Concept explainers

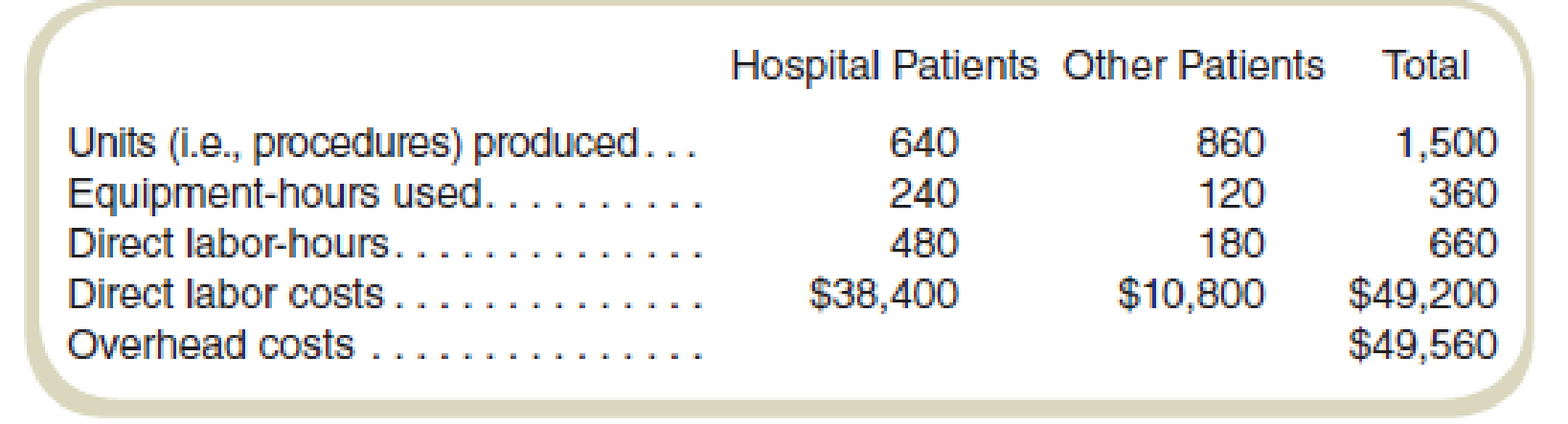

Owl-Eye Radiologists (OR) does various types of diagnostic imaging. Radiologists perform tests using sophisticated equipment. OR’s management wants to compute the costs of performing tests for two different types of patients: those who are hospitalized (including those in emergency rooms) and those who are not hospitalized but are referred by physicians. The data for June for the two categories of patients follow:

The accountant first assigns

Required

- a. Compute the predetermined overhead rates assuming that Owl-Eye Radiologists uses equipment-hours to allocate equipment-related overhead costs and labor-hours to allocate labor-related overhead costs.

- b. Compute the total costs of production and the cost per unit for each of the two types of patients undergoing tests in June.

a.

Calculate the predetermined overhead rates using equipment-hours for the allocation of equipment related overhead costs and labor-hours to allocate labor-related overhead costs.

Answer to Problem 56P

The Cost per unit is $46 for the overhead rates when using equipment-hours for allocation.

The Cost per unit is $50 for the overhead rates when using labor-hours for allocation.

Explanation of Solution

Predetermined overhead rate:

The predetermined overhead rate is the rate computed for applying manufacturing overheads to the work-in-process inventory. This rate can be computed by dividing the total amount of manufacturing overheads by the base of allocation.

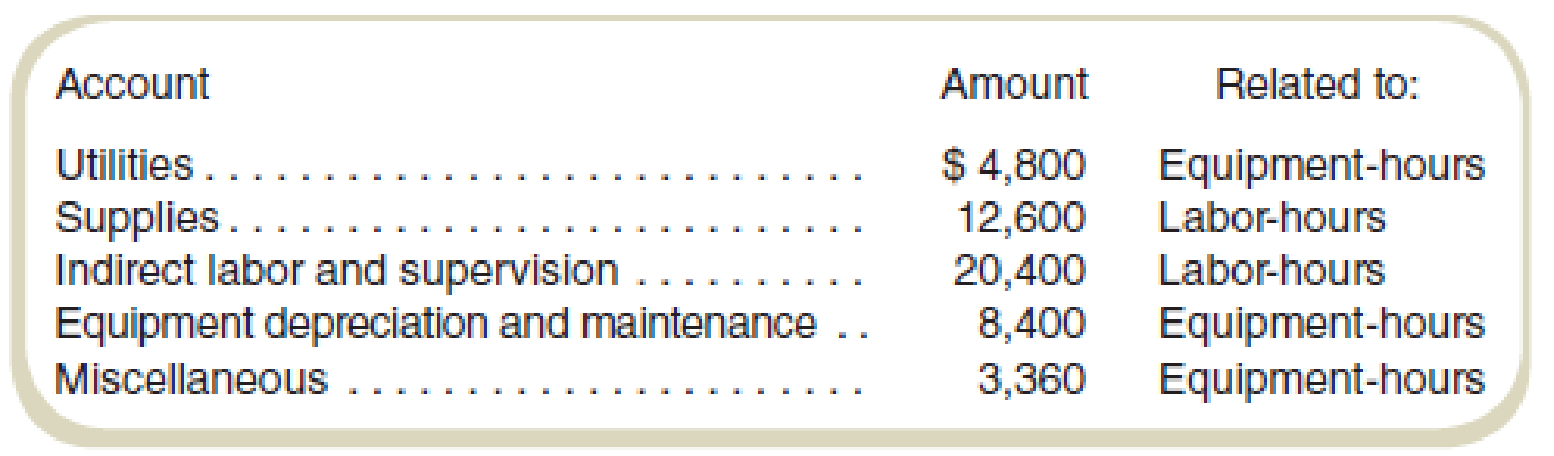

Analysis of overhead accounts by the cost accountant is as follows:

| Account | Amount | Related to: |

| Utilities | $ 4,800 | Equipment hours |

| Supplies | 12,600 | Labor-hours |

| Indirect labor and supervision | 20,400 | Labor-hours |

| Equipment depreciation and maintenance | 8,400 | Equipment hours |

| Miscellaneous | 3,360 | Equipment hours |

Compute equipment-hours related predetermined rate:

Hence, the equipment-hours related predetermined rate is $46.

Compute materials cost related predetermined rate:

Thus, the labor-hours related predetermined rate is $50.

b.

Compute the total costs of production and the cost per unit for each of the two types of patients undergoing tests in June.

Answer to Problem 56P

For hospital patients:

Total cost: $73,440

Cost per unit: $115

For other patients:

Total cost: $25,320

Cost per unit: $29

Explanation of Solution

Product cost:

Product cost includes all the costs that are attributed to the production of the product. All the money that has spent on the process of production or purchase of the product is known as product cost.

Product cost per unit:

The product cost per unit is determined by dividing the total of variable and fixed cost with the total number of units.

Compute the total cost of hospital patients:

Compute total cost of other patients:

Thus, the value of total cost for hospital patients and other patients are $73,440 and $25,320 respectively.

Compute cost per unit for product hospital patients:

Compute cost per unit for the product of other patients:

Working note 1:

Compute equipment hours related cost for hospital patients:

Working note 2:

Compute labor hours related cost for hospital patients:

Working note 3:

Compute equipment hours related cost for other patients:

Working note 4:

Compute labor hours related cost for other patients:

Want to see more full solutions like this?

Chapter 6 Solutions

COST ACCOUNTING W/CONNECT

- On July 31, Harrison Company had an Accounts Receivable balance of $25,400. During the month of August, total credits to Accounts Receivable were $68,000 from customer payments. The August 31 Accounts Receivable balance was $18,500. What was the amount of credit sales during August? A) $68,000 B) $39,100 C) $61,100 D) $75,900 E) $7,900arrow_forwardAccountingarrow_forwardA company can sell all the units it can produce of either Product X or Product Y but not both. Product X has a unit contribution margin of $18 and takes four machine hours to make, while Product Y has a unit contribution margin of $25 and takes five machine hours to make. If there are 6,000 machine hours available to manufacture a product, income will be: A. $6,000 more if Product X is made B. $6,000 less if Product Y is made C. $6,000 less if Product X is made D. the same if either product is made. Helparrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College