Concept explainers

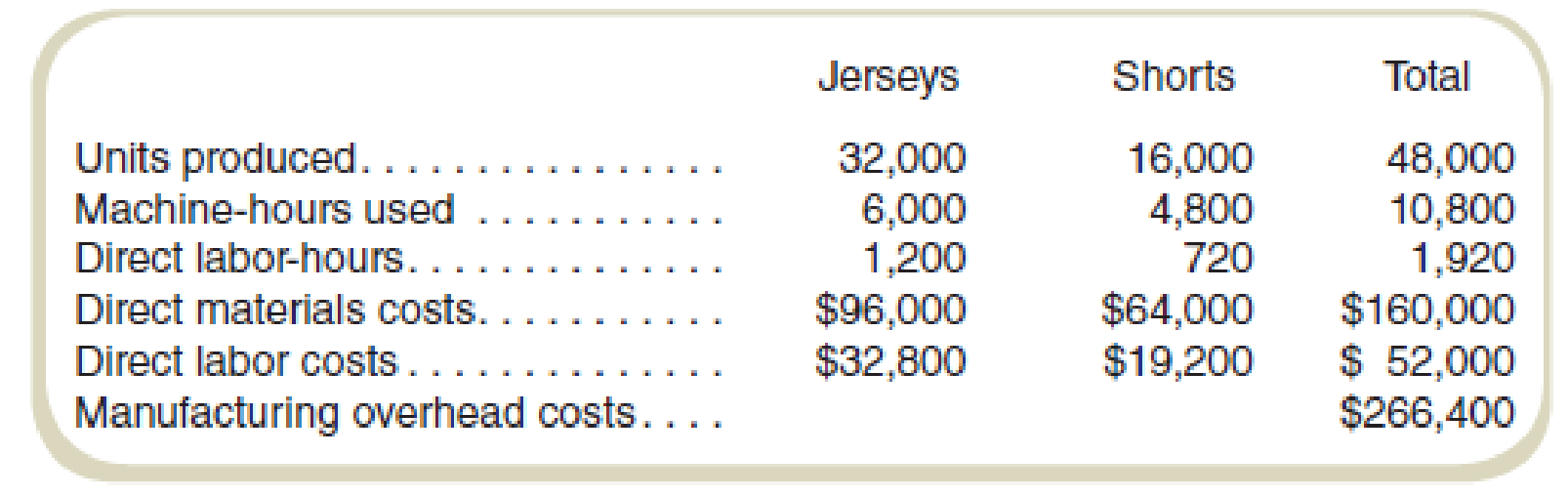

Donovan & Parents produces soccer shorts and jerseys for youth leagues. Most of the production is done by machine. Data on operations and costs for March follow:

Management asks the firm’s cost accountant to compute product costs. The accountant first assigns

Required

- a. Compute the predetermined overhead rates assuming that Donovan uses machine-hours to allocate machine-related overhead costs and materials costs to allocate materials-related overhead costs.

- b. Compute the total costs of production and the cost per unit for each of the two products for March.

a.

Find the predetermined overhead rates using machine-hours and materials costs for the allocation.

Answer to Problem 55P

The value of machine related predetermined overhead rate is $18.

The value of materials related predetermined overhead rate is 45% of the cost.

Explanation of Solution

Predetermined overhead rate:

The predetermined overhead rate is the rate computed for applying manufacturing overheads to the work-in-process inventory. This rate can be computed by dividing the total amount of manufacturing overheads by the base of allocation.

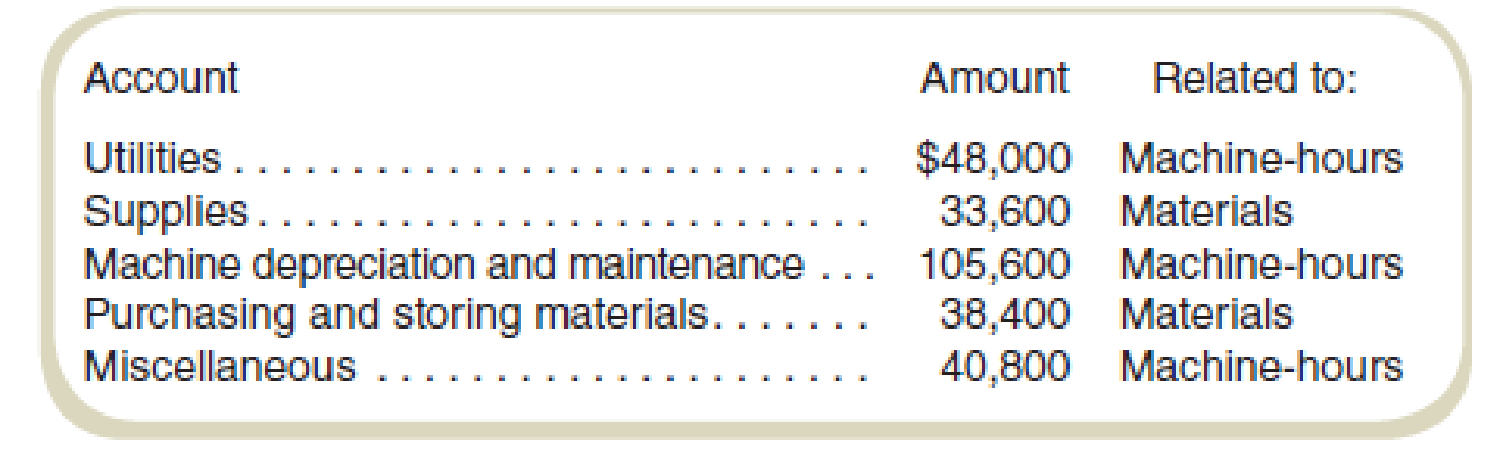

Analysis of overhead accounts by the cost accountant is as follows:

| Account | Amount | Related to: |

| Utilities | $ 48,000.00 | Machine-hours |

| Supplies | $ 33,600.00 | Materials |

| Machine depreciation and maintenance | $ 105,600.00 | Machine-hours |

| Purchasing and storing materials | $ 38,400.00 | Materials |

| Miscellaneous | $ 40,800.00 | Machine-hours |

Table (1)

Compute machine-hours related predetermined rate:

Hence, the machine-hours related predetermined rate is $18.

Compute materials cost related predetermined rate:

Thus, the materials cost related predetermined rate is 45% of the cost.

b.

Calculate the total costs of production and the cost per unit for the two products.

Answer to Problem 55P

The total cost of product J is $280,000 and for product S is $198,400.

Cost per unit of product J is $8.75 and for product S is $12.4.

Explanation of Solution

Compute total cost of product J:

Compute total cost of product S:

Thus, the value of total cost for the product J and product S are $198,400 and $280,000 respectively.

Compute cost per unit for product J:

Compute cost per unit for product S:

Thus, the cost per unit value for the product J and product S are $8.75 and $12.4 respectively.

Working note 1:

Compute machine related cost for product J:

Working note 2:

Computation materials related cost for product J:

Working note 3:

Compute machine related cost for product S:

Working note 4:

Computation materials related cost for product S:

Want to see more full solutions like this?

Chapter 6 Solutions

COST ACCOUNTING W/CONNECT

- not use ai solution given answer General accountingarrow_forwardOn June 15, 2022, Dom Manufacturing had an employee, Daniel, who worked 5 hours on Job B-3 and 3.5 hours on general overhead activities. Daniel is paid $18 per hour. Overhead is applied based on $28 per direct labor hour. Additionally, on June 15, Job B-3 requisitioned and entered into production $275 of direct material. Daniel, while working on Job B-3, used $35 of an indirect material. Indirect material is included in the overhead application rate. Use this information to determine the total cost that should have been recorded in Work in Process for Job B-3 on June 15.arrow_forwardWhat is the operating cycle?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning