Concept explainers

Missing Data; Basic CVP Concepts L06−1, L06−9

Fill in the missing amounts in each of the eight case situations below. Each case is independent of the others. (Hint: One way to find the missing amounts would be to prepare a contribution format income statement for each case, enter the known data, and then compute the missing items.)

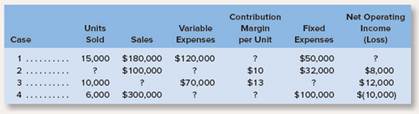

a. Assume that only one product is being sold in each of the four following case situations:

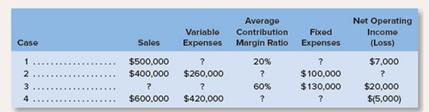

b. Assume that more than one product is being sold in each of the four following case situations:

Cost volume profit analysis: Cost volume profit analysis measures the effect on income of a company with the alteration of cost and volume of sales.

The missing amount in the table.

Answer to Problem 11E

Solution:

a) Assuming that only one product is being sold in each of the following case situations:

| Case | Units Sold | Sales | Variable

Expenses | Contribution

Margin per Unit | Fixed Expenses | Net Operating Income(loss) |

| 1 | 15,000 | $180,000 | $120,000 | $4 | $50,000 | $10,000 |

| 2 | 4,000 | $100,000 | $60,000 | $10 | $32,000 | $8,000 |

| 3 | 10,000 | $200,000 | $70,000 | $13 | $118,000 | $12,000 |

| 4 | 6,000 | $300,000 | $210,000 | $15 | $100,000 | ($10,000) |

Case 1

| Contribution format income statement | ||

| Total | Per Unit | |

| Sales (15,000 units) | $180,000 | $12.00 |

| Variable expenses | $120,000 | $8.00 |

| Contribution Margin | $60,000 | $4.00 |

| Fixed expenses | $50,000 | |

| Net operating income | $10,000 | |

Case 2

| Contribution format income statement | ||

| Total | Per Unit | |

| Sales (4,000 units) | $100,000 | $25.00 |

| Variable expenses | $60,000 | $15.00 |

| Contribution Margin | $40,000 | $10.00 |

| Fixed expenses | $32,000 | |

| Net operating income | $8,000 | |

Case 3

| Contribution format income statement | ||

| Total | Per Unit | |

| Sales (10,000 units) | $200,000 | $20.00 |

| Variable expenses | $70,000 | $7.00 |

| Contribution Margin | $130,000 | $13.00 |

| Fixed expenses | $118,000 | |

| Net operating income | $12,000 | |

Case 4

| Contribution format income statement | ||

| Total | Per Unit | |

| Sales (6,000 units) | $300,000 | $50.00 |

| Variable expenses | $210,000 | $35.00 |

| Contribution Margin | $90,000 | $15.00 |

| Fixed expenses | $100,000 | |

| Net operating income | ($10,000) | |

b) Assuming that more than one product is being sold in each of the four case situations:

| Case | Sales | Variable Expenses | Average

Contribution Margin Ratio | Fixed

Expenses | Net Operating

Income (loss) |

| 1 | $500,000 | $400,000 | 20% | $93,000 | $7,000 |

| 2 | $400,000 | $260,000 | 35% | $100,000 | $40,000 |

| 3 | $250,000 | $100,000 | 60% | $130,000 | $20,000 |

| 4 | $600,000 | $420,000 | 30% | $185,000 | ($5,000) |

Case 1

| Contribution format income statement | |

| Amounts | |

| Sales | $500,000 |

| Variable expenses | $400,000 |

| Contribution Margin | $100,000 |

| Fixed expenses | $93,000 |

| Net operating income | $7,000 |

| Contribution format income statement | |

| Amounts | |

| Sales | $400,000 |

| Variable expenses | $260,000 |

| Contribution Margin | $140,000 |

| Fixed expenses | $100,000 |

| Net operating income | $40,000 |

Case 3

| Contribution format income statement | |

| Amounts | |

| Sales | $250,000 |

| Variable expenses | $100,000 |

| Contribution Margin | $150,000 |

| Fixed expenses | $130,000 |

| Net operating income | $20,000 |

Case 4

| Contribution format income statement | |

| Amounts | |

| Sales | $600,000 |

| Variable expenses | $420,000 |

| Contribution Margin | $180,000 |

| Fixed expenses | $185,000 |

| Net operating income | ($5,000) |

Explanation of Solution

A contribution margin is calculated by deducting the variable expenses from the sales revenue. So, if the variable expense is missing, the contribution margin is deducted from the sales revenue and goes same in case of units. The net operating income is calculated by deducting the fixed expenses from the contribution margin. So, if the fixed expenses are missing, the operating income is deducted from the contribution margin. The contribution margin ratio is calculated by dividing the contribution margin by sales revenue. So, if the sales revenue is missing, it can be ascertained by dividing the contribution margin by the contribution margin ratio and if the contribution margin is missing, it is calculated by multiplying the contribution margin with the contribution margin ratio.

Given: a) Assume that only one product is being sold in each of the following case situations:

| Case | Units Sold | Sales | Variable

Expenses | Contribution

Margin per Unit | Fixed Expenses | Net Operating Income(loss) |

| 1 | 15,000 | $180,000 | $120,000 | ? | $50,000 | ? |

| 2 | ? | $100,000 | ? | $10 | $32,000 | $8,000 |

| 3 | 10,000 | ? | $70,000 | $13 | ? | $12,000 |

| 4 | 6,000 | $300,000 | ? | ? | $100,000 | ($10,000) |

b) Assume that more than one product is being sold in each of the four case situations:

| Case | Sales | Variable Expenses | Average

Contribution Margin Ratio | Fixed

Expenses | Net Operating

Income (loss) |

| 1 | $500,000 | ? | 20% | ? | $7,000 |

| 2 | $400,000 | $260,000 | ? | $100,000 | ? |

| 3 | ? | ? | 60% | $130,000 | $20,000 |

| 4 | $600,000 | $420,000 | ? | ? | ($5,000) |

The cost volume profit analysis aims determining an outcome of changes in the various variables of operations. A cost is the expenses incurred on the products which are being sold and the volume is the quantity of the products which is going to be sold. The profit is the difference between the cost incurred and sales revenue of a company. An analysis of cost volume profit helps in predicting or forecasting the various consequences of various decisions.

Want to see more full solutions like this?

Chapter 6 Solutions

Introduction To Managerial Accounting

Additional Business Textbook Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Financial Accounting, Student Value Edition (5th Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Fundamentals of Management (10th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

- In a brief essay format, explain the importance of a post-closing trial balance in the accounting process. Purpose: Explain why a post-closing trial balance is prepared and what specific purposes it serves in financial accounting. Timing: Describe when in the accounting cycle a post-closing trial balance is typically prepared and why this timing is essential. Content: Discuss the types of accounts that appear on a post-closing trial balance and why certain accounts are included while others are excluded. Comparison: Explain how a post-closing trial balance differs from a regular trial balance and what additional information it provides to a business.arrow_forwardFind outarrow_forwardwhat are three threats to an accountants and auditor's independence?arrow_forward

- Daud Company has an overhead application rate of 172% and allocates overhead based on direct material cost. During the current period, direct labor cost is $59,000 and direct materials used cost is $97,000. Determine the amount of overhead Daud Company should record in the current period.arrow_forwardIn your point of view, what are the main steps involved in the accounting cycle, and how do they contribute to the overall financial management of a business? How can an understanding of the accounting cycle help business owners make more informed decisions?arrow_forwardExplain the difference between the accrual basis and cash basis of accounting. What are the advantages and disadvantages of each method?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College