverage

Oslo Company prepared the following contribution format income statement based on a sales volume of

1,000 units (the relevant range of production is 500 units to 1,500 units):

Sales

Variable expenses

Contribution margin

Fixed expenses

Net operating income

$ 20,000

12,000

8,000

6,000

$ 2,000

Foundational 6-14 (Static)

14. Assume that the amounts of the company's total variable expenses and total fixed expenses were reversed. In other

words, assume that the total variable expenses are $6,000 and the total fixed expenses are $12,000. Under this scenario

and assuming that total sales remain the same, what is the degree of operating leverage?

Degree of operating leverage

Required information

[The following information applies to the questions displayed below]

Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the

relevant range of production is 500 units to 1,500 units):

$ 10,000

5,500

4,500

2,250

$ 2,250

Sales

Variable expenses

Contribution margin

Fixed expenses

Net operating income

15. Assume that the amounts of the company's total variable expenses and total fixed expenses were reversed. In other words,

assume that the total variable expenses are $2,250 and the total fixed expenses are $5,500. Given this scenario and assuming that

total sales remain the same. Using the degree of calculated operating leverage, what is the estimated percent increase in net

operating income of a 5% increase in sales? (Round your intermediate calculations and final answer to 2 decimal places.)

Increase in net operating income

Chapter 6 Solutions

Introduction To Managerial Accounting

Ch. 6.A - The Cheyenne Hotel in Big Sky, Montana, has...Ch. 6.A - Least-Squares Regression LOS11 Bargain Rental Car...Ch. 6.A - Prob. 3ECh. 6.A - Archer Company is a wholesaler of custom-built...Ch. 6.A - George Caloz&Freres, located in Grenchen,...Ch. 6.A - Least-Square. Regression; Scattergraph; Comparison...Ch. 6.A - Cost Behaviour; High4æw Method; Contribution...Ch. 6.A - Nova Company’s total overhead cost at various...Ch. 6.A - High-Low Method; Contribution Format Income...Ch. 6.A - Least-Squares Regression Method; Scattergraph;...

Ch. 6.A - Mixed Cost Analysis and the Relevant Range LOS-10...Ch. 6.A - Prob. 12PCh. 6 - What is the meaning of contribution margin ratio?...Ch. 6 - Prob. 2QCh. 6 - In all respects, Company A and Company B are...Ch. 6 - What is the meaning of operating leverage?Ch. 6 - What is the meaning of break-even point?Ch. 6 - In response to a request from your immediate...Ch. 6 - What is the meaning of margin of safety?Ch. 6 - Prob. 8QCh. 6 - Explain how a shift in the sales mix could result...Ch. 6 - The Excel worksheet form that appears be1o is to...Ch. 6 - The Excel work sheet from that appears below is to...Ch. 6 - Prob. 3AECh. 6 - The Excel worksheet form that appears be1o is to...Ch. 6 - Prob. 5AECh. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Prob. 11F15Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - The Effect of Cha noes ¡n Activity on Net...Ch. 6 - Prob. 2ECh. 6 - Prepare a Profit Graph L062 Jaffre Enterprises...Ch. 6 - Computing and Using the CM Ratio L063 Last month...Ch. 6 - Changes in Venable Costs, Fixed Costs, Selling...Ch. 6 - Prob. 6ECh. 6 - Lin Corporation has a single product 1ose selling...Ch. 6 - Compute the Margin of Safety LO6-7 Molander...Ch. 6 - Compute and Use the Degree 01 Operating Leverage...Ch. 6 - Prob. 10ECh. 6 - Missing Data; Basic CVP Concepts L061, L069 Fill...Ch. 6 - Prob. 12ECh. 6 - Change in selling price, Sales Volume, Variable...Ch. 6 - Prob. 14ECh. 6 - Operating Leverage 1061. 1068 Magic Realm, Inc.,...Ch. 6 - Prob. 16ECh. 6 - Break-Even and Target Profit Analysis 1064, 1066,...Ch. 6 - Break-Even and Target Profit Analysis; Margin of...Ch. 6 - Prob. 19PCh. 6 - Prob. 20PCh. 6 - Prob. 21PCh. 6 - Prob. 22PCh. 6 - CVP Applications; Contribution Margin Ratio:...Ch. 6 - Break-Even and Target Profit Analysis LO6-6, L066...Ch. 6 - Prob. 25PCh. 6 - Prob. 26PCh. 6 - Prob. 27PCh. 6 - Sales Mix; Commission Structure; Multiproduct...Ch. 6 - Changes in Cost Structure; Break-Even Analysis;...Ch. 6 - Graphing; Incremental Analysis; Operating Leverage...Ch. 6 - Interpretive Questions on the CVP Graph L062, L065...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 70,000 Variable expenses 38,500 Contribution margin 31,500 Fixed expenses 23,310 Net operating income $ 8,190 1. What is the contribution margin per unit? (Round your answer to 2 decimal places.) 2. What is the contribution margin ratio? 3. What is the variable expense ratio? 4. If sales increase to 1,001 units, what would be the increase in net operating income?arrow_forwardDhapaarrow_forwardOslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 24,200 Variable expenses 13,400 Contribution margin 10,800 Fixed expenses 7,668 Net operating income $ 3,132 Required: If sales declined to 900 units, what would be the net operating income? (Do not round intermediate calculations.)arrow_forward

- Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 25,000 Variable expenses 17,500 Contribution margin 7,500 Fixed expenses 4,200 Net operating income $ 3,300 14. Assume that the amounts of the company’s total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $4,200 and the total fixed expenses are $17,500. Under this scenario and assuming that total sales remain the same, what is the degree of operating leverage? (Round your answer to 2 decimal places.) 15. Assume that the amounts of the company’s total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $4,200 and the total fixed expenses are $17,500. Using the degree of operating leverage, what is the estimated percent increase in…arrow_forwardOslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 30,000 Variable expenses 16,500 Contribution margin 13,500 Fixed expenses 7,830 Net operating income $ 5,670 14. Assume that the amounts of the company’s total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $7,830 and the total fixed expenses are $16,500. Under this scenario and assuming that total sales remain the same, what is the degree of operating leverage? (Round your answer to 2 decimal places.)arrow_forwardThe Mariachi Company prepared the following contribution format income statement based on a sales volume of 1,200 units (the relevant range of production is 500 units to 2,000 units): Sales 26,400Variable expenses 18,000Contribution margin 8,400Fixed expenses 6,200Net operating income 2,200 What is the break-even point in dollar sales?arrow_forward

- The following information applies to the questions displayed below.] Baron Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 80,000 Variable expenses 52,000 Contribution margin 28,000 Fixed expenses 21,840 Net operating income $ 6,160 Please donot provide solution in image format provide solution in step by step format and asaparrow_forwardOslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses $15,000 9,000 6,000 3,120 $ 2,880 Net operating income Required: 1. What is the contribution margin per unit? (Round your answer to 2 decimal places.) Contribution margin per unitarrow_forwardOslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 50,000 Variable expenses 27,500 Contribution margin 22,500 Fixed expenses 14,850 Net operating income $ 7,650 Required: 1. What is the contribution margin per unit? (Round your answer to 2 decimal places.)arrow_forward

- Gadubhaiarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) 58 Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ Increase in net operating income $ 24,500 13,500 11,000 7,700 3,300 Required: If sales increased to 1,001 units, what would be the increase in net operating income? (Round your answer to 2 decimal places.)arrow_forwardThe following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 60,000 Variable expenses 39,000 Contribution margin 21,000 Fixed expenses 14,700 Net operating income $ 6,300 10. How many units must be sold to achieve a target profit of $12,600? 11. What is the margin of safety in dollars? What is the margin of safety percentage? 12. What is the degree of operating leverage? (Round your answer to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY