(GL and SL Entries–Errors, Pensions, Changes, Leases, Claims and Judgments, Etc.) The following transactions and events relate to the General Fund of Antonio County for the 20X6 fiscal year.

1. Early in 20X6 it was discovered that at the end of 20X5 (a) the inventory of supplies was overstated by $30,000, and (b) interest payable of $11,000 on General Fund debt was not accrued.

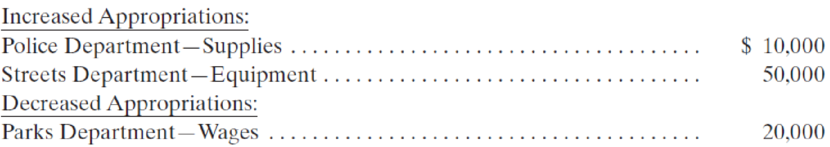

2. Appropriations were revised as follows:

3. The county entered a capital lease for equipment that could have been purchased for $850,000 (which is also the

4. An equipment capital lease payment, $80,000 (including $45,000 interest), was made.

5. Antonio County changed its method of inventory accounting from the purchases method to the consumption method (perpetual system) at the beginning of 20X6. The inventory of supplies at the end of 20X5 was $150,000.

6. During the year it was found that (a) $12,000 charged to Fire Department–Contractual Services should have been charged to that account in the Police Department, and (b) $16,000 charged to Salaries and Wages in a Capital Projects Fund should have been charged to the Streets Department, which is financed from the General Fund.

7. At year end it was determined that the county had estimated liabilities (including legal fees and related costs) for unsettled claims and judgments of $400,000, of which $100,000 is due and payable and is considered a fund liability. The comparable estimated liability amounts (which had been properly recorded) at the end of 20X5 were $350,000 and $60,000, respectively. The 20X5 liability balances remain in the accounts at this time.

8. The year-end physical count of the inventory of supplies revealed that $25,000 of supplies had been stolen; $20,000 will be recovered from the insurance company that bonds employees.

9. Although the required defined benefit pension plan contribution for 20X6 was $600,000, Antonio County made contributions of only $550,000. $50,000 was due and payable to the pension plan at year end.

Required

Prepare the

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Governmental and Nonprofit Accounting (11th Edition)

Additional Business Textbook Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Financial Accounting, Student Value Edition (5th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management

Horngren's Accounting (12th Edition)

- The following is a pre-closing trial balance for Olson City’s General Fund as of June 30, 2005. (See Image) Prepare Closing entries at June, 30, 2005arrow_forwardplease only solve for part c.arrow_forward4. The Village of Seaside Pines prepared the following enterprise fund Trial Balance as of December 31, 2020, the last day of its fiscal year. The enterprise fund was established this year through a transfer from the General Fund. Accounts payable Accounts receivable Accrued interest payable Accumulated depreciation Administrative and selling expenses Allowance for uncollectible accounts Capital assets Cash Charges for sales and services Cost of sales and services Depreciation expense Due from General Fund Interest expense Interest revenue Transfer in from General Fund Bank note payable Supplies inventory Totals Debits $32,000 47,000 712,000 89,000 479,000 45,000 17,000 40,000 18,000 $1,479,000 Credits $ 96,000 28,000 45,000 12,000 550,000 4,000 119,000 625,000 $1,479,000 Required: a. Prepare the closing entries for December 31. b. Prepare the Statement of Revenues, Expenses, and Changes in Fund Net Position for the year ended December 31. c. Prepare the Net Position section of the…arrow_forward

- The following unadjusted trial balances are for the governmental funds of the City of Copeland prepared from the current accounting records: General Fund Debit Credit Cash $ 19,000 Taxes Receivable 202,000 Allowance for Uncollectible Taxes $ 2,000 Vouchers Payable 24,000 Due to Debt Service Fund 10,000 Unavailable Revenues 16,000 Encumbrances Outstanding 9,000 Fund Balance—Unassigned 103,000 Revenues 176,000 Expenditures 110,000 Encumbrances 9,000 Estimated Revenues 190,000 Appropriations 171,000 Budgetary Fund Balance 19,000 Totals $ 530,000 $ 530,000 Debt Service Fund Debit Credit Cash $ 8,000 Investments 51,000 Taxes Receivable 11,000 Due from General Fund 10,000 Fund Balance—Committed $ 45,000…arrow_forwardThe City of Jonesboro engaged in the following transactions during the fiscal year ended September 30, 2018. Record the following transactions related to interfund transfers. Be sure to indicate in which fund the entry is being made. a. The city transferred $400,000 from the general fund to a debt service fund to make the interest payments due during the fiscal year. The payments due during the fiscal year were paid. The city also transferred $200,000 from the general fund to a debt service fund to advance-fund the $200,000 interest payment due October 15, 2019. b. The city transferred $75,000 from the Air Operations Special Revenue Fund to the general fund to close out the operations of that fund. c. The city transferred $150,000 from the general fund to the city’s Electric Utility Enterprise Fund to pay for the utilities used by the general and administrative offices during the year. d. The city transferred the required pension contribution of $2 million from the general fund to the…arrow_forwardPrepare the journal entries for the following transactions to consolidate financial statements from fund-level statements to government-wide statements. 1....An internal service fund had a loss of $50 2.....An internal service fund had interest expense of $30arrow_forward

- 4. The City of Grinders Creek maintains its books in a manner that facilitates the preparation of fund accounting statements and uses worksheet adjustments to prepare government-wide statements. General fixed assets as of the beginning of the year, which had not been recorded, were as follows: Land $ 8,500,000 Buildings 27,600,000 Improvements Other Than Buildings 24,500,000 Equipment 11,690,000 Accumulated Depreciation, Capital Assets 25,800,000 During the year, expenditures for capital outlays amounted to $9,000,000. Of that amount, $4,800,000 was for buildings; the remainder was for improvements other than buildings. The capital outlay expenditures outlined in (2) were completed at the end of the year (and will begin to be depreciated next year). For purposes of financial statement presentation, all capital assets are depreciated using the straight-line method, with no estimated salvage value. Estimated lives are as follows: buildings, 40 years; improvements…arrow_forward4. The City of Grinders Creek maintains its books in a manner that facilitates the preparation of fund accounting statements and uses worksheet adjustments to prepare government-wide statements. General fixed assets as of the beginning of the year, which had not been recorded, were as follows: Land $ 8,500,000 Buildings 27,600,000 Improvements Other Than Buildings 24,500,000 Equipment 11,690,000 Accumulated Depreciation, Capital Assets 25,800,000 During the year, expenditures for capital outlays amounted to $9,000,000. Of that amount, $4,800,000 was for buildings; the remainder was for improvements other than buildings. The capital outlay expenditures outlined in (2) were completed at the end of the year (and will begin to be depreciated next year). For purposes of financial statement presentation, all capital assets are depreciated using the straight-line method, with no estimated salvage value. Estimated lives are as follows: buildings, 40 years; improvements…arrow_forwardThe following trial balance is taken from the General Fund of the City of Jennings for the year ending December 31, 2017. Prepare a condensed statement of revenues, expenditures, and other changes in fund balance and also prepare a condensed balance sheet.arrow_forward

- Qw.20a. do all the entriesarrow_forwardplease help me to solve this questionarrow_forwardThe General Fund and Special Revenue Funds P4-2 (General Fund-Typical Transactions) Prepare all general journal entries required in the General Fund of Washington County for each of the following transactions. Also, use transaction analysis to show any effects on the GCA-GLTL accounts. The county levied property taxes of $5,000,000. It is estimated that 2% will be uncollectible. The rest of the taxes are expected to be collected by year end or soon enough thereafter to be considered available at year end. The county collected $4,300,000 of the taxes receivable before the due date and the balance of taxes became delinquent. The county collected another $540,000 of the taxes receivable by the end of the fiscal year. The county paid salariesarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education