COST ACCOUNTING W/CONNECT

6th Edition

ISBN: 9781264022021

Author: LANEN

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 51E

Operations Costing

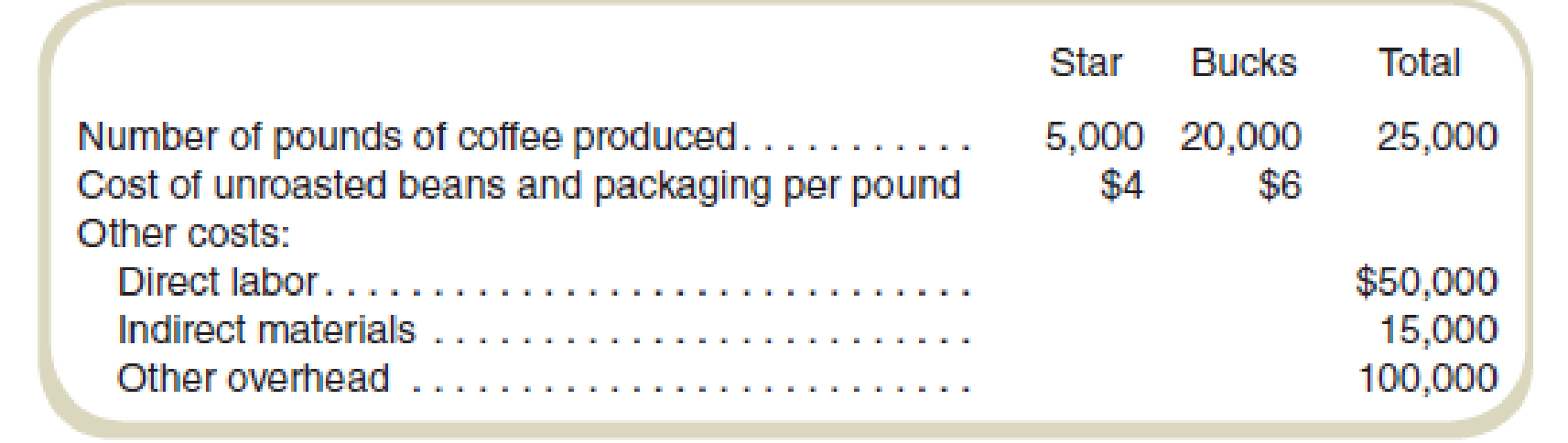

Organic Grounds produces two brands of coffee: Star and Bucks. The two coffees are produced in one factory using the same production process. The only difference between the two coffees is the cost of the unroasted coffee beans. The following data are available for February:

Required

Organic Grounds uses operations costing and assigns conversion costs based on the number of pounds of coffee produced. Compute the cost unit of each brand of coffee produced in February.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

General accounting

Crane Company sponsors a defined benefit pension plan. The corporation's actuary provides the following information about t

January 1, 2025 December 31, 2025

Vested benefit obligation $1,560 $2,010

Accumulated benefit obligation 2,010 2,820

Projected benefit obligation 2,260 3,630

Plan assets (fair value) 1,540 2,560

Settlement rate and expect rate of return 10%

Pension asset/liability 720 ?

Service cost for the year 2025 $400

Contributions (funding in 2025) 730

Benefits paid in 2025 200

(a)Compute the actual return on the plan assets in…

The volume variance for sales revenue was

Chapter 6 Solutions

COST ACCOUNTING W/CONNECT

Ch. 6 - How are product costing and cost allocation...Ch. 6 - What are the three criteria for the design of cost...Ch. 6 - Why are cost flow diagrams useful in describing...Ch. 6 - What are the characteristics of the following...Ch. 6 - How are job order, process, and operation costing...Ch. 6 - Describe the predetermined overhead rate. What is...Ch. 6 - Ideally, what does an allocation base reflect...Ch. 6 - What is two-stage cost allocation?Ch. 6 - What is continuous flow processing? Give at least...Ch. 6 - What is each component of the basic cost flow...

Ch. 6 - Cost allocation is arbitrary, so there is nothing...Ch. 6 - When designing a cost system, what points should...Ch. 6 - When is the basic cost flow model used? Give an...Ch. 6 - It is your first day at a new job and you talk...Ch. 6 - Rex Santos, a cost accountant, prepares a product...Ch. 6 - Prob. 16CADQCh. 6 - Identify a particular support function in a...Ch. 6 - Prob. 18CADQCh. 6 - Cost allocation bases are ideally based on a...Ch. 6 - Prob. 20CADQCh. 6 - Why might two companies in the same industry have...Ch. 6 - Is it possible for a company to have a two-stage...Ch. 6 - Your colleague says, If a company only has one...Ch. 6 - Basic Cost Flow Model Ralphs Mini-Mart store in...Ch. 6 - Basic Cost Flow Model Assume that the following...Ch. 6 - Basic Cost Flow Model Fill in the missing items...Ch. 6 - Prob. 27ECh. 6 - Prob. 28ECh. 6 - Basic Product Costing Enviro Corporation...Ch. 6 - Basic Product Costing Saras Sodas produces a...Ch. 6 - Basic Product Costing In June, Saras Sodas...Ch. 6 - Basic Product Costing In December, Saras Sodas...Ch. 6 - Basic Product Costing Big City Bank processes the...Ch. 6 - Basic Product Costing Lukes Lubricants starts...Ch. 6 - Basic Product Costing: Ethical Issues Old Tyme...Ch. 6 - Process Costing Sanchez Company produces paints....Ch. 6 - Process Costing Graham Petroleum produces oil. On...Ch. 6 - Process Costing Joplin Corporation produces syrups...Ch. 6 - Tiger Furnishings produces two models of cabinets...Ch. 6 - Refer to the data in Exercise 6-39. Compute the...Ch. 6 - Refer to the data in Exercise 6-39. Compute the...Ch. 6 - Refer to the data in Exercise 6-39. Draw the cost...Ch. 6 - Compute the predetermined overhead rate used to...Ch. 6 - Compute the predetermined overhead rate used to...Ch. 6 - Prob. 45ECh. 6 - Prob. 46ECh. 6 - The system is referred to as a two-stage cost...Ch. 6 - Channing uses a two-stage cost allocation system,...Ch. 6 - Operations Costing Howrley-David, Inc.,...Ch. 6 - Operations Costing S. Lee Enterprises produces two...Ch. 6 - Operations Costing Organic Grounds produces two...Ch. 6 - Refer to the data in Exercise 6-39. Compute the...Ch. 6 - Refer to the data in Exercise 6-39. Compute the...Ch. 6 - Refer to the data in Exercise 6-39. The president...Ch. 6 - Donovan Parents produces soccer shorts and...Ch. 6 - Owl-Eye Radiologists (OR) does various types of...Ch. 6 - Prob. 57PCh. 6 - Compute the predetermined overhead rate used to...Ch. 6 - Operations Costing Vermont Instruments...Ch. 6 - Operation Costing DiDonato Supplies manufactures...Ch. 6 - Account Analysis, Two-Stage Allocation, and...Ch. 6 - Product Costing, Cost Estimation, and Decision...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Carla Vista Companyhad a January 1 inventory of $306,000 when it adopted dollar-value LIFO. During the year, purchases were $1,770,000 and sales were $3,010,000. December 31 inventory at year-end prices was $371,520, and the price index was 108. What is Carla Vista Company's Gross Profit? 2,662,960 1,277,240 1,281,040 1,305,520arrow_forwardGeneral accountingarrow_forwardSanju has $12,500 of net long-term capital gain and $7,800 of net short-term capital loss. This nets out to a: (a) $4,700 net long-term loss (b) $4,700 net long-term gain (c) $4,700 net short-term gain (d) $4,700 short-term lossarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Incremental Analysis - Sell or Process Further; Author: Melissa Shirah;https://www.youtube.com/watch?v=7D6QnBt5KPk;License: Standard Youtube License