COST ACCOUNTING W/CONNECT

6th Edition

ISBN: 9781264022021

Author: LANEN

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 49E

Operations Costing

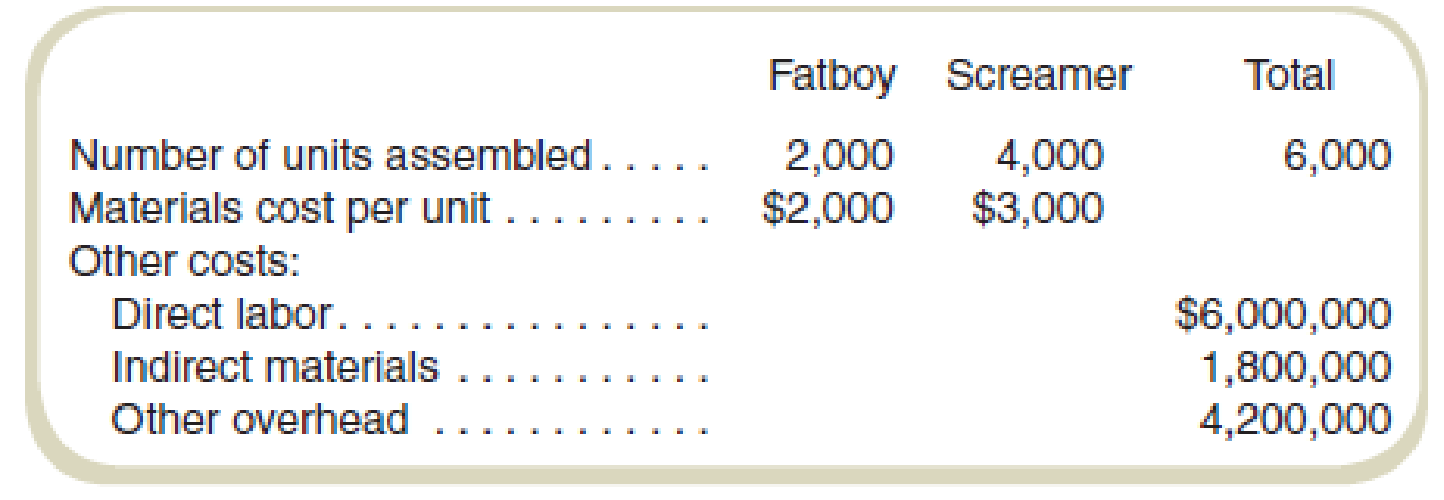

Howrley-David, Inc., manufactures two models of motorcycles: the Fatboy and the Screamer. Both models are assembled in the same plant and require the same assembling operations. The difference between the models is the cost of materials. The following data are available for August:

Required

Howrley-David uses operations costing and assigns conversion costs based on the number of units assembled. Compute the cost of each model assembled in August.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the return on assets?

Net cash from investing activities for the period was.

The company's price earnings ratio equal general accounting

Chapter 6 Solutions

COST ACCOUNTING W/CONNECT

Ch. 6 - How are product costing and cost allocation...Ch. 6 - What are the three criteria for the design of cost...Ch. 6 - Why are cost flow diagrams useful in describing...Ch. 6 - What are the characteristics of the following...Ch. 6 - How are job order, process, and operation costing...Ch. 6 - Describe the predetermined overhead rate. What is...Ch. 6 - Ideally, what does an allocation base reflect...Ch. 6 - What is two-stage cost allocation?Ch. 6 - What is continuous flow processing? Give at least...Ch. 6 - What is each component of the basic cost flow...

Ch. 6 - Cost allocation is arbitrary, so there is nothing...Ch. 6 - When designing a cost system, what points should...Ch. 6 - When is the basic cost flow model used? Give an...Ch. 6 - It is your first day at a new job and you talk...Ch. 6 - Rex Santos, a cost accountant, prepares a product...Ch. 6 - Prob. 16CADQCh. 6 - Identify a particular support function in a...Ch. 6 - Prob. 18CADQCh. 6 - Cost allocation bases are ideally based on a...Ch. 6 - Prob. 20CADQCh. 6 - Why might two companies in the same industry have...Ch. 6 - Is it possible for a company to have a two-stage...Ch. 6 - Your colleague says, If a company only has one...Ch. 6 - Basic Cost Flow Model Ralphs Mini-Mart store in...Ch. 6 - Basic Cost Flow Model Assume that the following...Ch. 6 - Basic Cost Flow Model Fill in the missing items...Ch. 6 - Prob. 27ECh. 6 - Prob. 28ECh. 6 - Basic Product Costing Enviro Corporation...Ch. 6 - Basic Product Costing Saras Sodas produces a...Ch. 6 - Basic Product Costing In June, Saras Sodas...Ch. 6 - Basic Product Costing In December, Saras Sodas...Ch. 6 - Basic Product Costing Big City Bank processes the...Ch. 6 - Basic Product Costing Lukes Lubricants starts...Ch. 6 - Basic Product Costing: Ethical Issues Old Tyme...Ch. 6 - Process Costing Sanchez Company produces paints....Ch. 6 - Process Costing Graham Petroleum produces oil. On...Ch. 6 - Process Costing Joplin Corporation produces syrups...Ch. 6 - Tiger Furnishings produces two models of cabinets...Ch. 6 - Refer to the data in Exercise 6-39. Compute the...Ch. 6 - Refer to the data in Exercise 6-39. Compute the...Ch. 6 - Refer to the data in Exercise 6-39. Draw the cost...Ch. 6 - Compute the predetermined overhead rate used to...Ch. 6 - Compute the predetermined overhead rate used to...Ch. 6 - Prob. 45ECh. 6 - Prob. 46ECh. 6 - The system is referred to as a two-stage cost...Ch. 6 - Channing uses a two-stage cost allocation system,...Ch. 6 - Operations Costing Howrley-David, Inc.,...Ch. 6 - Operations Costing S. Lee Enterprises produces two...Ch. 6 - Operations Costing Organic Grounds produces two...Ch. 6 - Refer to the data in Exercise 6-39. Compute the...Ch. 6 - Refer to the data in Exercise 6-39. Compute the...Ch. 6 - Refer to the data in Exercise 6-39. The president...Ch. 6 - Donovan Parents produces soccer shorts and...Ch. 6 - Owl-Eye Radiologists (OR) does various types of...Ch. 6 - Prob. 57PCh. 6 - Compute the predetermined overhead rate used to...Ch. 6 - Operations Costing Vermont Instruments...Ch. 6 - Operation Costing DiDonato Supplies manufactures...Ch. 6 - Account Analysis, Two-Stage Allocation, and...Ch. 6 - Product Costing, Cost Estimation, and Decision...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kennedy Company issued stock to Ed Kennedy in exchange for his investment of $66,000 cash in the business. The company recorded revenues of $578,000 and expenses of $495,000, and the company paid dividends of $49,000. What was Kennedy's net income for the year?arrow_forwardAnswer this MCQarrow_forward?!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY