(Capital Outlay; Inventory–Consumption Method) (a) Record the following transactions in the General Fund General Ledger of Benford Township using the consumption method (periodic inventory system) to account for materials, supplies, and prepayments. Record both the budgetary and actual entries. (b) Compute the amount of expenditures to be reported in the school district General Fund statement of revenues, expenditures, and changes in fund balance. (c) Compute the amount of nonspendable fund balance to be reported at year end. Materials and supplies costing $90,000 were on hand at the beginning of the year.

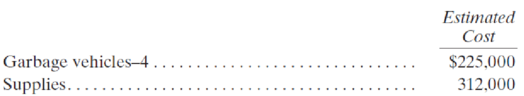

1. The town ordered the following:

2. The town received the garbage vehicles. The actual cost of $222,000 was vouchered for payment.

3. The town received most of the supplies ordered (estimated cost $302,000). The actual cost was $301,800.

4. The town paid $523,800 of vouchers payable.

5. At year end, the town had supplies on hand costing $102,000.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Governmental and Nonprofit Accounting (11th Edition)

- Encumbrances outstanding at year-end in a state’s general fund should be reported as a a. liability in the general fund. b. fund balance reserve in the general fund. c. liability in the general long-term debt account group. d. fund balance designation in the general fund.arrow_forwardWhich of the following is budgetary account: a. Budgetary fund balance b. Revenue- fines and fees c. Voucher payable d. Unreserved fund balancearrow_forwardThe following transactions relate to the general fund of the city of Lost Angels for the year ending December 31, 2020. Prepare a statement of revenues, expenditures, and other changes in fund balance for the general fund for the period to be included in the fund financial statements. Assume that the fund balance at the beginning of the year was $180,000. Assume also that the city applies the purchases method to supplies. Receipt within 60 days serves as the definition of available resources. Collects property tax revenue of $700,000. A remaining assessment of $100,000 will be collected in the subsequent period. Half of that amount should be received within 30 days, and the remainder approximately five months after the end of the year. Spends $200,000 on three new police cars with 10-year lives. The anticipated price was $207,000 when the cars were ordered. The city calculates all depreciation using the straight-line method with no expected residual value. The city applies the…arrow_forward

- ces Following are transactions and events of the General Fund of the City of Springfield for the fiscal year ended December 31, 2020. 1. Estimated revenues (legally budgeted) Property taxes Sales taxes Licenses and permits Miscellaneous 2. Appropriations: General government Culture and recreation Health and welfare. 3. Revenues received (cash) Property taxes Sales taxes Licenses and permits General government Culture and recreation Health and welfare. 5. Goods and services received (paid in cash) General government culture and recreation Health and welfare Miscellaneous 4. Encumbrances issued (includes salaries and other recurring items) Estimated $5,275,000 4,630,000 995,000 6. Budget revisions Estimated Revenues Appropriations Increase appropriations: General government $ 140,000 110,000 Culture and recreation. 7. Fund balance on January 1, 2020, was $753,000. There were no outstanding encumbrances at that date. a. Record the transactions using appropriate journal entries, b. Prepare…arrow_forwardAs per the bond agreement that the district periodically set aside funds to repay the principal of the debt. The district transfers funds from the General Fund to the fund specially created to account for resources restricted for debt service. Which one of the following journal entry records transfer of funds in the general fund? a. None of the options b. Transfer to general fund Account Dr, Bank Account Cr c. Bank Account Dr, Transfer from general fund Account Cr d. Transfer to debt service fund Account Dr, Bank Account Crarrow_forwardPrepare the journal entries necessary for the following transactions. For each transaction you must identify the fund in which the entries are recorded. Make the entries only for the Fund-Based Financial Statements for the fiscal year ended 6/30/2021. 1. The board of commissioners of the Cosmo City adopted a General Fund budget for the year ending June 30, 2021, which indicated revenues of $5,100,000, bond proceeds of $620,000, appropriations of $1,900,000 for salaries, $800,000 for advertising, $400,000 for supplies, and $800,000 for utilities, and also operating transfers out of $980,000. 2. Cosmo City collected $22,000 from parking meters. 3. On March 12, 2021, Cosmo City ordered a new computer at an anticipated cost of $414,000. The computer was received on April 16 with an actual cost of $416,200. Payment was subsequently made on May 15, 2021. 4. Property taxes of 1,800,000 are levied for Cosmo City. The city expects that 5% will be uncollectible. Of the levied amount,…arrow_forward

- Please help with problem Preparation of fund financial statements and schedules Prepare a governmental funds balance sheet; a governmental funds statement of revenues, expenditures, and changes in fund balances; and a General Fund budgetary comparison schedule. In the budgetary comparison schedule, include a column for variances. To ease financial statement preparation, we supply you with the pre-closing trial balances for Croton City’s General Fund, Library Special Revenue Fund, Capital Projects Fund, and Debt Service Fund. Consider all funds as major funds for this exercise and classify the fund balance for the Debt Service Fund as Assigned fund balance. In addition, make calculations to determine which of the funds would be considered as nonmajor if Croton had not considered all of them to be major. Preclosing Trial Balance for Croton City General Fund December 31, 2019 Debits Credits Budgetary Accounts Estimated revenues – property taxes $9,000 Estimated…arrow_forwardAll oI toe above are 3. Which of the following accounts appears on both the interim and year-end balance sheets of the General Fund? a) Revenues. b) Reserve for encumbrances. c) Encumbrances. d) Appropriations. 4. Which of the following would be considered a general capital asset? a) A vehicle purchased from general fund revenues. b) A vehicle purchased and maintained by an enterprise fund. c) A computer purchased from revenues of an internal service fund and used by the supplies department. d) Real estate purchased with the assets of a pension trust fund. 5. A machine is sold for S500. It had originally been purchased for $8,000 using GF It is fully depreciated. Gain on sale of equipment account should be revenues. recorded in the General fund journal as: a) Debit in 500$. b) Credit in 500$. c) Credit in 7500$. d) Gain on sale of equipment account will not recorded in general fund journal. الولايات المتحدة الأمريكية( hparrow_forwardThe City of Algonquin maintains its books to prepare fund accounting statements and records worksheet adjustments in order to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the following situations: Deferred inflows of resources—property taxes of $73,500 at the end of the previous fiscal year were recognized as property tax revenue in the current year's Statement of Revenues, Expenditures, and Changes in Fund Balance. The City levied property taxes for the current fiscal year in the amount of $13,789,400. When making the entries, it was estimated that 2 percent of the taxes would not be collected. At year-end, $309,200 is thought to be uncollectible, $365,000 would likely be collected during the 60-day period after the end of the fiscal year, and $52,800 would be collected after that time. The City had recognized the maximum of property taxes allowable under modified accrual accounting. In addition to the expenditures…arrow_forward

- The following selected information was taken from SunValley City’s general fund statement of revenues, expenditures, and changes in fund balance for the year ended December 31, 2019:Revenues:Property taxes—2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 825,000Expenditures:Current services:Public safety . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 350,000Capital outlay (police vehicles) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100,000Debt service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74,000Excess of revenues over expenditures . . . . . . . . . . . . . . . . . . . . $ 153,000Other financing uses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (125,000)Excess of revenues over expenditures and other financing uses. $ 28,000Decrease in fund balance assigned (encumbrances) during 2019 . 15,000Residual equity transfers-out…arrow_forwardRequired: For each of the summarized transactions for the Village of Sycamore General Fund, prepare the general ledger journal entries. The budget was formally adopted, providing for estimated revenues of $1,076,000 and appropriations of $1,006,000. Revenues were received, all in cash, in the amount of $1,019,000. Purchase orders were issued in the amount of $486,000. Of the $486,000 in (c), purchase orders were filled in the amount of $479,500; the invoice amount was $478,000 (not yet paid). Expenditures for payroll not encumbered amounted to $518,000 (not yet paid). Amounts from (d) and (e) are paid in cash. Note: If no entry is required for a transaction or event, select "No Journal Entry Required" in the first account field.arrow_forwardAssume that the County of Katerah maintains its books and records in a manner that facilitates preparation of the fund financial statements. The county formally integrates the budget into the accounting system and uses the encumbrance system. All appropriations lapse at year-end. At the beginning of the fiscal year, the county had the following balances in its accounts. All amounts are in thousands. Prepare the necessary entries for the current fiscal year. Cash $200 Fund balance unassigned 50 Reserve for encumbrances (committed or assigned) 150 (a) The county made the appropriate entry to restore the prior-year purchase commitments. (b) The county board approved a budget with revenues estimated to be $800 and expenditures of $750. (c) The county received the items that had been ordered in the prior year at an actual cost of $135. (d) The county ordered supplies at an estimated cost of $50 and equipment at an estimated cost of $70. (e) The county incurred salaries and other operating…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education