A manager is trying to decide whether to purchase a certain part or to have it produced internally. Internal production could use either of two processes. One would entail a variable cost of $17 per unit and an annual fixed cost of $200,000; the other would entail a variable cost of $14 per unit and an annual fixed cost of $240,000. Three vendors are willing to provide the part. Vendor A has a price of $20 per unit for any volune up to 30,000 units. Vendor B has a price of $22 per unit for demand of 1,000 units or less, and $18 per unit for larger quantities. Vendor C offers a price of $21 per unit for the first 1,000 units, and $19 per unit for additional units.

a)

To determine: The best alternative from a cost standpoint for an annual volume of 10,000 units and 20,000 units.

Introduction: Decision-making is the process that helps to make decision. It is the process of choosing a best alternative by evaluating many alternatives.

Answer to Problem 8P

Explanation of Solution

Given information:

A manager has to decide whether to purchase a product or produce it internally. Internal production consists of two processes. Variable cost and fixed cost of the first process is $17 and $200,000 respectively. Variable cost and fixed cost of the second process is $14 and $240,000 respectively.

There are three vendors available to purchase a product. Vendor A has a price of $20 per unit up to 30,000 units. Vendor B has a price of $22 per unit if the demand is 1,000 units or less and $18 for larger volumes. Vendor C has a price of $21 per unit for first 1,000 units and $19 per unit for additional units.

Determine the best alternative from a cost standpoint for an annual volume of 10,000 units:

Calculate the total cost for the first internal process:

It is calculated by adding the fixed cost with the value attained by multiplying the variable cost and the annual volume. Annual volume is given as 10,000 units. Hence, the total cost for the first internal process is $370,000.

Calculate the total cost for the second internal process:

It is calculated by adding the fixed cost with the value attained by multiplying the variable cost and the annual volume. Annual volume is given as 10,000 units. Hence, the total cost for the first internal process is $380,000.

Calculate the total cost for the Vendor A:

It is calculated by multiplying the price and the annual volume. Hence, the total cost for Vendor A is $200,000.

Calculate the total cost for the Vendor B:

It is calculated by multiplying the price and the annual volume. It is given that the price is $22 if the volume is less than 1,000 and $18 if the volume is larger. As the annual volume is more than 1,000, the price is $18. Hence, the total cost for Vendor B is $180,000.

Calculate the total cost for the Vendor C:

It is calculated by multiplying the price and the annual volume. It is given that the price is $21 for the volume up to 1,000 and $19 for the additional volume. Thus, price is $21 for the 1,000 units and $19 for additional 9,000 units. Hence, the total cost for Vendor C is $192,000.

At the annual volume of 10,000 units, Vendor B has the lowest total cost of ($180,000). Hence, it should be chosen from a cost standpoint.

Determine the best alternative from a cost standpoint for an annual volume of 20,000 units:

Calculate the total cost for the first internal process:

It is calculated by adding the fixed cost with the value attained by multiplying the variable cost and the annual volume. Annual volume is given as 20,000 units. Hence, the total cost for the first internal process is $540,000.

Calculate the total cost for the second internal process:

It is calculated by adding the fixed cost with the value attained by multiplying the variable cost and the annual volume. Annual volume is given as 20,000 units. Hence, the total cost for the first internal process is $520,000.

Calculate the total cost for the Vendor A:

It is calculated by multiplying the price and the annual volume. Hence, the total cost for Vendor A is $400,000.

Calculate the total cost for the Vendor B:

It is calculated by multiplying the price and the annual volume. It is given that the price is $22 if the volume is less than 1,000 and $18 if the volume is larger. As the annual volume is more than 1,000, the price is $18. Hence, the total cost for Vendor B is $360,000.

Calculate the total cost for the Vendor C:

It is calculated by multiplying the price and the annual volume. It is given that the price is $21 for the volume up to 1,000 and $19 for the additional volume. Thus, price is $21 for the 1,000 units and $19 for additional 19,000 units. Hence, the total cost for Vendor C is $382,000.

At the annual volume of 20,000 units, Vendor B has the lowest total cost of ($360,000). Hence, it should be chosen from a cost standpoint.

b)

To determine: The range of the best alternative.

Introduction:Decision-making is the process that helps to make decision. It is the process of choosing a best alternative by evaluating many alternatives.

Answer to Problem 8P

Explanation of Solution

Given information:

A manager has to decide whether to purchase a product or produce it internally. Internal production consists of two processes. Variable cost and fixed cost of the first process is $17 and $200,000 respectively. Variable cost and fixed cost of the second process is $14 and $240,000 respectively.

There are three vendors available to purchase a product. Vendor A has a price of $20 per unit up to 30,000 units. Vendor B has a price of $22 per unit if the demand is 1,000 units or less and $18 for larger volumes. Vendor C has a price of $21 per unit for first 1,000 units and $19 per unit for additional units.

Cost function for each alternative if the annual volume is 1-1,000 units:

First internal process:

Second internal process:

Vendor A:

Vendor B:

Vendor C:

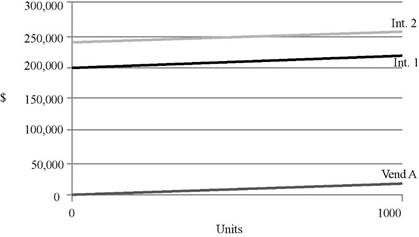

When considering the cost functions, Vendor A would exhibit less cost when compare to Vendor B and Vendor C. Vendor A should be preferred over other alternatives. The graph is as follows:

Cost function for each alternative if the annual volume is more than 1,000 units:

First internal process:

Second internal process:

Vendor A:

Vendor B:

Vendor C:

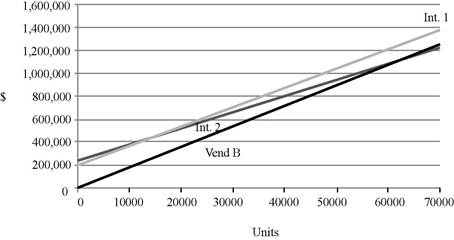

When considering the cost functions, Vendor B would dominate Vendor A and Vendor C. Hence, Vendor A and Vendor C should be eliminated. The graph considering two internal processes and Vendor B is as follows:

Determine the value of Q by equaling two cost equations:

Equal the cost function of second internal process and Vendor B to determine the value of Q.

Calculate the total cost of first internal process:

Substitute the value Q in the cost equation of first internal process. Hence, the total cost is $1,220,000.

Calculate the total cost of second internal process:

Substitute the value Q in the cost equation of second internal process. Hence, the total cost is $1,080,000.

Calculate the total cost of Vendor A:

Substitute the value Q in the cost equation of Vendor A. Hence, the total cost is $1,200,000.

Calculate the total cost of Vendor B:

Substitute the value Q in the cost equation of Vendor B. Hence, the total cost is $1,080,000.

Calculate the total cost of Vendor C:

Substitute the value Q in the cost equation of Vendor C. Hence, the total cost is $1,142,000.

Inference:

- Vendor A should be preferred when the purchasing quantity ranges from 1 to 1,000 units.

- Vendor B should be preferred when the purchasing quantity ranges from 1,001 to 59,999 units.

- There would indifferent between Vendor B and second internal process if the quantity is 60,000 units.

- Second internal process should be preferred if the quantity is more than 60,000 units.

First internal process and Vendor C are never best.

Want to see more full solutions like this?

Chapter 5 Solutions

Operations Management (McGraw-Hill Series in Operations and Decision Sciences)

- Question 6. An electrical engineering company is designing two types of solar panel systems: Standard Panels (S) and High-Efficiency Panels (H). The company has certain constraints regarding the hours of labor and material available for production each week. Each Standard Panel requires 4 hours of labor and 2 units of material and each High-Efficiency Panel requires 3 hours of labor and 5 units of material. The company has a maximum of 60 hours of labor and 40 units of material available per week. The profit from each Standard Panel is GH¢80, and the profit from each High-Efficiency Panel is GH¢100. The company wants to determine how many of each type of panel to produce in order to maximize profit. i) Solve this LPP by using graphical analysis ii) What will be the slack at the optimal solution point? Show calculation.arrow_forwardqusestion 6. An electrical engineering company is designing two types of solar panel systems: Standard Panels (S) and High-Efficiency Panels (H). The company has certain constraints regarding the hours of labor and material available for production each week. Each Standard Panel requires 4 hours of labor and 2 units of material and each High-Efficiency Panel requires 3 hours of labor and 5 units of material. The company has a maximum of 60 hours of labor and 40 units of material available per week. The profit from each Standard Panel is GH¢80, and the profit from each High-Efficiency Panel is GH¢100. The company wants to determine how many of each type of panel to produce in order to maximize profit. i. Formulate a linear programming model of the problem for the company. ii Convert the linear programming model formulated in (a) to a standard form.arrow_forwardG ווח >>> Mind Tap Cengage Learning 1- CENGAGE MINDTAP Chapter 09 Excel Activity: Exponential Smoothing Question 1 3.33/10 e Submit 自 A ng.cengage.com C Excel Online Student Work G A retail store records customer demand during each sales period. 1. What is the f... Q Search this course ? ✓ Co Excel Online Tutorial Excel Online Activity: Exponential Smoothing A-Z A retail store records customer demand during each sales period. The data has been collected in the Microsoft Excel Online file below. Use the Microsoft Excel Online file below to develop the single exponential smoothing forecast and answer the following questions. Office Video X Open spreadsheet Questions 1. What is the forecast for the 13th period based on the single exponential smoothing? Round your answer to two decimal places. 25.10 2. What is the MSE for the single exponential smoothing forecast? Round your answer to two decimal places. 21.88 Activity Frame ? 3. Choose the correct graph for the single exponential…arrow_forward

- Not use ai pleasearrow_forwardItems removed from the work area (5S) were taken to a storage area called ___________. Choose from: SORT, STORD, KNUJ, STUFF, FUDG SORT STORD KNUJ STUFF FUDGarrow_forwardCould you please help explain How was the poor strategic decisions lead to economic downturns of Circuit City Company? What are the sequences of key events and problems that contribute to its collapse. Could you please explain each one them and give the examples If Circuit City would apply Lean Six Sigma. would it helped prevent businesses from collapsed?? How Qualitative and quantitative Research Methodology in Case Study Research would affect Circuit City?arrow_forward

- Apple is a global technology company renowned for its innovation and design. To create its products, Apple has established a world class global supply chain to bring their products to market. What strategies is Apple using to source and manufacture its products? How does Apple view its responsibility to its suppliers and those who build its products?arrow_forwardCritical Path Method (CPM) is an important Project Management Tool that has wide industry application in modern day Project Management. By using an example of the project of your choice, critically examine the practical application of CPM as a Project Management Tool.arrow_forwardwhat is an other difination for principle?arrow_forward

- Need help or ideas to design out two slides as my script and writing quite long to squeese into two slides. But can just point form in slides with correct title and a good script for me to present two slides in only 2.5 mins. Following is my draft, pls guide me step by step on powerpoint creation and good script to present findings. My draft: Slide 1: Foreign Labor Exploitation in Dyson's Supply Chain Introduction Dyson's former Malaysian supplier, ATA IMS Bhd, became embroiled in serious labor exploitation allegations in 2021. These concerns surfaced when whistleblowers exposed unethical labor practices affecting migrant workers, primarily from Nepal and Bangladesh. Key Forms of Exploitation Debt Bondage Due to Recruitment Fees Workers were forced to pay exorbitant recruitment fees before securing employment, often taking loans at high interest rates. This financial burden trapped them in debt bondage, leaving them with little choice but to accept exploitative working…arrow_forwardNot use ai pleasearrow_forwardThe Business Development Bank of Canada. (2023). Canadian economic outlook for 2024: Shifting into neutral. https://www.bdc.ca/en/articles-tools/blog/canadian-economic-outlook-for-2024-shifting-into-neutral “Despite persistently high inflation and rising interest rates, the news was generally better than expected for the Canadian economy in 2023” (BDC Blog 2024). Discussion Question: In your view, what are the most pressing problems for Canadian companies or consumers in 2024? Explain your answer using current examples of companies or consumer concerns.arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning